As a seasoned crypto investor with years of experience navigating the turbulent waters of the digital asset market, I can’t help but feel a mix of intrigue and apprehension upon learning about the recent Ethereum sell-off by the largest recipient of Genesis Trading bankruptcy proceedings.

In simpler terms, the entity that received the most from Genesis Trading’s bankruptcy is currently offloading a substantial amount of Ethereum.

Based on information from Arkham Intelligence, the creditor recently offloaded 12,100 Ethereum (ETH), valued at approximately $31.43 million, over a span of merely three days. This action follows close on the heels of a substantial repayment received from Genesis Trading, which was part of its liquidation proceedings in August.

During the Genesis Trading creditor refunds, the individual at wallet address 0x999…46E was given the most significant reimbursement by the lender.

On August 2nd, this wallet received 114,502 Ether, which was equivalent to approximately $358.19 million at that moment. However, despite possessing a large portion of the funds from liquidation, the creditor has initiated the process of selling off a considerable chunk of their holdings.

On September 23, the process of selling started as the wallet moved Ethereum to FalconX, a well-known brokerage company specializing in institutional cryptocurrency transactions.

Over the next few days, the creditor transferred a total of 12,100 ETH, with the most recent transaction occurring on Sept. 25 at 15:39 UTC. This latest transfer alone involved 7,099 ETH valued at $18.56 million.

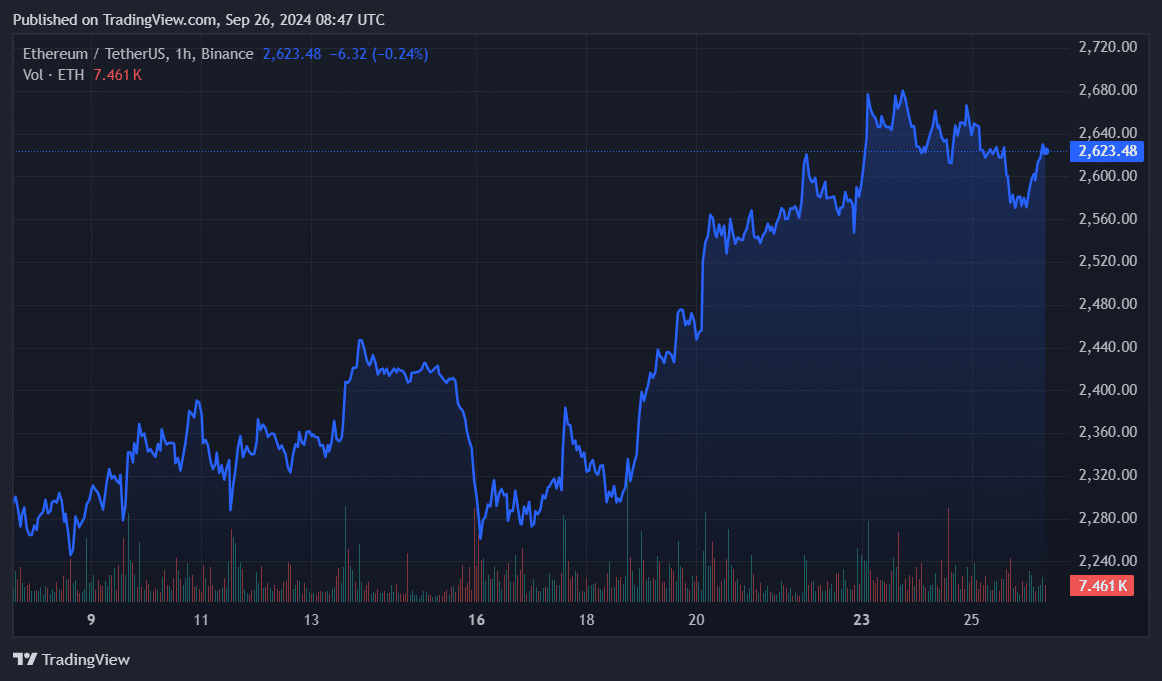

The widespread sell-off occurs concurrently with persistent market fluctuations. Importantly, Ethereum has experienced horizontal price movements since it experienced a significant surge from September 17th to the 21st.

Over the last five days, the value of this asset has been fluctuating between approximately $2,529 and $2,703. But, potential sell-offs following recent credit sales from Genesis might lead to increased selling pressure in the market.

Keep in mind that Genesis sought bankruptcy protection in 2023 due to a string of difficulties, one of which was the turmoil experienced by its overarching organization, Digital Currency Group.

In the recent course of its Chapter 11 bankruptcy process, I’ve been keeping a close eye on Genesis’ developments. Last month, they started returning funds, distributing approximately $4 billion worth of crypto assets to those affected by their financial situation. As one of the creditors, I was fortunate enough to receive the largest repayment from this liquidation process.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Castle Duels tier list – Best Legendary and Epic cards

- Fortress Saga tier list – Ranking every hero

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Seven Deadly Sins Idle tier list and a reroll guide

- Maiden Academy tier list

2024-09-26 12:10