As a seasoned researcher with years of experience in the dynamic and unpredictable world of cryptocurrencies, I find myself constantly intrigued by the ebb and flow of market trends. Today’s surge in short liquidations, particularly in Bitcoin and Ethereum, is yet another testament to the volatility that characterizes this space.

In simpler terms, there’s a rise in the forced selling of cryptocurrencies due to their increasing positive price movements, with significant coins like Bitcoin leading the charge.

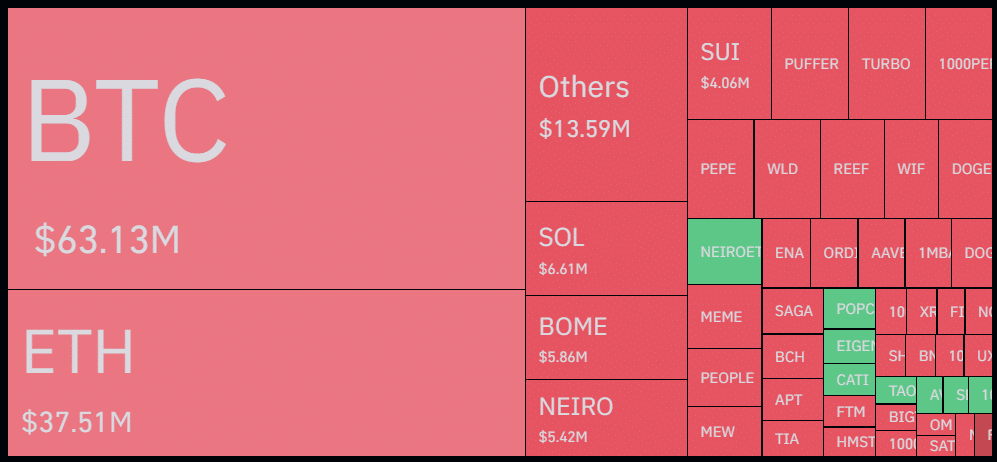

Based on figures from Coinglass, the value of liquidations over the last 24 hours exceeded a staggering $192 million. Out of this sum, approximately $145 million was due to short positions being closed out, while the remaining $46 million is associated with long trades.

Yesterday, I witnessed a significant event in the crypto market as Bitcoin (BTC) hit the $66,000 mark, leading to liquidations worth approximately $63 million. Out of this total, around $55 million was from short positions, while longs accounted for about $7.7 million. Despite this, BTC is still showing a 2.3% growth over the past 24 hours and currently trades at $65,300 as I pen this down.

Currently, Ethereum (ETH) holds the second position with approximately $37 million being daily liquidated—$30 million from short positions and $7 million from long ones. The significant number of short liquidations allowed ETH to surpass the $2,600 threshold for the first time in two weeks.

According to Coinglass analysis, the biggest individual liquidation order transpired on Binance, the leading cryptocurrency exchange by trade volume, which amounted to approximately 5.2 million dollars in the ETH/USDT trading pair.

As an analyst, I can assert that my findings indicate that Binance exchange holds approximately 76% of the total liquidations, equating to around $94 million in short positions, thus demonstrating a significant influence within the market.

Despite the rallying liquidations, the total open interest in the crypto market increased by 4.7%, reaching $69.5 billion, per Coinglass data. This movement usually shows signs of FOMO and greed.

As per information from CoinGecko, the overall value of the cryptocurrency market has risen by more than $109 billion in the last 24 hours, now standing at approximately $2.406 trillion. Right now, Bitcoin accounts for about 54.2% of the entire market, boasting a total market capitalization close to $1.3 trillion.

A significant factor contributing to the rise in Bitcoin’s price was the substantial increase in U.S.-based Bitcoin spot exchange-traded funds. According to a recent article from crypto.news, these ETFs saw a record inflow of $555.9 million on Monday – reaching a four-month peak.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-10-15 10:00