As an analyst with over a decade of experience in the cryptocurrency market, I must say that the recent surge in Bitcoin NFT sales is a promising sign for the industry. The fact that new collections like NodeMonkes and Bitcoin Puppets are performing well indicates that there’s still room for innovation and growth in this space.

Last week, the number of non-interchangeable tokens on the Bitcoin network rebounded, as the NFT sector showed signs of recovery.

Bitcoin NFT sales rose

As reported by CryptoSlam, the sales volume of Bitcoin Non-Fungible Tokens (NFTs) has soared by an impressive 56% within the past week, surpassing $20 million. Additionally, the count of buyers on this network has increased by a significant 48%, reaching 29,403 individuals.

In the NFT ecosystem, NodeMonkes, a fresh collection, emerged as the top performer, recording approximately $3.4 million in sales and executing 302 transactions. However, during that particular week, only Immutable X’s Guild of Guardian Heroes collection surpassed it in terms of total sales.

Bitcoin Puppets had a sales volume of $3.03 million. That’s a 239% increase from the previous week.

Following Ordinal Maxi Business, which saw its sales soar beyond $1.89 million, was Taproot Witches, who managed to sell approximately $1.3 million.

Ethereum, Solana

In a bustling scene, Ethereum (ETH) led the Non-Fungible Token (NFT) market with transactions totaling approximately $28 million. Meanwhile, Solana (SOL) and BNB Chain followed closely behind, recording sales of around $13 million and $3.7 million respectively.

In simpler terms, it seems that September saw a significant decrease in NFT sales, with the total amount dropping by approximately 48% to around $318 million. The individual sales for Ethereum, Bitcoin, and Solana were reported at $108 million, $63 million, and $61 million respectively.

Bitcoin bounces back

As a crypto investor, it was thrilling to witness the surge in weekly NFT sales and the rebound in most cryptocurrency prices last week. The price of Bitcoin reached an impressive milestone, touching $66,000 for the first time since July. Moreover, the total market capitalization of all coins soared, breaking the $2.3 trillion mark – a testament to the vibrant state of the crypto market!

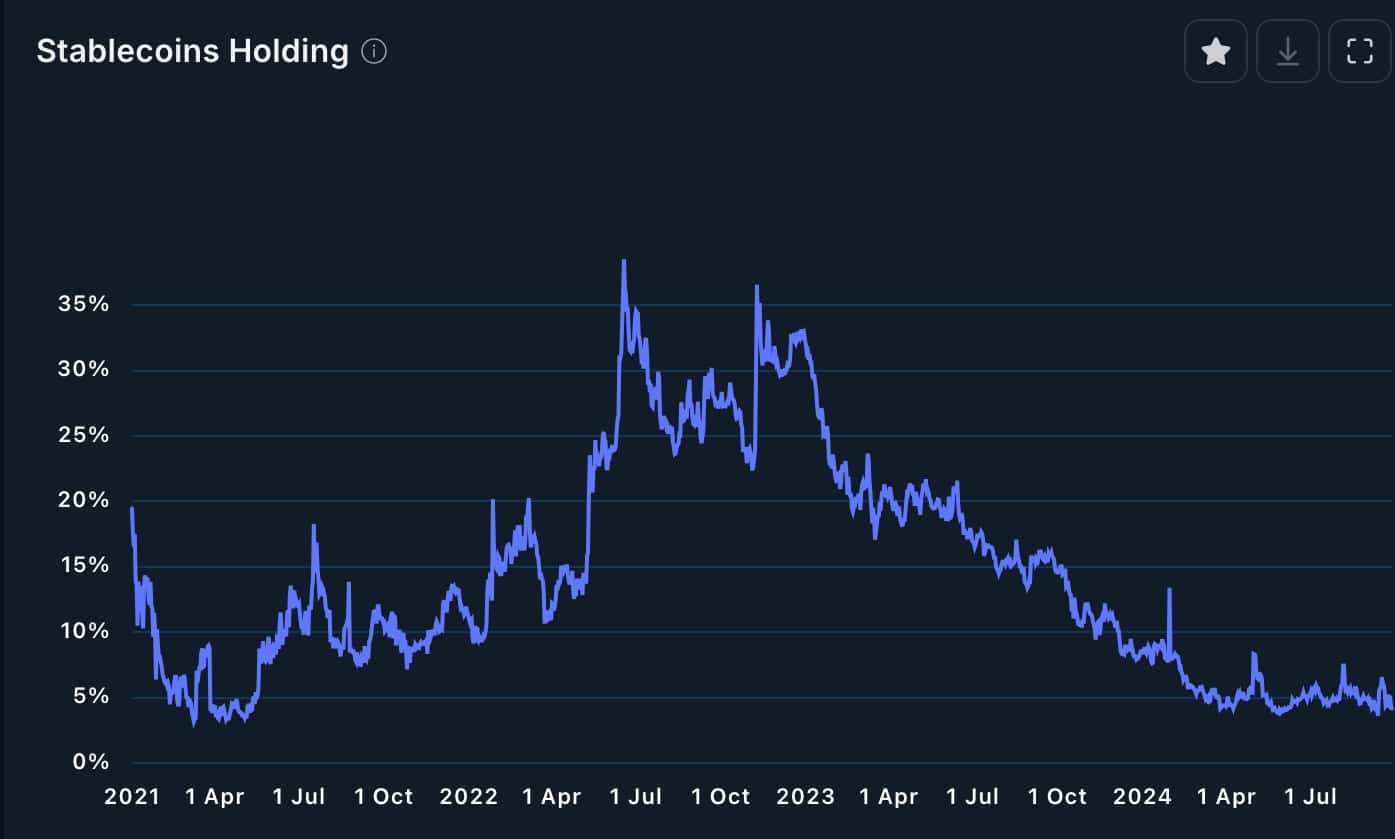

As an analyst, I’ve noticed a significant shift in the crypto market recently. For the first time in two months, the closely monitored Fear & Greed Index has surged into the “Greed” zone at 60. Historically, when this index enters the “Greed” territory, traders tend to gravitate towards riskier assets such as stocks and cryptocurrencies, a trend we’re seeing now due to factors like the Federal Reserve reducing interest rates, China implementing stimulus measures, and the ongoing decrease in stablecoin holdings among sophisticated investors.

Over the past two years, the amount of stablecoins held by these investors has reached its lowest level.

As a researcher, I’ve observed an interesting pattern in my studies. The Nansen chart indicates that the surge in these holdings, which peaked in 2022 following the collapse of FTX and Terra ecosystem, has since been on a downtrend. It seems that sophisticated investors have been adjusting their strategies, possibly liquidating some stablecoin investments and redirecting funds towards cryptocurrencies and Non-Fungible Tokens (NFTs).

The key risk investors face with NFTs is that the industry has become highly saturated, with thousands of new collections. A recent report reveals that 96% of more than 5,000 existing NFT collections are “dead.”

Essentially, they’ve got no trades being made, a week-long drought of sales, and no signs of engagement on social media platforms.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-09-29 16:14