As a seasoned crypto investor with over a decade of experience under my belt, I find Patrick Hansen’s predictions about the EU’s crypto market by late 2025 quite intriguing and potentially profitable. Having navigated through numerous regulatory hurdles in various regions, I can attest to the fact that comprehensive guidelines like MiCA are a breath of fresh air for investors and businesses alike.

According to Patrick Hansen, the European strategy director at Circle, significant advancements are expected in the European Union’s cryptocurrency and stablecoin sector by the end of 2025.

During the European Blockchain Convention held in Barcelona, I shared my anticipations for significant developments in the crypto market structure across the European Union. According to me, during a panel discussion labeled “What’s Happening Behind the Scenes – Post MiCA?”, the Bloc’s Markets in Crypto-Assets Regulation (MiCA) would serve as the main driver for this growth.

The European Union’s approach to regulating cryptocurrencies took a significant turn with MiCA, offering extensive instructions to help governments, financial institutions, and investors navigate the world of digital assets effectively.

Indeed, MiCA outlined requirements for crypto exchanges and thresholds for stablecoin reserves. Circle (USDC) was one of the first stablecoin beneficiaries of this new regime and snagged MiCA’s inaugural stablecoin license.

Hansen pointed out that the process of ensuring MiCA compliance and gaining regulatory approval differs from what’s typically seen in other parts of the world. To illustrate, the company responsible for issuing USDC spent around 24 months working with regulators prior to receiving their approval.

The circle has likewise sought and obtained approval for its Electronic Money Institution license from the French supervisory authority on banking, known as the Autorité de Contrôle Prudentiel et de Résolution.

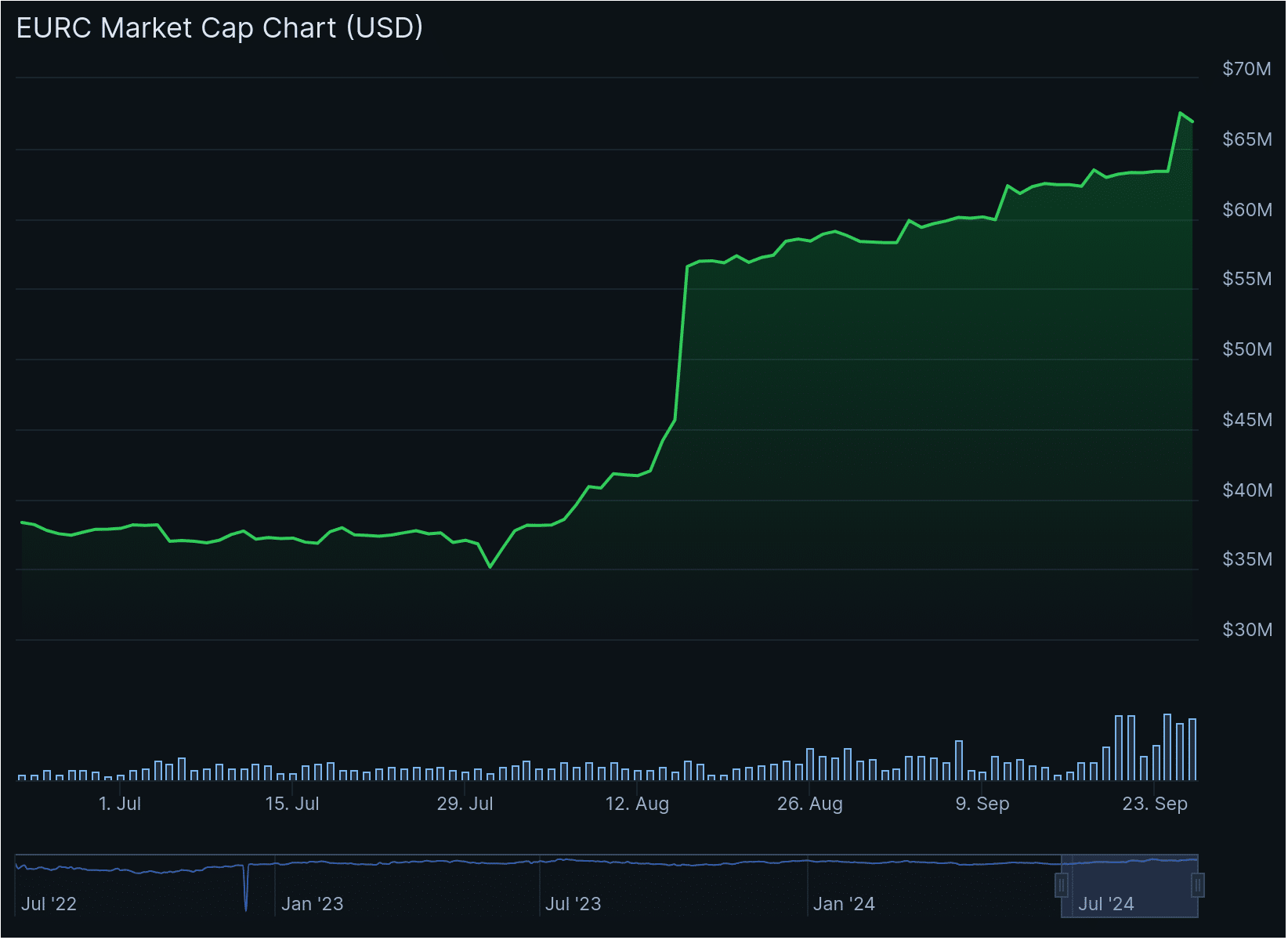

As per Hansen’s statements, the company’s euro-backed digital currency, EURC, has experienced a significant increase of around 60-70% since it received approval in July. Currently, the market capitalization of EURC stands at over 67 million euros. Hansen anticipates further growth for EURC and other stablecoins within the EU due to the regulations set by MiCA.

As a researcher exploring the digital currency landscape within the European Union, I am optimistic about the potential expansion of my proposed euro stablecoin, as well as the broader category of euro stablecoins, over the course of the next 12 months. The anticipated growth is expected to be substantial.

Patrick Hansen, Circle’s EU senior director, strategy & policy

With a strong presence now established in Europe, Circle’s CEO, Jeremy Allaire, moved forward with the preparations for an Initial Public Offering (IPO) in the United States. As part of this strategy to become publicly traded, Circle decided to shift its global headquarters to the bustling city center of New York, specifically in the One World Trade Center, joining financial giants such as Goldman Sachs.

Read More

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run Kingdom Town Square Vault password

- 10 Hardest Bosses In The First Berserker: Khazan

- Maiden Academy tier list

- Girls Frontline 2 Exilium tier list

- `H&M’s Wild White Lotus Getaway`

- ‘White Lotus’ Fans React to That Incest Kiss: “My Jaw Is On The Floor”

- Be Happy’s Abhishek Bachchan reveals how daughter Aaradhya gives him a reality check; says he did the same with dad Amitabh Bachchan

- Wizardry Variants Daphne tier list and a reroll guide

- Russian Finance Ministry staffer calls crypto a ‘locomotive’ for development

2024-09-26 22:12