As a seasoned researcher with over two decades of experience in the financial markets, I find myself nodding in agreement with Matt Hougan’s sentiments at the European Blockchain Convention. Having witnessed the gradual adoption of Bitcoin and other digital assets, it is not surprising that the timing for spot Ethereum ETFs might have been premature.

At the European Blockchain Convention, Bitwise CIO Matt Hougan voiced optimism that Exchange-Traded Funds (ETFs) based on Ethereum‘s spot market will be successful, even though they’ve had a gradual beginning.

According to comments made by Hougan during a panel discussion at the EBC event in Barcelona, Spain on September 25th, it was suggested that Ethereum (ETH) exchange-traded funds might have been introduced prematurely. The reasoning behind this is that major players in the Wall Street market are still adjusting to Bitcoin‘s (BTC) message, and ETH spot ETFs were introduced at a time when this adjustment was ongoing.

If we had waited an additional year, they could potentially have amassed assets that are five times greater, given how slowly people adapt to Bitcoin and prepare for the next investment opportunity.

Matt Hougan, Bitwise CIO

In simple terms, Exchange Traded Funds (ETFs) that follow Ether’s market price were introduced in late July. These were introduced about five months after the U.S. Securities and Exchange Commission (SEC) approved similar Bitcoin-backed ETFs in January. Although other issuers have requested options for these new ETH ETFs, only BlackRock’s spot Bitcoin ETF has been approved by the SEC so far. The SEC hasn’t yet made a decision on the options for spot Ether ETFs, which is now expected in November.

As an analyst, I’ve observed that the majority of outflows primarily stem from existing Grayscale ETH funds, which have, in turn, affected the success of spot Ether ETFs, according to certain market participants. However, Bitwise’s Hougan presents a contrasting perspective, implying that Ethereum ETFs are likely to draw in traditional finance investors in the future.

It’s a more intricate concept, and it seems they’re struggling to grasp Bitcoin. However, give it time. Fast forward a year, you’ll find $20 billion in Ethereum ETFs available in the U.S., and people will be amazed, saying, “I thought they were doomed.” But they weren’t doomed. These ETFs simply require patience to develop.

Currently, the Ethereum ETF sector is experiencing approximately $624 million in total withdrawals. This sector is primarily steered by BlackRock, a massive asset manager worth $10 trillion, which currently oversees around $7.2 billion in Ethereum-related assets.

Hougan anticipates that enhanced performance figures for the Ether ETF will correlate with a renewed storyline for Ethereum. While Bitcoin has prospered under the “digital gold” narrative and Solana has garnered attention due to its swift transactions, Ethereum has not kept pace in this regard, as suggested by Hougan.

That will end, though. I think the market is coming back around to Ethereum, but it’s taken some time.

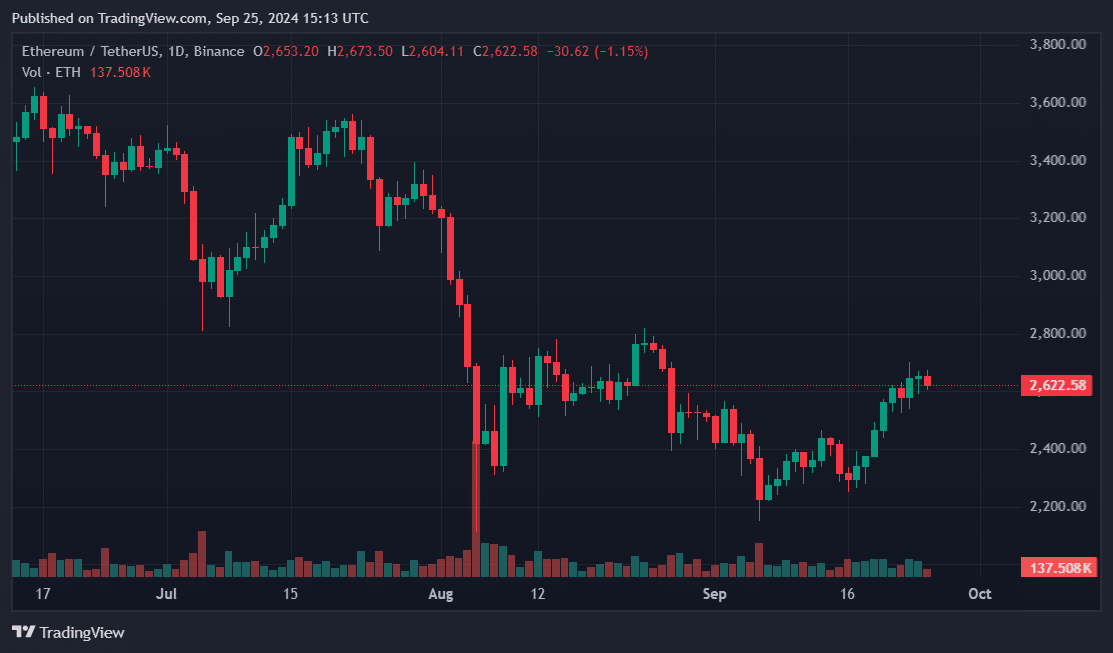

In the last seven days, Ethereum has seen a growth of 14% and surpassed $2,600 again. Some experts predict that this second-largest cryptocurrency might have a bullish fourth quarter due to potential Federal Reserve interest rate decreases and increased enthusiasm in the digital currency market.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cat Fantasy tier list

- Overwatch Stadium Tier List: All Heroes Ranked

- EUR CNY PREDICTION

2024-09-25 18:26