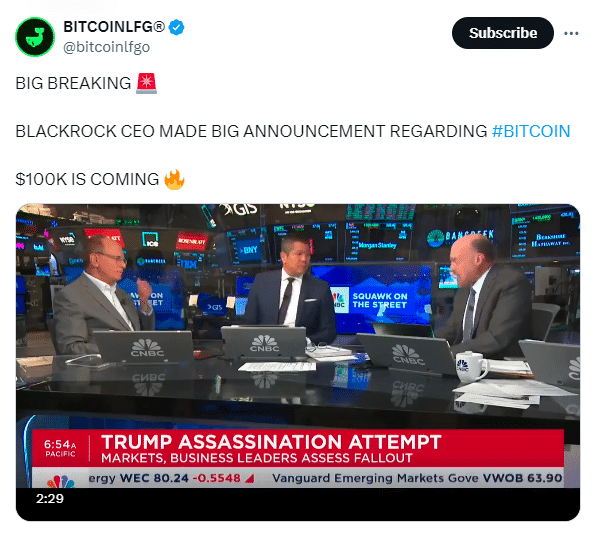

As an analyst with over two decades of experience in the financial industry, I have witnessed firsthand the evolution of traditional finance and its reluctance to embrace disruptive technologies. However, Larry Fink’s recent endorsement of Bitcoin as a legitimate investment and his prediction of $100,000 valuation is a game-changer.

The head of BlackRock, Larry Fink, believes that the worth of Bitcoin could soar to an astounding $100,000 and considers it a valid investment option.

Fink conceded that Bitcoin, much like any other investment, may potentially be exploited. Yet, he holds the opinion that it carries significant worth during challenging economic periods. In times of financial hardship or when there’s a fear about one’s nation’s economy, particularly when the currency is devalued due to massive debts, many people tend to resort to Bitcoin as an investment alternative.

He pointed out that Bitcoin gives people a way to take control of their finances, especially in countries where they feel unsafe about their money. By investing in Bitcoin, they can have an asset that isn’t controlled by their government.

As a crypto investor, I’m excited about Fink’s shift in perspective towards cryptocurrencies, as it signals a significant transformation in the way traditional financial leaders perceive digital assets. His endorsement could potentially attract more institutional investors to explore Bitcoin, which might lead to increased adoption and potential growth in the market.

With growing curiosity towards Bitcoin, Fink’s remarks might further boost its appeal. This could signify a promising trajectory for Bitcoin, as more financiers seek out innovative avenues for investment. Keep an eye on Bitcoin’s evolution in the upcoming years to see where it leads.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Outerplane tier list and reroll guide

- Maiden Academy tier list

- Fortress Saga tier list – Ranking every hero

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Best teams for Seven Deadly Sins Idle

2024-09-23 10:28