As a seasoned researcher with a penchant for decentralized finance and a soft spot for memecoins, I must say that the recent surge of AAVE has caught my attention like a moth to a flashing LED. The token’s impressive climb to its highest point since 2022, coupled with its substantial increase in assets, has placed it firmly on the DeFi map as a major player.

This year, Aave, a key player in the world of decentralized finance, has seen significant growth, reaching its peak levels not seen since 2022.

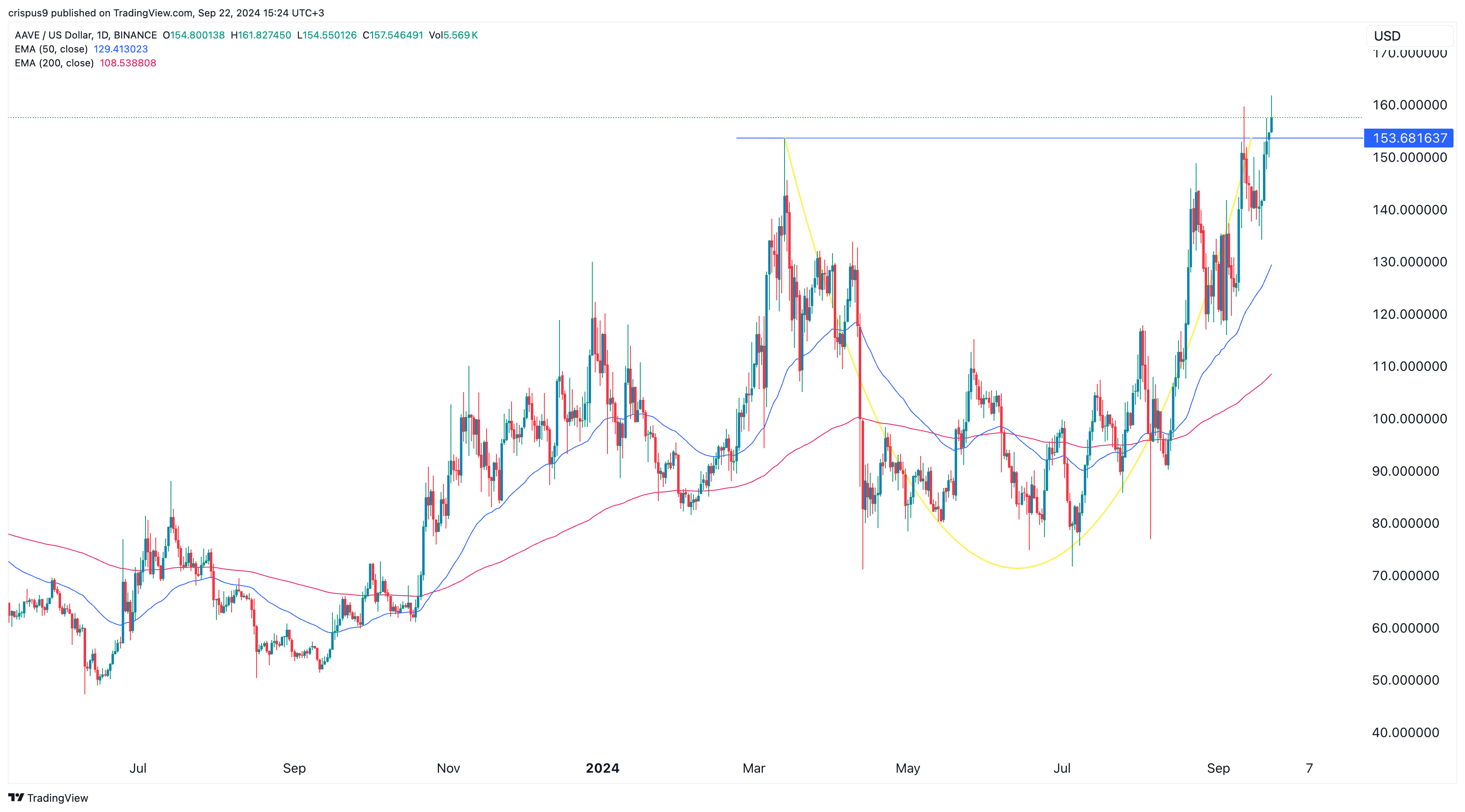

In a remarkable surge, the value of AAVE (AAVE) has reached an all-time high of $160, representing an increase of nearly 120% from its lowest price this year. This growth pushes its market capitalization above the $2.5 billion mark.

AAVE’s DeFi TVL has jumped

The token has performed admirably, boosted by a significant expansion of assets within its network. It’s been demonstrated through data that the total value locked within its ecosystem has soared above $12.1 billion.

As a researcher, I find myself reporting that my findings position this project as the second largest contender in the Decentralized Finance (DeFi) landscape, trailing only Lido which boasts over $25 billion in staked assets. Notably, EigenLayer, Ether.fi, and JustLend are also significant players in this space, following closely behind.

The expansion of AAVE has resulted in significant transaction costs within the network. As reported by TokenTerminal, the total fees accumulated in the system this year have surpassed $287 million, placing it as the third most profitable DeFi player behind Lido and Uniswap.

Over the last few months, an increase in significant whale transactions has contributed to a price surge in AAVE. To illustrate, numerous whales have bought large quantities, making them the dominant group among the majority of AAVE’s holders, preceded by institutional and individual investors, as well as retail buyers.

According to data from Nansen, although the amount of ‘smart money’ has decreased slightly in recent times, it still stands well above the June low of 71. Notably, the cumulative assets managed by these investors have remained stable at approximately 439,000.

The biggest smart money holds over 25,000 AAVE tokens worth $4 million plus other coins like Ethereum (ETH), Pepe (PEPE), Ondo Finance, and Beam.

The digital currency platform AAVE has also experienced a surge, as the Federal Reserve reduces interest rates. During their meeting on Wednesday, the bank chose to decrease interest rates by 0.50% and suggested that further reductions might be on the horizon. This potential for lower interest rates could result in increased investment into lending platforms such as AAVE and JustLend.

AAVE forms golden cross in July

In simple terms, the surge in value for Aave occurred following the formation of a ‘golden cross’ pattern in July. This technical phenomenon took place when the 50-day and 200-day exponentially weighted moving averages crossed paths.

The price trend has consistently reached new peaks (highs) and new troughs (lows), indicating a positive upward movement. Furthermore, the previous resistance at $150 is now acting as a support level. Additionally, it’s surged above a significant mark of $153.68, its highest point in March 2021.

Most importantly, AAVE has formed a cup and handle pattern, a popular continuation sign.

Consequently, following the observation made by the analyst, it’s possible that the token could keep increasing since the resurgence of DeFi persists. In such a case, the significant level to monitor would be around $170.

The price of AAVE has reached its peak since last May and appears to be breaking free from a two-year period of stagnation. This potential breakout could serve as confirmation of the ongoing DeFi Revolution, potentially reaching new all-time highs again.— Arthur (@Arthur_0x) September 22, 2024

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-22 16:42