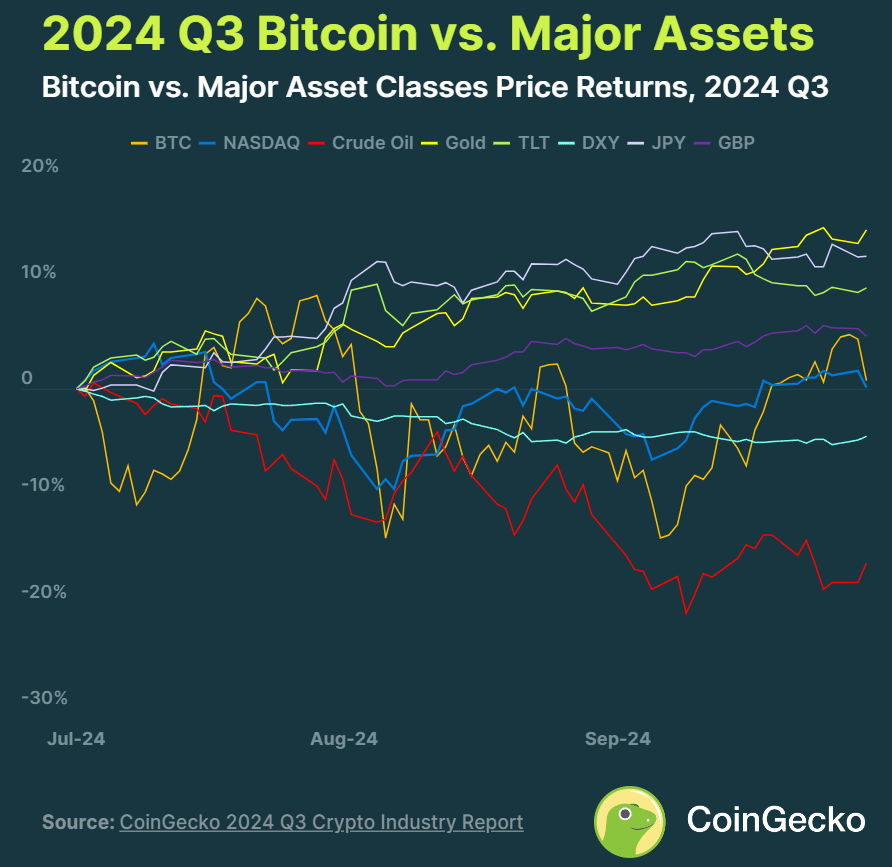

As a seasoned crypto investor with a decade of market experience under my belt, I must admit that the modest 0.8% price increase Bitcoin (BTC) managed in Q3 2024 left me a bit underwhelmed. While gold’s impressive 13.8% surge and the Japanese Yen’s strong performance were not surprising given the global uncertainties, I had hoped for more from BTC.

In Q3, Bitcoin experienced a slight 0.8% price bump, however, its progress was dwarfed by gold’s substantial 13.8% surge. This growth in gold was driven by economic worries and global tensions.

During a time when global instability is rising, investors are shifting towards secure investments for reliability. Consequently, Bitcoin (BTC) experienced only a slight 0.8% increase in price during Q3 of 2024, based on CoinGecko’s collected data. For contrast, traditional assets such as gold saw a significant surge of 13.8%, fueled by increasing concerns about an economic downturn in the U.S. and heightened conflicts in the Middle East.

Furthermore, noteworthy is the fact that the Japanese Yen exhibited a robust surge, increasing by 12.0%, following an unexpected interest rate increase from the Bank of Japan, coupled with rate reductions by the Federal Reserve. However, Bitcoin managed to surpass only crude oil and the U.S. Dollar Index in performance. This is due to the fact that all significant fiat currencies strengthened against the dollar, signaling a shift in market conditions driven by apprehensions about diminishing demand and monetary policy adjustments.

Bitcoin’s modest gains lead to decline in trading volumes

During the same period, Bitcoin saw minimal growth, but the combined trading volume on the top ten centralized cryptocurrency exchanges dropped by nearly 15%, amounting to $3.05 trillion. This represents a decrease when compared to the previous quarter. Interestingly, Binance remained the largest centralized exchange, although its market share dipped below 40% for the first time since January 2022, finishing September at 38%.

In Q2, Crypto.com climbed up to become the second-largest cryptocurrency exchange, showing an impressive 160.8% increase in trading volume and claiming a 14.4% market share. On the other hand, OKX and Gate.io experienced significant setbacks, each suffering over 30% declines in trading volumes. Meanwhile, Coinbase, a U.S.-based crypto exchange, encountered difficulties, leading to a 23.8% drop in trading volumes and a fall from sixth to tenth position among the top exchanges.

Even though the market saw only slight growth during Q3, experts at CoinGecko pointed out that Bitcoin’s influence grew to 53.6%, a rise of 2.7% compared to the previous quarter. They also mentioned that the last time Bitcoin managed such dominance was back in April 2021.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-10-14 17:12