As a seasoned crypto investor with a knack for deciphering market trends, I must admit that the current Solana (SOL) downturn has me slightly concerned but not deterred. Having been through numerous crypto winters and bull runs, I’ve learned to stay calm amidst the sea of red.

As a researcher, I’ve observed a consistent decline in Solana’s performance over the past four days, with a wave of red dominating the cryptocurrency market landscape.

On October 3rd, Thursday, Solana (SOL), the fifth-largest cryptocurrency, saw a decline to $135, marking its lowest point in more than three weeks. Additionally, it has entered a brief period of correction, dropping by approximately 16% from its peak last week.

The decline in Dogwifhat (WIF) occurred concurrently with a general withdrawal of most Solana-based meme tokens. For three consecutive days, Dogwifhat has seen a drop. Similarly, other tokens such as Popcat (POPCAT), Cat in a dog’s world (MEW), and Book of Meme (BOME) have also receded. As reported by CoinGecko, the total market capitalization of all Solana meme coins shrank by 7%, settling at approximately $7.8 billion.

It appears that recent data indicates Solana is increasingly dominating the decentralized exchange sector. As per DeFi Llama’s findings, the volume of transactions within its ecosystem has grown by 46%, reaching a staggering $9.25 billion weekly. This positions Solana as the second most significant player in this field, with Ethereum leading the way at $9.6 billion.

The majority of the increase occurred in Raydium, with its volume jumping by 71% to reach a staggering $4.3 billion. Next in line were Orca, Phoenix, and Lifinity, each handling transactions worth approximately $3.1 billion, $933 million, and $734 million respectively.

Furthermore, Solana’s ecosystem is thriving, with the total value locked surpassing $5.06 billion, a peak not seen since 2022. Six major networks, namely Jito, Kamino, Jupiter, Marinade, and Raydium, have collectively amassed over $1 billion in TVL (Total Value Locked), a significant milestone.

It appears that the continued selling of Solana is largely influenced by heightened global political tensions. According to the New York Times, there are indications that Israel might initiate a conflict with Iran. Such a conflict could potentially trigger inflation, leading central banks to reconsider or slow down their plans for reducing interest rates.

Solana price could form a death cross

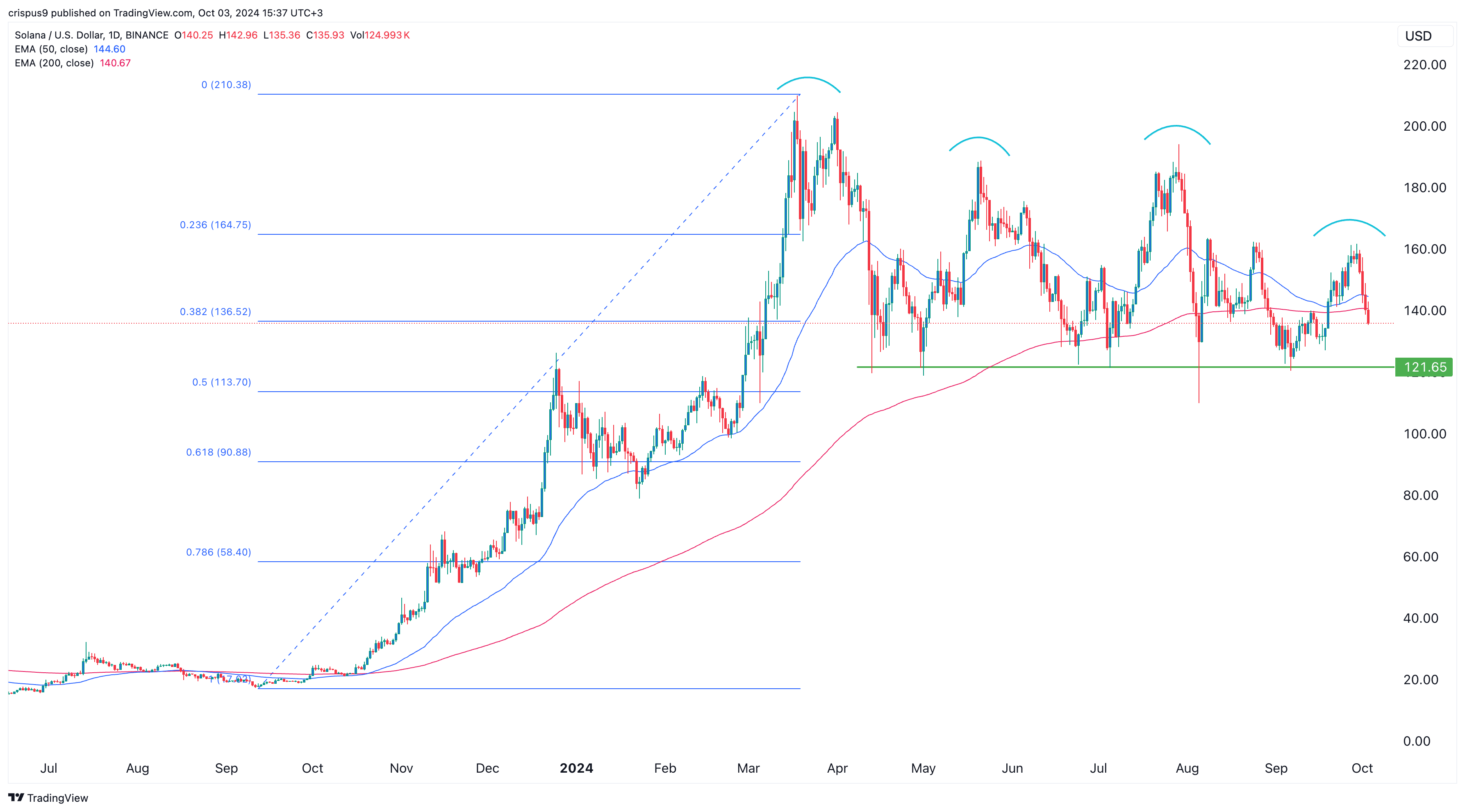

Over the past few months, the graph for Solana’s daily pricing indicates a pattern of successive decreasing highs and lows starting from March. Moreover, there has been a robust resistance at approximately $121.65, with Solana finding it difficult to drop below this level since April 12.

As Solana gets closer to hitting the 50% Fibonacci Retracement mark, its 200-day and 50-day Exponential Moving Averages are almost crossing over, a situation known as a “death cross.” This pattern could potentially initiate further selling, with an initial predicted drop to around $121.65. If Solana falls below this level, it will confirm the bearish trend and likely lead to additional declines.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-10-03 16:09