As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find the recent price movement of AAVE intriguing. The increase in centralized exchange outflows, coupled with the surge in purchases by top accounts, paints a picture of growing investor confidence in AAVE and the broader DeFi landscape.

On Tuesday, September 24th, the price of AAVE experienced a retreat, as information from on-chain analysis suggested a rise in withdrawals from centralized exchanges.

In simpler terms, after doing great in the world of DeFi (short for Decentralized Finance), AAVE dipped to around $164.5, dropping from this week’s peak at $178. Yet, it’s still sitting pretty, being 131% higher than its all-time low back in July.

As stated by Nansen, there were outflows of approximately $6.35 million from AAVE‘s centralized exchanges (CEX), which represents a significant increase of around 4.96 times more than the usual average. Outflows from CEX are generally viewed as favorable for cryptocurrencies, as they suggest that investors are transferring their tokens to personal custody, implying a commitment to long-term holding.

New information reveals that the leading ten largest accounts purchased AAVE tokens valued at approximately $8.4 million, while sales totaled around $7.8 million. This trend indicates that many investors continue to be optimistic about AAVE, anticipating a resurgence in DeFi.

Currently, as per DeFi Llama’s data, AAVE currently manages over $12.53 billion in assets, with the majority being in its V3 version. Out of these assets, approximately $8.09 billion has been lent out, and the platform has earned over $260 million in fees during the past year. This makes AAVE one of the most profitable DeFi platforms around.

The excitement about AAVE‘s future continues to run high, as indicated by the data from CoinGlass. This data shows that the daily open interest has consistently stayed above 87 million dollars since August 15, peaking at a whopping 214 million on September 11. Prior to that, the highest recorded open interest was only 124 million on August 2.

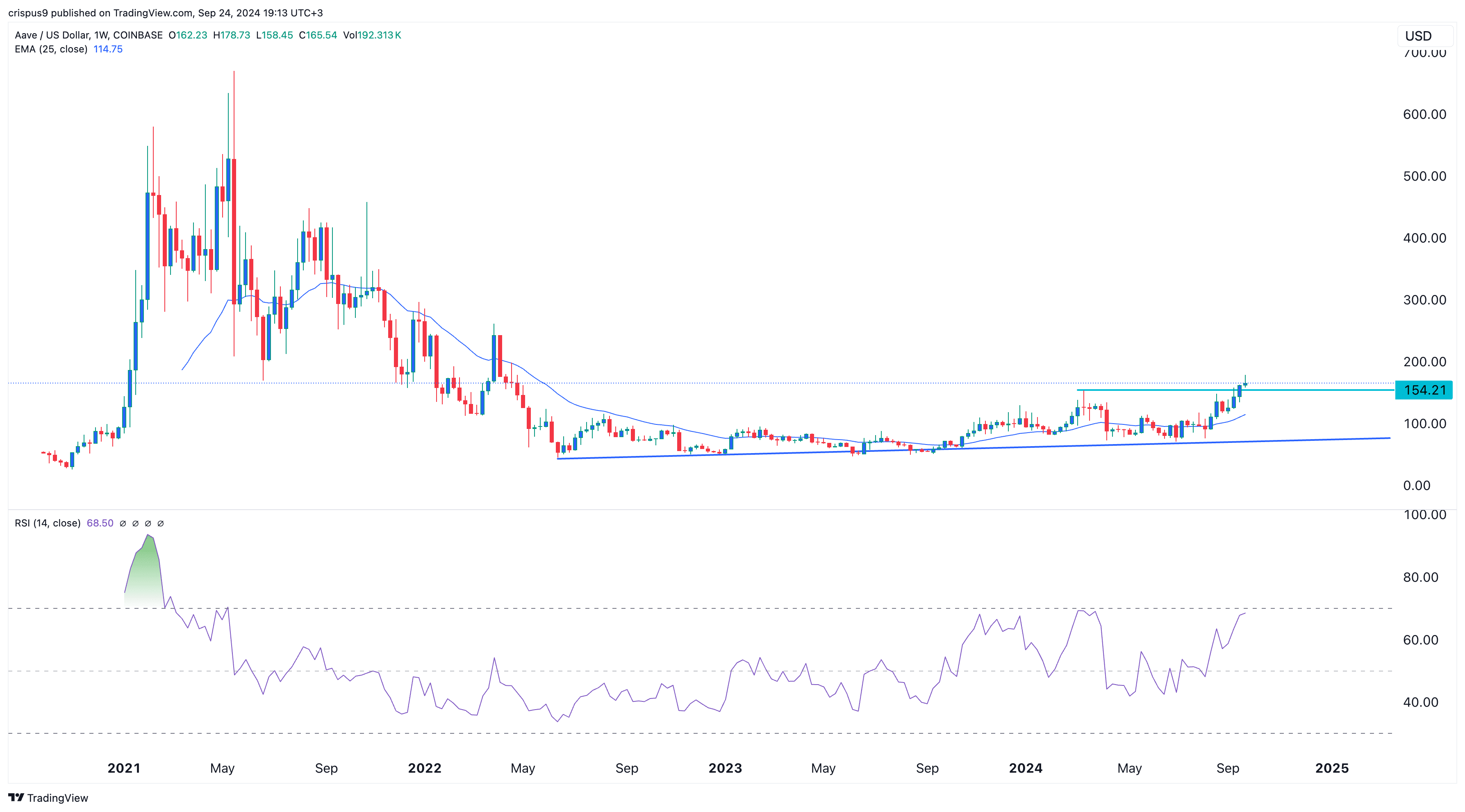

AAVE just flipped a key resistance

Over the last several weeks, the AAVE token has been experiencing a robust upward momentum on its weekly chart. It’s consistently stayed above the uptrend line, which links the lowest price points from June 2022 and onwards.

AAVE has surpassed a significant resistance level of around $154.21, marking its highest peak in March this year. It’s now sitting above its 25-week moving average, and the Relative Strength Index is edging towards an overbought state.

Therefore, AAVE may continue its bull run, with buyers targeting the psychological level of $200.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Cookie Run Kingdom Town Square Vault password

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2024-09-24 19:34