As a researcher with extensive experience in studying global financial markets and blockchain technology, I find it fascinating to witness the rapid growth of stablecoins, particularly in emerging markets like Brazil and Sub-Saharan Africa.

The worth of transactions involving stablecoins on Brazil’s domestic trading platforms has significantly outpaced that of Bitcoin, indicating a marked increase in their utilization for business-to-business cross-border payments.

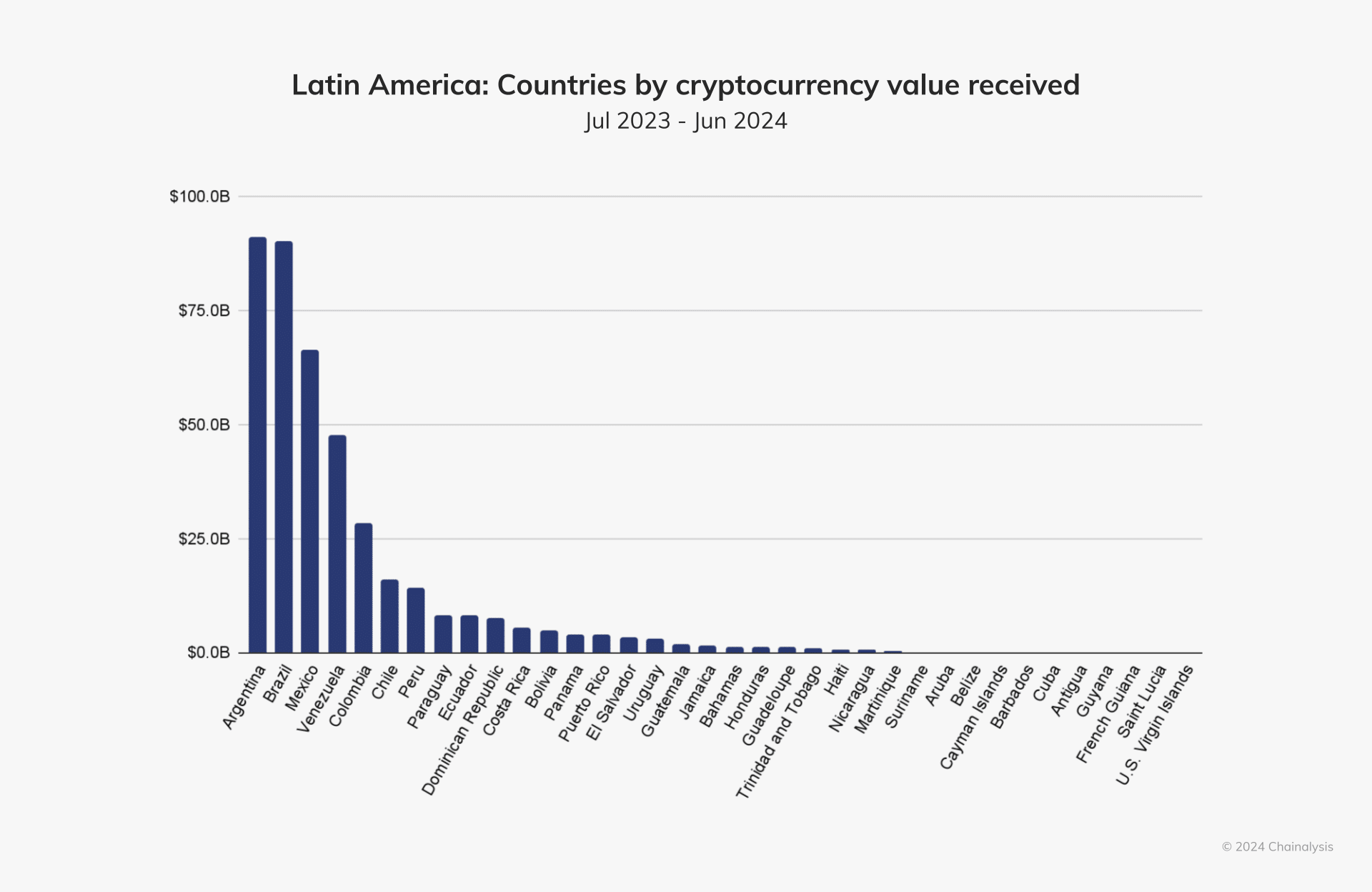

In simple terms, the use of digital coins backed by Brazil, known as stablecoins, is flourishing. This is because Latin America is showing rapid expansion, being the second-highest region in terms of annual growth rate, surpassing 42%, as reported by data from Chainalysis, a firm specializing in blockchain analysis.

According to a company based in New York, Brazil received approximately $90.3 billion worth of cryptocurrency from July 2023 to June 2024, making it the second-highest recipient behind Argentina. Although Bitcoin (BTC) continues to be favored, stablecoins have gained traction on domestic platforms due to a growing preference for U.S. dollar exposure in response to local currency volatility.

According to Chainalysis, the worth of stablecoin transactions on Brazilian exchanges has risen by a staggering 207.7% compared to last year, significantly surpassing the growth rate of other digital currencies such as Ethereum (ETH).

In spite of economic difficulties, including a depreciating Brazilian real and decreasing growth rate, there persist promising prospects for cryptocurrency development. This is particularly true as regulators become more accepting of the technology, according to the firm’s statement. As trading platforms like OKX and Coinbase extend their operations in Brazil, stablecoins are expected to maintain their influence in the country’s rapidly changing crypto market, as suggested by Chainalysis.

Furthermore, it’s not just Latin America that is experiencing a surge in demand for stablecoins during economic instability. Previous reports from crypto.news have highlighted Sub-Saharan Africa as another region where stablecoins play a crucial role, representing around 43% of the total transaction volume in the region’s cryptocurrency economy.

In simple terms, the transfer of retail-sized stablecoins (a type of digital currency) in Ethiopia, Africa’s second-largest country by population, has increased by 180% compared to the previous year. This surge is likely due to a recent decline of about 30% in the value of its local currency, the birr.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Henry Cavill Reveals Struggles Behind the Scenes of ‘Warhammer 40k’ Live-Action Series

2024-10-09 16:35