As a seasoned researcher with over two decades of experience navigating the ever-evolving financial markets, I find myself intrigued by Canary Capital’s latest move to list a Litecoin ETF. Having closely followed the crypto market since its inception, I can recall the days when Litecoin was just a promising offshoot of Bitcoin. Seeing it now vying for a spot on Wall Street is a testament to the rapid evolution and growing acceptance of digital assets.

Canary Capital filed with the U.S. Securities and Exchange Commission to list an exchange-traded fund underpinned by the Bitcoin-inspired cryptocurrency, Litecoin.

A crypto investment company named Canary Capital has filed necessary documents with the Securities and Exchange Commission to make it possible for traders on Wall Street to buy shares in a Litecoin (LTC) exchange-traded fund (ETF). This new wealth management firm, established by Valkyrie’s founder Steven McClurg, has submitted paperwork, which includes a Form S-1, indicating the official registration of securities for its Litecoin spot ETF.

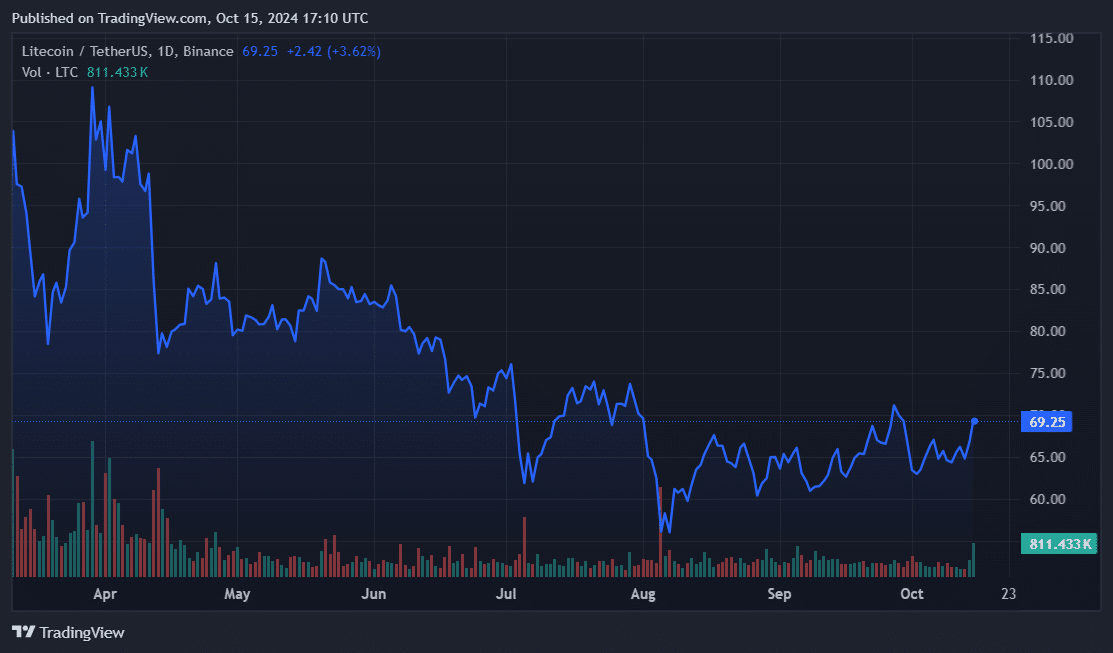

Litecoin, established in 2011, is frequently viewed as a spin-off from Bitcoin (BTC). Contrary to popular belief, it’s not a direct fork of Bitcoin but rather a streamlined version. Fast forward to the present day, each Litecoin coin was worth around $70 and its total market value exceeded $5.25 billion. The token ranked 27th in terms of valuation among the top 100 cryptocurrencies available.

Canary Capital has jumped head-first into the crypto ETF bidding scene. Last week, the investment firm joined Bitwise to bid for a spot (XRP) ETF. On Oct. 1, Canaray unveiled its inaugural private fund focused on Hedera (HBAR) and called the Canary HBAR Trust.

Filings for Cryptocurrency Exchange-Traded Funds (ETFs) have been a recurring topic at the Securities and Exchange Commission (SEC). Since January, no less than 11 issuers have received approval to launch Bitcoin funds, paving the way for other digital currencies. In late July, ETFs based on Ethereum (ETH) appeared, igniting widespread debate about which cryptocurrency would be next to be enveloped by the institutional ETF structure.

Solana’s native currency and Ripple‘s token are often mentioned among the top choices for a cryptocurrency Exchange-Traded Fund (ETF) following Bitcoin (BTC) and Ethereum (ETH). Nevertheless, the Securities and Exchange Commission’s (SEC) regulatory stance and their view on which tokens comply with securities regulations create an ongoing ambiguity.

As a researcher delving into the realm of digital currencies, I’ve come across an interesting point: In 2018, according to Fortune, SEC Chair Gary Gensler indicated that Ethereum and Litecoin were not classified as securities. Given Litecoin’s resemblance to Bitcoin, this could potentially bolster the approval process for a spot LTC ETF. However, it’s important to note that under Gensler’s leadership, the SEC maintains a generally cautious stance towards the crypto economy. Consequently, there may be resistance from agency staff when it comes to this particular product.

Read More

2024-10-15 21:12