As a seasoned crypto investor with over a decade of experience under my belt, I must admit that the news of World Liberty Financial (WLF) caught my attention. With its ambitious plans and the high-profile association with the Trump family, it seems like an intriguing opportunity. However, as someone who’s been through numerous crypto projects, I can’t help but feel a sense of deja vu.

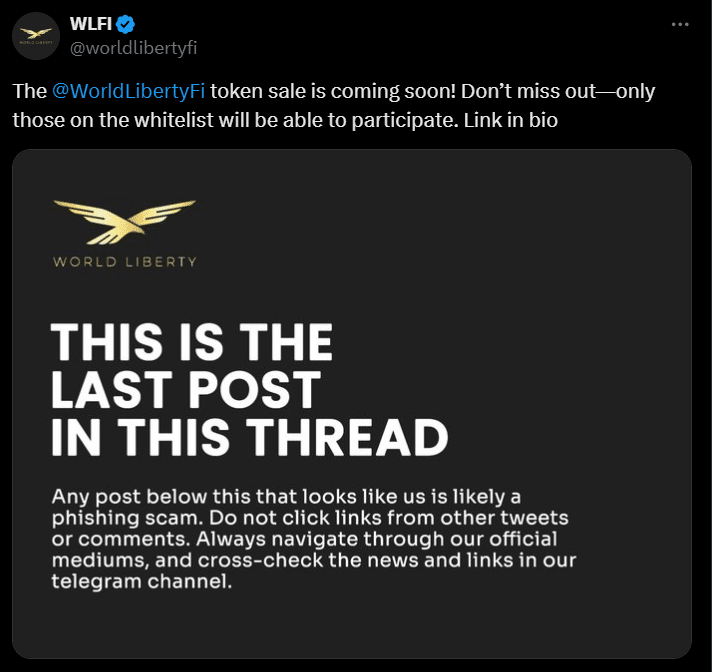

A decentralized finance initiative known as World Liberty Financial, which has connections to the Trump family, including former U.S. President Donald Trump and his sons, is planning to collect around $300 million via a token offering starting next week.

As per the outlined plan, this transaction is set to distribute 20% of the entire token inventory, with an estimated market value of $1.5 billion.

Steve and Zach Witkoff, along with Zak Folkman and Chase, have disclosed in a recent announcement that this is just the beginning of their project, with intentions to sell more in the future. A total of 63% of the token supply will be made available for public purchase, while the remaining 37% will be divided; 17% will go towards user rewards and 20% to the team.

The WLFI token serves as a tool for governing the platform, enabling its holders to voice their opinions and decide on the platform’s future developments. Yet, during the initial period of 12 months, these tokens will remain non-transferable, regardless of any decisions made by the community regarding transfers.

The project is planned to unfold in three distinct phases. Initially, it aims to establish a Decentralized Finance (DeFi) lending platform compatible with the Ethereum Layer 2 network Scroll, resembling Aave. This will enable users to lend and borrow various digital currencies including bitcoin, ether, and stablecoins.

During the next stage, we’ll work on linking with various trading platforms to provide onboarding (on-ramping) and offboarding (off-ramping) facilities, as well as a credit card backed by stablecoins for everyday transactions in the physical world.

At its last phase, the platform intends to divide tangible assets such as hotels and sports clubs into smaller portions. Additionally, it aims to secure necessary licenses to function as a platform for settling transactions involving stablecoins.

The project has already started its first stage and is currently open to accredited investors in the U.S., as well as qualified investors in the UK and other countries

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- EUR CNY PREDICTION

2024-10-10 19:00