As a seasoned analyst with over two decades of market experience under my belt, I’ve seen countless cryptocurrencies rise and fall like waves in the ocean. The current surge of “First Neiro on Ethereum” (NEIRO) is no exception, and it certainly has my attention.

Initially launched as a meme token on the Ethereum platform, “Neiro” is aiming to maintain the positive trajectory it experienced after the news of its listing on Binance was announced.

September 16th saw Binance announcing the addition of Neiro (NEIRO) to their spot trading platform, along with two other assets. This announcement led to a significant surge in the meme coin’s price, resulting in an impressive 856% increase within a single trading day.

Of particular interest is that the value of the cryptocurrency reached a record peak of $0.00044012 on September 16th. However, this new high encountered a minor obstacle in its upward trajectory. Despite this temporary setback causing some losses, it still maintained a positive position.

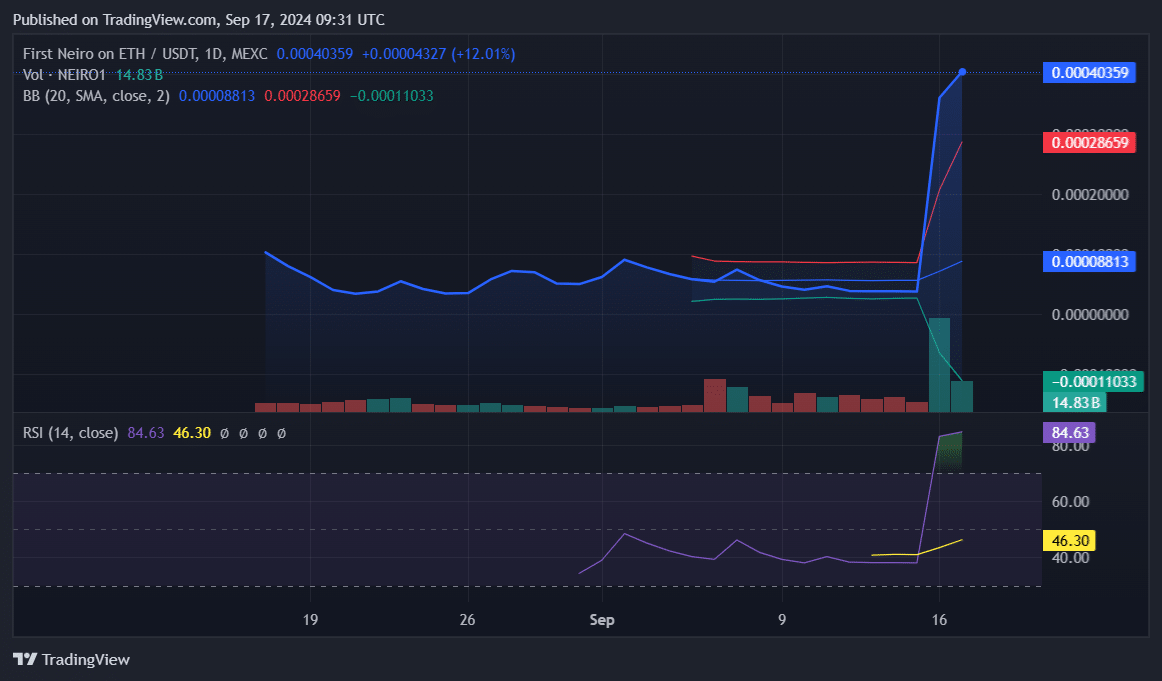

NEIRO is presently experiencing a surge of 22.69% over the past 24 hours and is being traded at $0.00040359 as we speak. In the last seven days, the value of this popular meme coin has soared by an astounding 748%, reaching a market capitalization of $166.76 million. Over the same period, it has also seen a 24-hour trading volume of a staggering $424.8 million.

Right now, Neiro finds itself perched above its upper Bollinger Band, specifically at $0.00028659. This position signals a robust upward trend, but it also implies that the asset is overbought, a condition that might hint at an upcoming dip or price adjustment.

On occasion, market excitement might prolong an overbought situation. Right now, the significant resistance is around $0.0004401. Should this meme coin continue its momentum, it may potentially move higher towards those levels.

In simpler terms, when the Relative Strength Index (RSI) stands at 84.63, it’s significantly higher than the overbought level of 70. This usually suggests that the asset could experience a potential decrease due to traders possibly deciding to cash out, thereby creating downward pressure on the price.

If the price falls, the crucial turning point is located at approximately $0.00015806. This level would provide immediate support, meaning it might prevent further drops. However, if the price breaks through this level, it could lead to a test of the significantly lower support at around $0.00001442.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Mini Heroes Magic Throne tier list

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Outerplane tier list and reroll guide

- Call of Antia tier list of best heroes

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

2024-09-17 13:30