As a seasoned researcher with a knack for deciphering market trends and a soft spot for ETFs, I find myself intrigued by the surge of MicroStrategy-related exchange-traded funds (ETFs). The Defiance Daily Target 1.75x Long MSTR ETF and the T-Rex 2x Long MSTR Daily Target funds have been firing on all cylinders lately, with impressive gains of 28% and 31%, respectively, in just five days. This is a clear sign that these ETFs are not for the faint-hearted but for those who are willing to take calculated risks for potentially high rewards.

Investments in MicroStrategy’s exchange-traded funds, made possible by leveraging, are performing optimally with increased inflows and a rise in their stock prices.

MicroStrategy ETFs surge

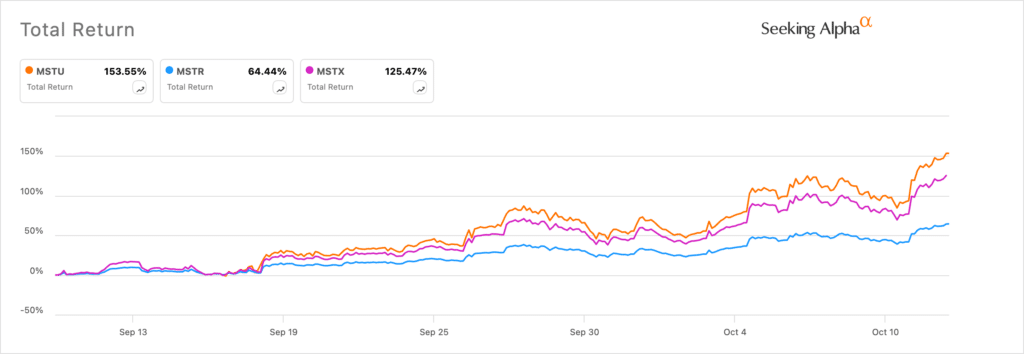

As a researcher, I’ve noticed an impressive surge in the performance of two funds focused on MicroStrategy (MSTR) – the Defiance Daily Target 1.75x Long MSTR ETF and the T-Rex 2x Long MSTR Daily Target fund. Over the last five days, these funds have experienced remarkable growth, with the former soaring by approximately 28% and the latter seeing a staggering 31% increase.

These ETFs have outperformed MicroStrategy stock, which has risen by 16.1% in the last five days.

On Monday, October 14, the three investments maintained their robust momentum. Bitcoin (BTC) and other digital currencies bounced back, while MicroStrategy’s shares increased by more than 5.3% in early trading, before the market opened. Furthermore, the MSTX and MSTU ETFs experienced gains of 9.50% and 10.6%, respectively.

Bitcoin, the most valued digital currency in terms of market worth, reached a new high of $65,000 for the first time since September 30th. This surge occurred as the Crypto Fear and Greed Index moved out of the ‘fear’ category.

The reason behind the market’s surge could be attributed to Chinese authorities announcing additional financial support. In a public announcement, Finance Minister Lan Fo’an confirmed their commitment to helping the struggling real estate industry and subtly suggested an increase in government expenditure.

Consequently, Goldman Sachs’ economic analysts have raised their forecast for growth. They now anticipate that the economy will expand by 4.9% as compared to their earlier prediction of 4.7%.

Following this declaration, there was a noticeable improvement in the mood of the global financial markets. Stock markets in America, Asia, and Europe all maintained their upward trajectory.

MicroStrategy’s stocks tend to follow Bitcoin’s price fluctuations because of its significant Bitcoin holdings. As per BitcoinTreasuries, the company owns approximately 252,220 Bitcoin, valued at around $16.3 billion.

MSTU and MSTX offer a high-risk, high-reward opportunity

As a researcher, I find that exchange-traded funds (ETFs) such as MSTU and MSTX present an alluring, albeit risky, prospect for MicroStrategy investors. These funds employ leverage, which amplifies potential returns, but also increases the level of risk involved.

At one percent increase in MicroStrategy’s stock price on a given day, MSTU’s stock doubles its value. Conversely, MSTX increases by 1.75%. Over an extended period, their collective returns tend to be robust when the market for MicroStrategy shares is performing exceptionally well.

MSTU and MSTX are designed to mimic the achievements of other ETFs that amplify returns, such as the ProShares Triple Leveraged NASDAQ-100 (TQQQ), which follows the Nasdaq 100 index. Over the past decade, this index has soared by an impressive 430%, and the TQQQ fund has seen even more significant growth, climbing over 2,360% in the same timeframe.

As a crypto investor, I’ve learned that investing in leveraged products like the TQQQ ETF isn’t without its risks. The danger lies when the asset it represents doesn’t perform as well as expected. Take 2022 for instance, when the Nasdaq 100 index declined by 32%, the TQQQ ETF plummeted a staggering 79%. So, while the potential rewards can be enticing, it’s crucial to always consider the associated risks.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Mini Heroes Magic Throne tier list

- Summoners Kingdom: Goddess tier list and a reroll guide

- Castle Duels tier list – Best Legendary and Epic cards

- Adriana Lima Reveals Her Surprising Red Carpet Secrets for Cannes 2025

- Run! Goddess codes active in May 2025

- Ludus promo codes (April 2025)

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Grimguard Tactics tier list – Ranking the main classes

- Call of Antia tier list of best heroes

2024-10-14 16:02