As a seasoned market analyst with over two decades of experience under my belt, I have seen my fair share of market swings driven by political events and celebrity endorsements. The recent surge in Bitcoin to $63,000 is no exception, as it seems to be directly linked to the Trump-Musk rally in Pennsylvania.

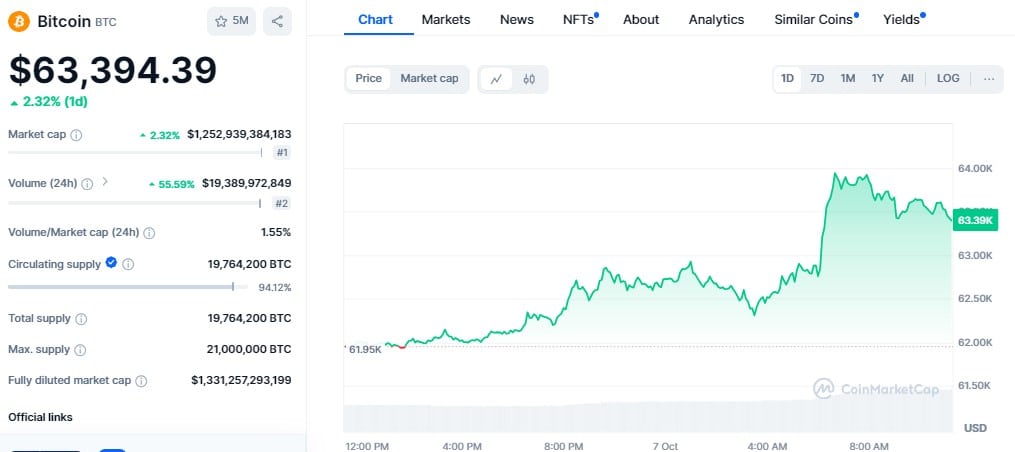

On Monday, the price of Bitcoin rose to $63,000, up 2% in the last 24 hours. This recovery comes after a recent decline due to increased conflict between Iran and Israel and thus raises questions about the effects of Trump and Musk’s recent rally.

At a gathering in Butler, Pennsylvania, Donald Trump had Elon Musk standing alongside him, publicly backing Trump’s campaign. It’s thought that this joint appearance invigorated Trump’s base of supporters, potentially influencing the optimistic outlook toward Bitcoin seen in financial markets.

The rise in Bitcoin’s value mirrors indications of a robust U.S. economic expansion, fueled by job numbers exceeding expectations. As investor sentiment improved, so did their faith in Bitcoin, creating a connection between political context and financial fluctuations.

The advancement of Bitcoin mirrored that of significant global stock markets, with data suggesting a lower risk of an economic crisis in the U.S. economy.

Interestingly, betting markets are showing a significant shift towards Donald Trump over Kamala Harris, with Polymarket predicting a 51% chance for Trump and 48% for Harris. This change comes after Trump held a rally in Butler, Pennsylvania, where Elon Musk, a key executive at Tesla, expressed his support for him.

This perspective might stem from Trump’s favorable stance towards cryptocurrencies, demonstrated through accepting Bitcoin donations and his promise to enact advantageous laws should he be elected.

Moreover, Bitcoin isn’t the only digital currency experiencing rapid growth. In fact, Ether, the second-largest cryptocurrency, increased by 3% to reach $2,487.07. Similarly, other alternative coins like Solana (SOL), Ripple (XRP), and Cardano (ADA) also saw gains ranging from 2.3% to 5%.

As an analyst, I’m keeping a close eye on the forthcoming economic reports, particularly the Consumer Price Index (CPI) inflation data due out this week. The potential impact of these figures on the Federal Reserve’s interest rate expectations is a key factor to consider. Moreover, there’s growing speculation that a slight reduction in interest rates could be on the table as early as November. This potential move might not only influence traditional investment markets but could also resonate through the crypto market, making it an intriguing area to monitor closely.

It’s plausible that Bitcoin could rise to $63,000, given the market’s renewal and the impact of political factors such as the interaction between Trump and Musk, which might have ignited investor excitement.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Cookie Run Kingdom Town Square Vault password

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-10-07 10:44