As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of geopolitical tensions and market fluctuations. The recent trend in Bitcoin whale addresses is indeed intriguing. It seems that these large Bitcoin holders are playing a cautious game, waiting for the dust to settle in the Middle East before making significant moves.

As tensions lessen in the Middle East, there’s been an increase in the count of significant Bitcoin owners.

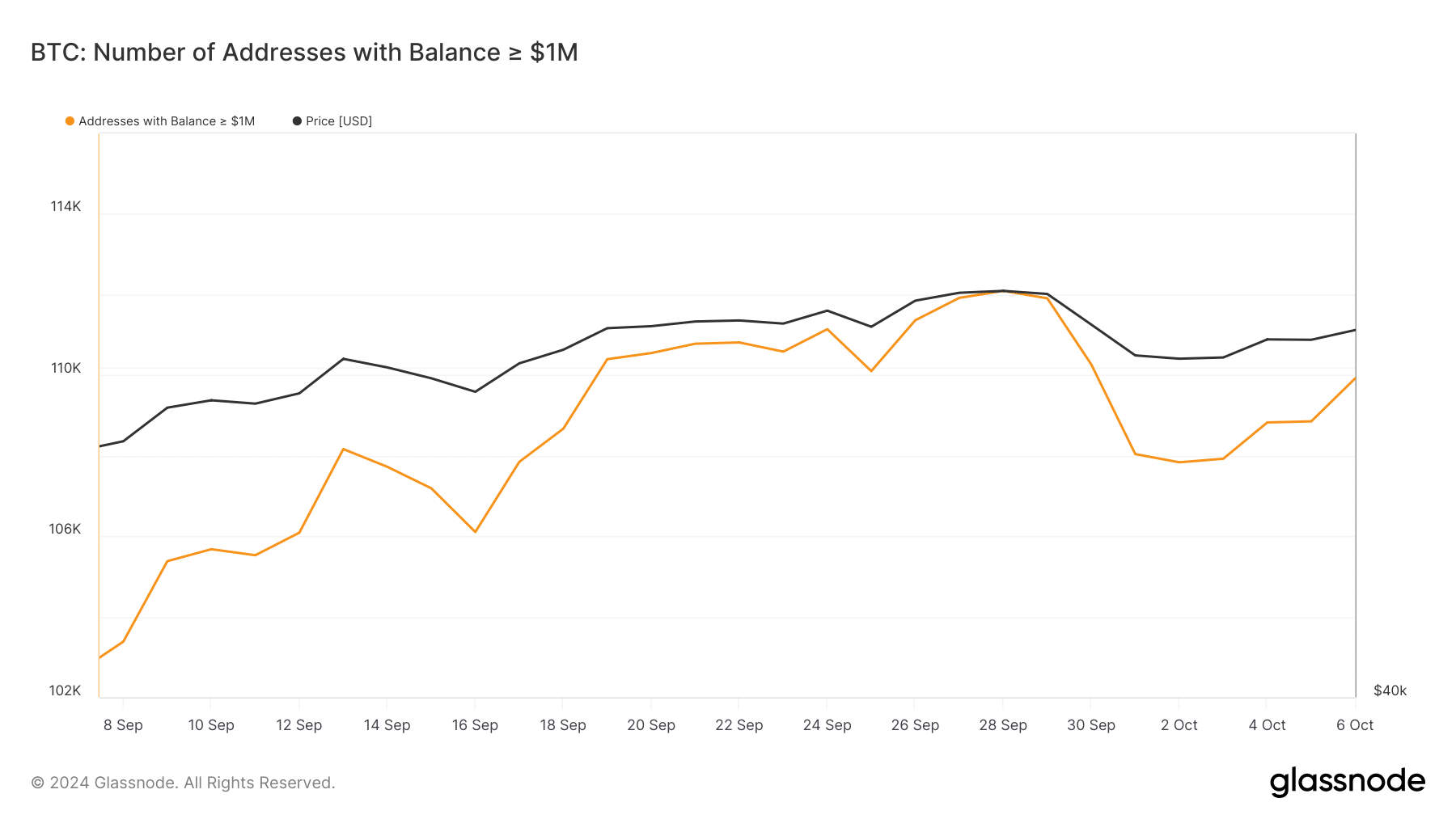

The number of whales, who hold more than a million dollars worth of Bitcoin (BTC), decreased from 111,906 to 107,835 between September 29 and October 2, according to data from Glassnode. This decline seems to have been mainly caused by a selloff that took place on October 1, following Iran’s missile attack on Israel.

According to Glassnode’s data, a significant number of large cryptocurrency holders (whales) began to increase their activity – peaking at 109,921 distinct wallets on October 6 – as tensions in the Middle East showed signs of easing.

Over the weekend, the wider cryptocurrency market experienced significant growth as well. As per a recent article from crypto.news, the total market capitalization of all cryptocurrencies grew by approximately 1.7% within the last 24 hours, exceeding the $2.3 trillion threshold.

In the last 24 hours, Bitcoin experienced an increase of 1.8% and is currently valued at approximately $63,150. At this moment, its market capitalization hovers around $1.25 trillion, and the daily trade volume amounts to roughly $21 billion.

Over the past week, the Bitcoin price dropped under the $60,000 mark, following the Biden administration’s expressed approval of possible Israeli strikes against Iranian oil infrastructure.

The surge in Bitcoin’s price led to a significant increase in cryptocurrency liquidations, as reported by Coinglass. In total, these liquidations amounted to approximately $162 million, with Bitcoin dominating at around $37 million. This figure includes both short and long positions, with $24.3 million coming from short positions and $12.8 million from long positions.

Excessive sell-offs of Bitcoin could lead to a price adjustment, since the market currently shows signs of being overvalued or overbought.

Mark your calendars! On October 10th, we’ll see the publication of the U.S. Consumer Price Index for September 2024. This report often carries great weight in the financial world, particularly in sectors like cryptocurrency.

If the actual inflation rate falls below the predicted 2.2%, there’s a good chance that the U.S. Federal Reserve will lower interest rates again, possibly sparking a positive trend in the financial markets.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Castle Duels tier list – Best Legendary and Epic cards

- EUR CNY PREDICTION

- Mini Heroes Magic Throne tier list

- 9 Most Underrated Jeff Goldblum Movies

- USD CNY PREDICTION

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

2024-10-07 14:12