As a seasoned crypto investor with years of experience navigating the volatile and unpredictable cryptocurrency market, I must admit that the recent surge of MSTU, the 2x leveraged MicroStrategy ETF, has caught my attention. Having witnessed the rise and fall of numerous altcoins and ETFs in the past, I’ve learned to take such rapid growth with a grain of salt.

The newly launched MicroStrategy ETF, utilizing leverage, is performing exceptionally well with an increase in assets and a new peak in its stock price.

The T-REX 2X Long MSTR Daily Target ETF has added over $82 million in assets just a week after its launch. According to Eric Balchunas, Bloomberg’s head of ETFs, these inflows place it in the top twenty of all 515 funds launched this year.

The investment fund identified by the ticker symbol MSTU has surpassed the Defiance Daily Target 1.75X Long MSTR ETF, a product that debuted in August, in terms of performance.

astonishingly, within a week of its debut, the 2x MSTR ETF has amassed over $72 million in assets under management, placing it in the top 20% among the 515 ETFs launched this year. Interestingly, despite the 1.75x MSTR ETF having been released earlier and boasting a larger initial investment of $357 million (top 8% of new launches), both funds have demonstrated strong liquidity. I didn’t expect such rapid growth for the newer ETF.

— Eric Balchunas (@EricBalchunas) September 27, 2024

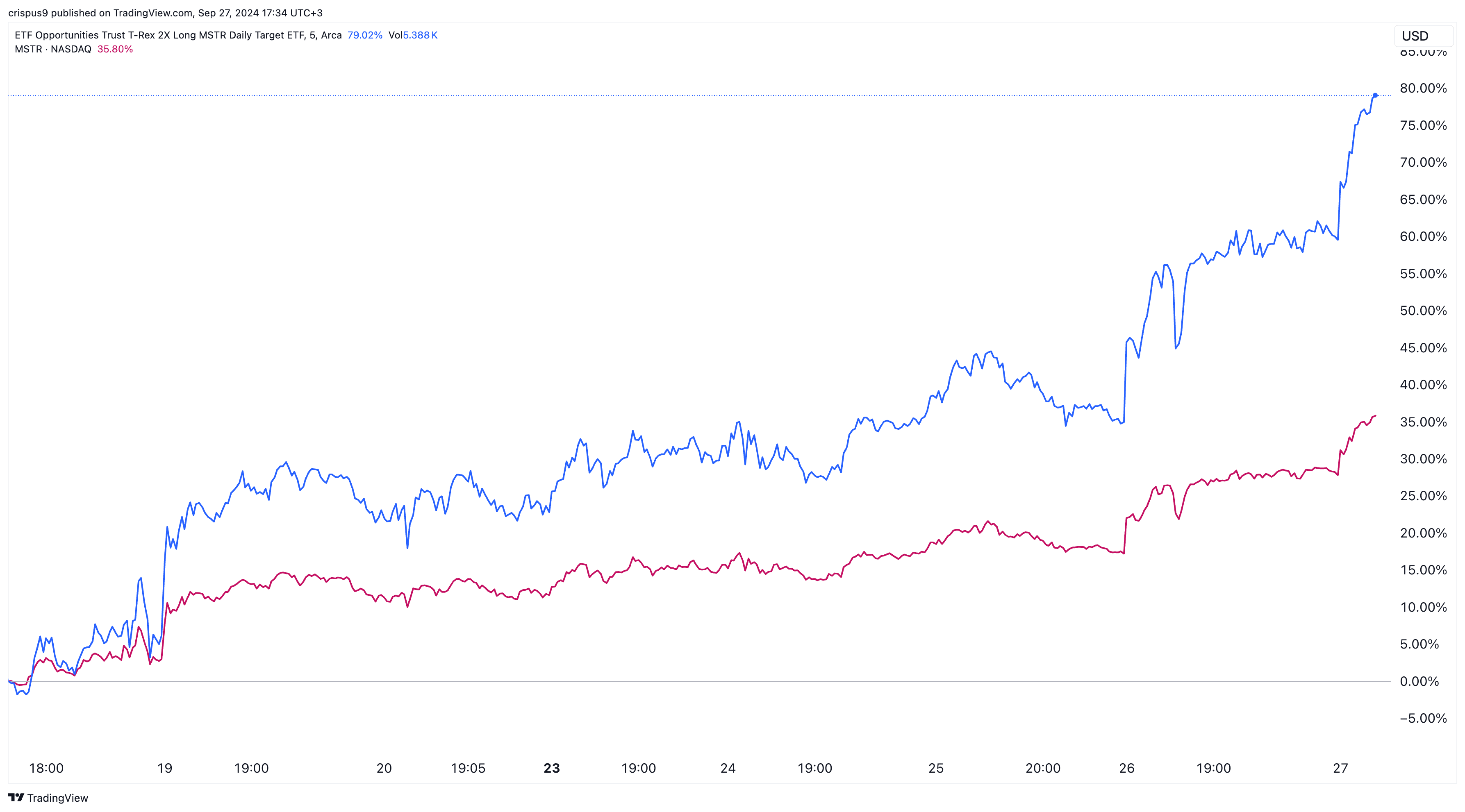

On September 27th, MSTU’s shares reached an all-time peak of $44, representing a 81% increase from its initial price. This strong performance places it among the top performers on Wall Street. Notably, MSTU’s growth surpasses that of MicroStrategy stock, which has increased by 35% during the same timeframe.

The MSTU fund is an enhanced ETF designed to double the daily returns of MicroStrategy’s stock. To illustrate, if MicroStrategy stocks increased by 6.6% on a particular Friday, then the MSTU fund would have risen by approximately 13%.

Historically, funds that use leverage tend to thrive when their underlying asset is increasing in value and decline when it’s decreasing. For example, the ProShares UltraPro ETF, a leveraged fund linked to the Nasdaq 100 index, has surged by 373% over the past five years, while the ProShares UltraPro Short QQQ, another leveraged fund, has fallen by approximately 98.8% during the same timeframe.

It’s clear that both MSTU and MSTX investment funds have seen gains as a result of MicroStrategy’s recovery during the current Bitcoin price surge, which has reached an all-time high of $66,000 in the past two months, following an upward trend that started earlier this month.

In comparison to Bitcoin, MicroStrategy’s shares tend to perform better because of the significant assets the company holds. Over the past year, the stock has experienced a staggering increase of 457%, whereas Bitcoin has only risen by approximately 151% in the same timeframe.

Last week, the company bought more coins worth over $458 million, bringing its total holdings to 252,220 worth $16.7 billion.

A number of experts predict that Bitcoin’s value may further increase due to anticipated reductions in Federal Reserve interest rates before the American general election, as well as the release of Changpeng Zhao from prison.

Furthermore, it appears that whales are buying more Bitcoin, as their holdings increase, while the reserves at cryptocurrency exchanges have reached their lowest levels this year. Over the past three days, Blackrock has been among those increasing their Bitcoin holdings, purchasing an additional 5,894 coins.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-09-27 19:13