After observing the rapidly evolving landscape of “to-earn” projects for quite some time now, I must say it’s an intriguing mix of innovation and speculation that catches my attention. As someone who has seen their fair share of market cycles, I can’t help but draw parallels to the dot-com boom of the late ’90s.

There’s a longstanding desire among people to quickly amass wealth through games, actions involving movement or simple taps, but such endeavors frequently result in disappointment. Could the concept of earning money for everyday activities have a promising future?

Thousands, if not millions, of Hamster Kombat users are disheartened by the airdrop event. This situation isn’t novel; the crypto community has previously witnessed the swift increase and decline of numerous mechanisms promising earnings for basic tasks. So, what insights have we gained from this?

Table of Contents

Early appearance: hope for stable earnings

The rise of web3 games has sparked significant curiosity about making cryptocurrency by performing straightforward tasks. These play-to-earn (P2E) games represent a novel category, enabling players to accumulate both cryptocurrencies and Non-Fungible Tokens (NFTs) through various activities.

Axie Infinity was one of the first to pave the way in this field. To begin playing, players had to initially invest money to acquire Axies, which are virtual NFT pets. Players could earn tokens by finishing tasks, engaging in battles with other players, and progressing through game levels. These tokens could be traded for various digital or traditional currencies, and items could be sold on cryptocurrency exchanges and NFT marketplaces.

As an analyst, I’ve found that for quite some time, this game was seen as a potentially lucrative venture, even jokingly so. It garnered significant attention, particularly in the Philippines. In the unprecedented year of 2020, when the pandemic forced global lockdowns and many lost their jobs, Filipino crypto enthusiasts, known for their entrepreneurial spirit, started creating guilds. These guilds provided a platform for regular users to earn income through Play-to-Earn games.

Despite the initial success of Axie Infinity, it eventually faced a problem with in-game inflation. This continuous expansion led to a decrease in the value of its utility token, Smooth Love Potion (SLP), and later, its governance token AXS. To keep the demand for both SLP and AXS high, an unending stream of new registrations, even from players who don’t currently hold either token, is necessary.

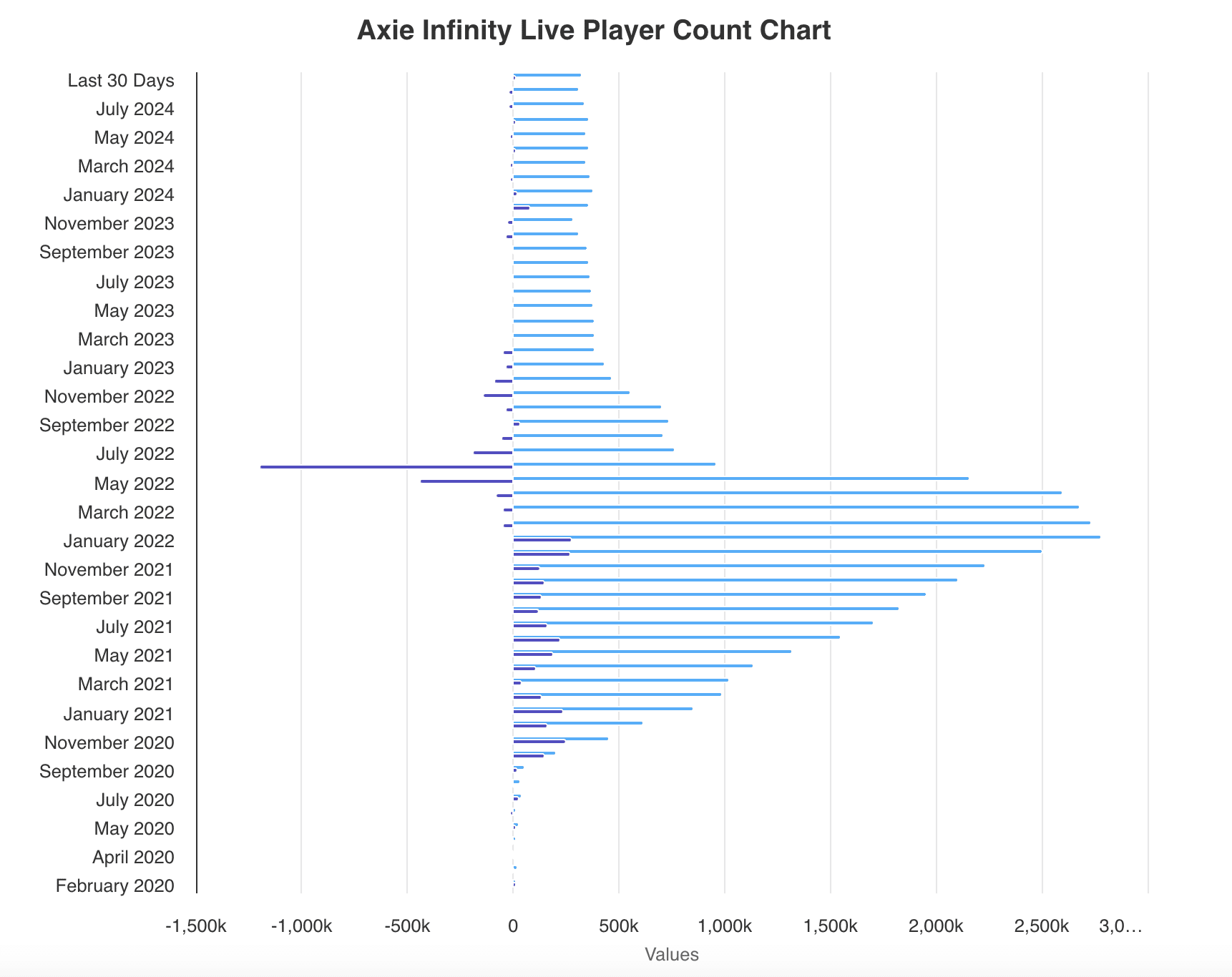

If our monthly active users (MAU) surpassed 2.7 million at its highest point, it had dropped to approximately 310,000 by July 2024. The decline in Axie Infinity performance can be attributed to the market-wide correction following Bitcoin‘s (BTC) previous all-time high (ATH) on November 10, 2021.

In March 2022, a widespread hacking incident significantly impacted the game’s decreasing popularity. The loss of users and lack of newcomers meant that existing users could no longer generate income. This unfortunate situation became even more disheartening for some platform users who had invested in the game, finding themselves in debt due to their failed attempts to profit from the project. Some user stories turned out to be particularly sad as a result.

Healthy habits replace gaming, but not for long

Amidst the waning popularity of Play-to-Earn (P2E) games, a novel approach to earning called Move-to-Earn has emerged in the realm of web3. One well-known instance of this type of game is STEPN.

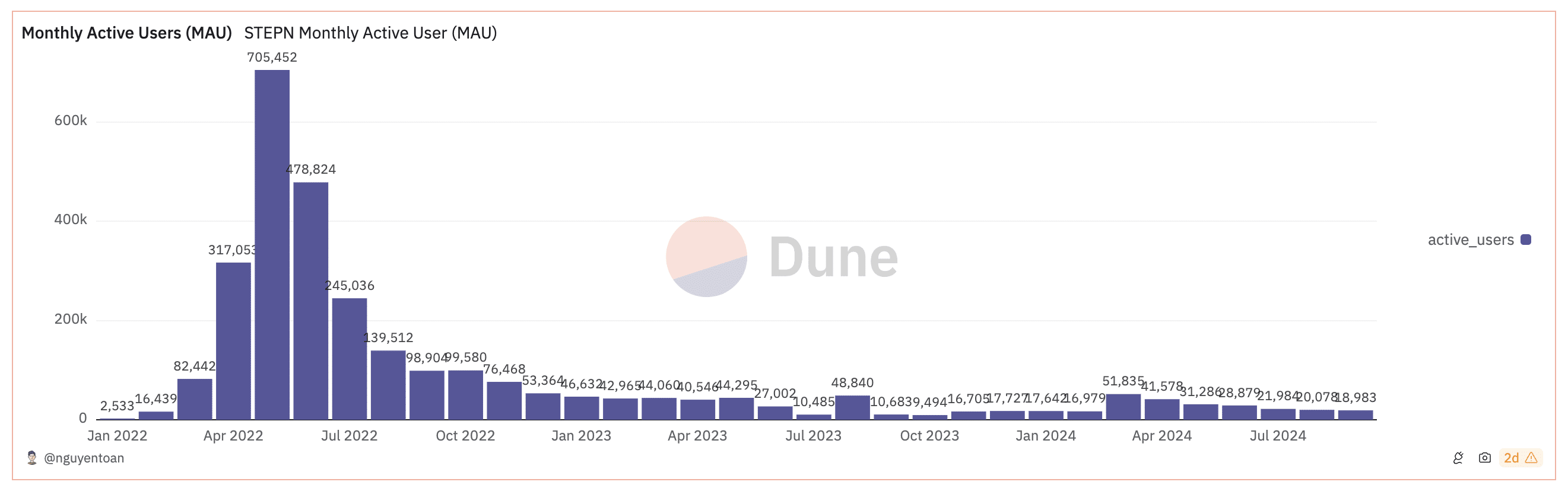

Nevertheless, its profits saw a substantial decrease as a result of increased user numbers, and certain analysts detected indications of a Ponzi scheme within the STEPN system’s internal workings.

Simultaneously, doubts surrounding the project don’t diminish the reality that the initial users of the platform indeed earned a decent sum. These early adopters were able to recover their investments, whereas the losses outweighed the profits for those who jumped on board during the height of excitement.

The game intended to promote healthy habits, STEPN, ultimately faltered due to its success. Instead of using the allocated Green Satoshi Token (GST) within the game, users opted to trade them for Green Metaverse Token (GMT), seeking potential profit, particularly following the surge in spring 2022, when the token peaked at $4.11. The cost maintenance mechanisms set by the project team did not prove effective enough to counterbalance this trend.

As reported by Dune, there was a substantial drop in the number of Monthly Active Users (MAU) for the project. In May 2022, this count exceeded 705,000, but by September 2024, it had already fallen below 19,000.

On their official site, the creators clarify that while some may view the play-to-earn aspect as resembling a Ponzi scheme, STEPN distinctly differs. Instead, they emphasize that the platform’s architecture includes robust economic mechanisms, which maintains the project’s coin value consistency.

From my perspective as an analyst, it’s crucial to note that STEPN, at its core, lacked a substantive economy. Instead, it primarily relied on the influx of funds from new users who purchased virtual assets for substantial sums, dreaming of recouping their investment within a few months. This financial support, in essence, fueled the economy, while the work performed was essentially imaginary and devoid of tangible value.

To keep the audience engaged, it’s essential to have a continuous flow of fresh players who might purchase game currency and NFT items from existing players. A large number of new entrants can make such projects feasible. However, the mechanism of profit distribution in “earn-to-play” is distinct from traditional Ponzi schemes and is more akin to retail trading.

For about a year now, STEPN has been in operation, drawing in individuals who appreciate the concept of earning money through straightforward tasks. As I write this, the value of its native GMT token stands at $0.1464, which represents a staggering 96% decrease compared to its All-Time High (ATH).

Mechanics become simpler

In the realm of “earning” games, a new offshoot of evolution is the “tap-to-win” feature. This innovation made earning easier for players than previous versions as they could now make money just by tapping on their screens, eliminating the need for extensive gameplay.

As a researcher delving into this particular field, one noteworthy endeavor that garnered significant attention was Hamster Kombat. Unfortunately, despite the massive user base that rallied behind it, the project encountered a substantial backlash due to the magnitude of the airdrop’s size.

Was there anything in Hamster Kombat’s development or its community that might have foreshadowed its demise? Certainly, examining the project’s economic structure and its following provides valuable insights.

75% of the token supply is designated for the community, but since a substantial portion of our audience consists of newbies or those who prefer free items, there’s a possibility they might sell their tokens promptly after listing. This could lead to high pressure on the coin price due to the sudden surge in supply. Additionally, the project team has yet to disclose the long-term value of the coin, which may cause uncertainty among potential investors.

Because of its referral system, Hamster Kombat attracted a massive user base of millions. Yet, this success came with a potential drawback: when the project was listed, many users quickly disposed of their tokens, potentially leading to the project’s instability.

Will the community learn from past failures?

Yat Siu, co-founder and executive chairman of Animoca Brands, pointed out in a statement to crypto.news that one major challenge for blockchain games is the absence of well-established channels for widespread distribution. Major platforms like the Apple App Store and Steam typically impose restrictions on games featuring NFTs and limit their broad accessibility.

As more gamers engage with blockchain technology through user-friendly Telegram Mini Apps, it’s likely that these platforms will gain increasing popularity, potentially leading mainstream game creators to invest more heavily in the web3 gaming sector. This trajectory mirrors the way mobile games initially emerged from a niche overlooked by much of the traditional gaming industry, eventually becoming a dominant force within the gaming business.

Bozena Rezab, a co-founder and chairman at GAMEE, however, believes that these types of games are instrumental in encouraging widespread use of cryptocurrencies, benefiting the industry. She mentioned that 131 million users obtained Hamster Kombat tokens, which is significantly greater than typical web3 engagement rates, often limited to thousands or even tens of thousands of participants.

It’s evident that casual gaming on Telegram could significantly boost the acceptance of cryptocurrencies.

Is there any hope for making money?

In most to-earn projects, it’s primarily the project creators and early participants who stand to gain financially. However, whether users of web3 games can genuinely earn real money is a topic of discussion. While some have successfully withdrawn in-game currency, there are also many active players, which often makes it challenging for the developer company to compensate all the earnings generated by the players.

Projects that allow users to earn rewards through playing, moving, or tapping are often undermined by their sudden surge in popularity. The majority of these widely-played games tend to operate like a pyramid scheme where new players finance older ones until the excitement wanes. Consequently, such projects are destined for failure once interest subsides.

From my perspective as an analyst, it’s incorrect to state that all easy money projects will inevitably fail. The primary challenges these projects often face stem from flawed token economics and their reliance on a continuous stream of new users. Therefore, the success of earning-based projects hinges on their capacity to develop sustainable business models. It’s important to note that while many web3 games primarily use pyramid-like mechanics, the world of web3 gaming has experienced its fair share of high-profile rises and falls.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Mini Heroes Magic Throne tier list

- Adriana Lima Reveals Her Surprising Red Carpet Secrets for Cannes 2025

- Summoners Kingdom: Goddess tier list and a reroll guide

- Castle Duels tier list – Best Legendary and Epic cards

- Ludus promo codes (April 2025)

- Kingdom Rush 5: Alliance tier list – Every hero and tower ranked

- DEEP PREDICTION. DEEP cryptocurrency

- Grimguard Tactics tier list – Ranking the main classes

- Call of Antia tier list of best heroes

2024-10-01 20:30