As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed countless bull and bear cycles, but the current surge in Bitcoin is truly captivating. Having closely monitored the crypto space since its inception, I can confidently say that this rebound reminds me of the dot-com boom of the late ’90s.

The price of Bitcoin experienced a robust recovery, climbing for three straight days, hitting its peak since the 29th of July.

The first and foremost digital currency, Bitcoin (BTC), which boasts the largest market capitalization among cryptocurrencies, recently approached the significant figure of $68,000. This represents a nearly 40% increase from its lowest point in August.

It’s becoming increasingly likely that Bitcoin will keep going up. To start with, the Crypto Fear & Greed Index shifted from a greed level of 37 last week to 58 this week. Historically, Bitcoin and other cryptocurrencies tend to surge when there is a high level of market greed.

The graphical representation of Bitcoin’s price shows a golden cross formation, which occurs when the short-term (50-day) average line crosses above the long-term (200-day) average line, suggesting an optimistic outlook for future price movements.

As a crypto investor looking back, the last instance when this particular coin crossed paths with that significant event was on October 23rd of last year. Remarkably, it soared by an astounding 120% and reached its record peak of $73,800 in March.

The Weighted Moving Average (WMA) is considered superior to Simple and Exponential Moving Averages due to its ability to smoothen data by assigning greater importance to recent trends.

Bitcoin recently developed an inverted “head and shoulders” chart formation, surpassing the significant resistance level at approximately $66,561 (its peak from September 27th). Additionally, it crossed above a downward-sloping trendline that connects its highest points since March.

Why Bitcoin price is rising

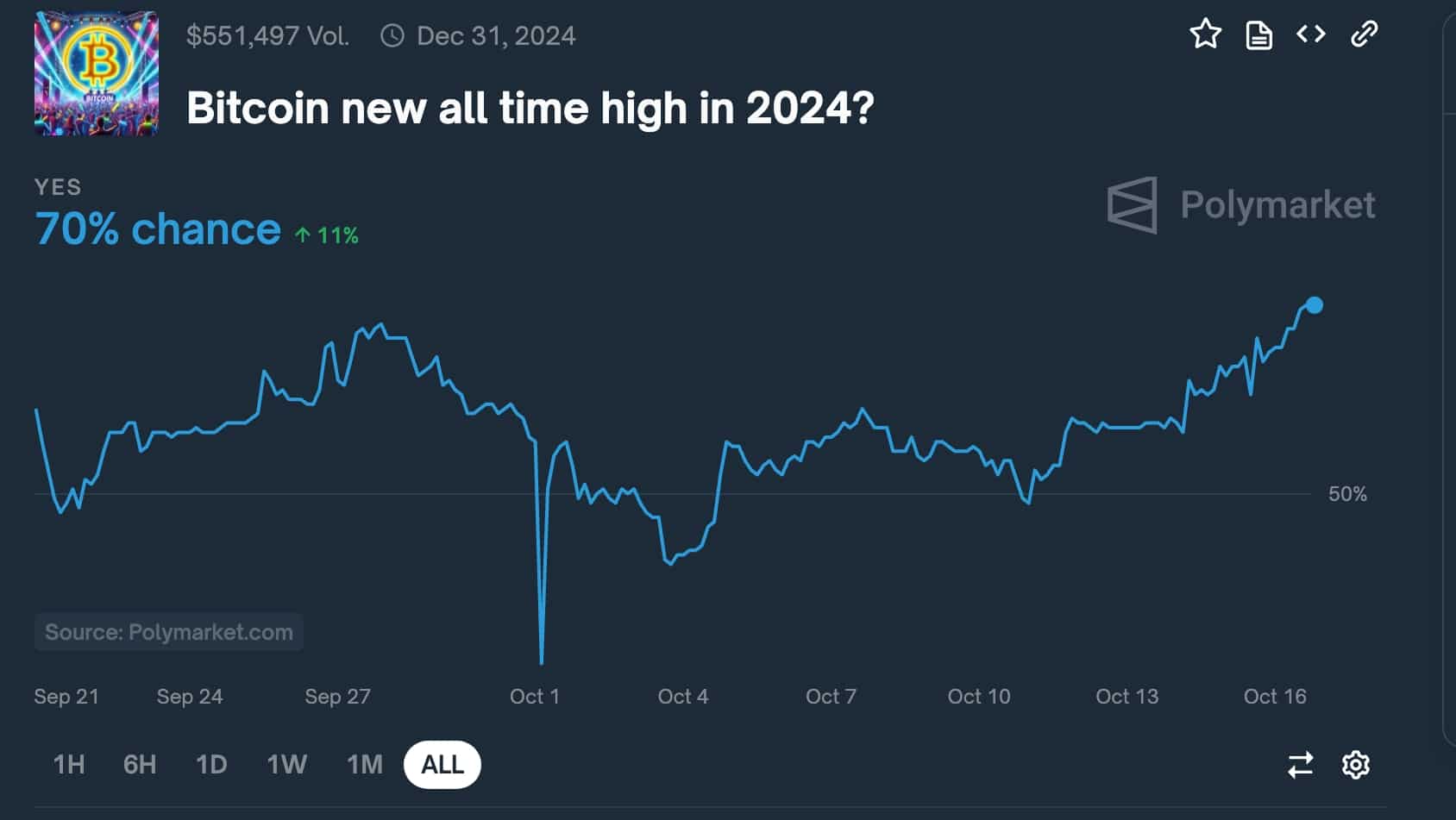

For two primary factors, Bitcoin is experiencing a surge. Initially, there’s growing speculation that Donald Trump might win the upcoming election, as indicated by Polymarket who assign a 60% chance to this event.

Trump is widely regarded as an appealing choice for the cryptocurrency industry due to his firm support for the field. He himself owns cryptocurrencies, with a reported portfolio value exceeding $6 million. Additionally, he has introduced World Liberty Financial, a venture within the cryptocurrency sector.

Concurrently, research indicates that his proposed policies involving tax reductions, military expenditure, and tariffs might result in a staggering $7.5 trillion deficit within a decade. This is significant given that the U.S. national debt has surpassed $35.5 trillion. In contrast, Bitcoin appeals to investors as a more attractive option than the U.S. dollar due to its limited supply of 21 million coins.

Polymarket odds of Bitcoin reaching a record high rose to 70%.

As a researcher delving into the realm of digital currencies, I find myself buoyed by the optimistic outlook on Bitcoin. Notably, renowned trader Peter Brandt, boasting an impressive following of over 740,000, foresees further growth in the coin. His initial projection points towards a potential peak at $73,800 – a level reminiscent of its all-time high.

In simpler terms, if an inverted expanding triangle pattern has approximately a 50-50 chance of reaching its intended goal, it may be challenging for those who question the usefulness of charts to successfully participate in trading, as they might not fully grasp the importance of timing and the potential for greater rewards compared to risks.

— Peter Brandt (@PeterLBrandt) October 16, 2024

Other experts, including Miles Deutscher, have shared optimistic projections about Bitcoin. Deutscher anticipates that the next Bitcoin surge could exceed expectations, leading to a wave of FOMO (Fear Of Missing Out). Meanwhile, Michael van de Poppe envisions further growth in the long term, particularly as the Federal Reserve reduces interest rates, implying potential upward price movements for Bitcoin.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Castle Duels tier list – Best Legendary and Epic cards

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Cookie Run Kingdom Town Square Vault password

- Hero Tale best builds – One for melee, one for ranged characters

- Overwatch Stadium Tier List: All Heroes Ranked

2024-10-16 15:52