As a seasoned analyst with years of experience navigating the volatile crypto markets, I must say that the current state of Ethereum (ETH) leaves me somewhat concerned. The double-top chart pattern, death cross, and bearish pennant are all warning signs that suggest further weakness in the coming months. Moreover, the lackluster performance of Ether exchange-traded funds and intensifying competition from other layer-1 and layer-2 blockchains add fuel to this bearish outlook.

This year, Ethereum, the second-largest cryptocurrency, has struggled to keep pace with Bitcoin due to a sluggish expansion in its Exchange-Traded Funds (ETFs) and intense competition from various Tier 1 (layer-1) and Tier 2 (layer-2) blockchain platforms.

Ethereum (ETH) has rallied by less than 20% in 2024, while Bitcoin (BTC) has risen by over 50%.

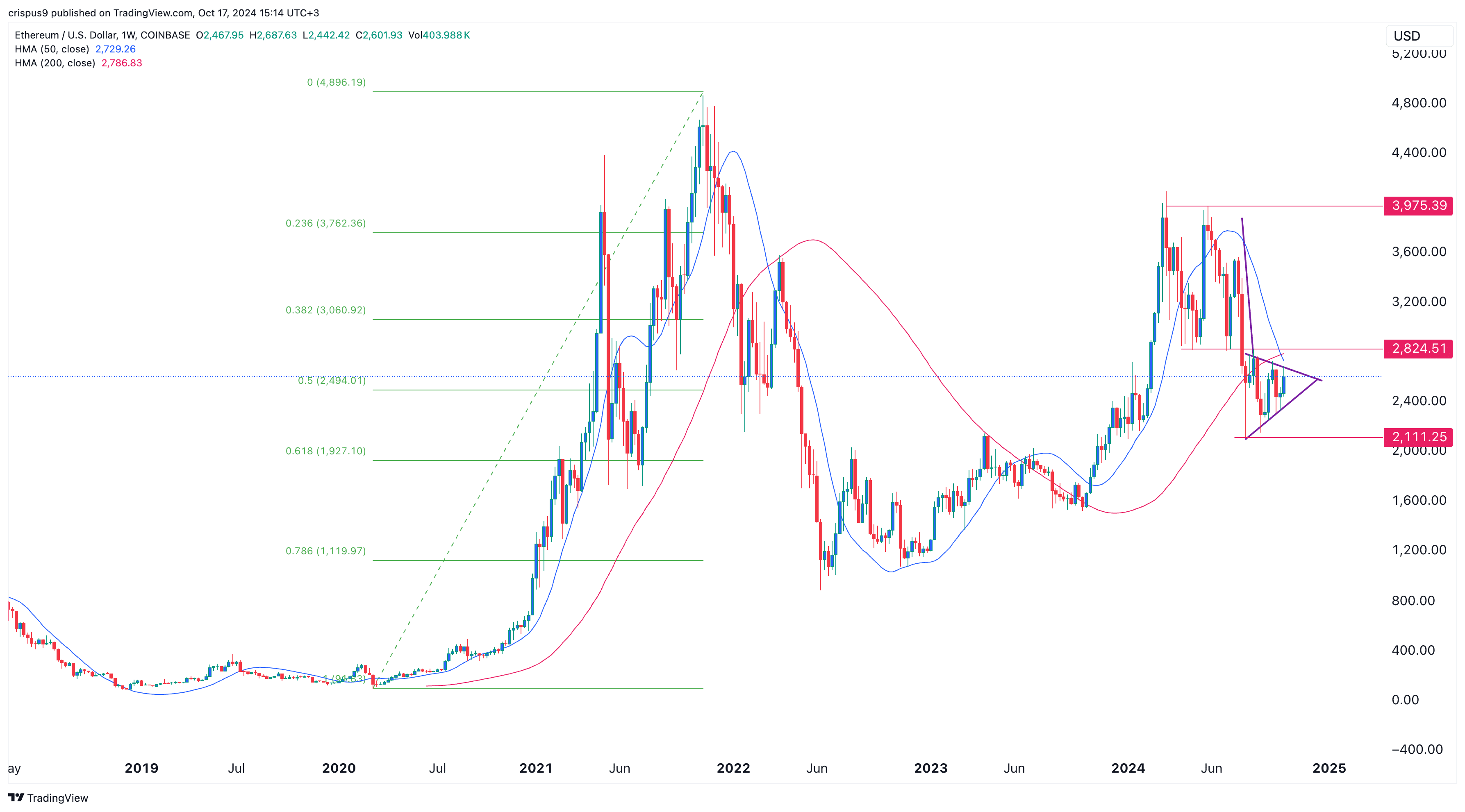

The technical analysis indicates that Ethereum may experience more vulnerability in the upcoming months. On the weekly graph, the coin has formed a double-top chart configuration near the $4,000 mark. It dipped below the neckline of this pattern at $2,824 in July, which suggests a bearish breakout, strengthening the bearish outlook.

Ethereum’s trajectory shows a so-called “death cross,” where the path of its 200-day and 50-day moving averages has crossed, suggesting a potential downtrend. The Hull Moving Average (HMA) is employed to minimize lag by applying weighted moving averages to streamline the price data.

In March 2022, the last instance when Ethereum exhibited a “death cross” on its weekly chart occurred, followed by a significant decrease of more than 70% in the coin’s value.

Ether’s chart shows a bearish pennant formation, identifiable as a tall straight segment followed by a contracting, symmetrical triangle shape. Generally, such a pattern indicates a potential decline in price, especially when the edges of the triangle meet or ‘break’.

Furthermore, this merging is taking place at the 50% Fibonacci Retracement point. Consequently, there’s a growing likelihood that the coin will experience a significant downward breakout in the immediate future. A key level to keep an eye on is $2,111, which was its lowest point on Aug. 5.

Ethereum’s weak fundamentals

Beyond facing technical hurdles, Ethereum is also grappling with substantial fundamental difficulties. For instance, Ether Exchange-Traded Funds (ETFs) haven’t attracted significant investment in the couple of months following their debut.

As reported by SoSoValue, these particular funds have seen a total withdrawal exceeding $530 million, largely because of the Grayscale Ethereum Fund. However, Exchange-Traded Funds (ETFs) tied to Bitcoin have surpassed the $20 billion mark in inflows, suggesting increased interest from institutional investors in Bitcoin.

As a researcher, I’ve noticed an escalating competition in sectors once considered Ethereum’s strongholds, such as DeFi and NFTs. Interestingly, data from DeFi Llama indicates that Solana has surpassed Ethereum in terms of DEX volume over the past seven days. Specifically, Solana processed a staggering $10.87 billion, while Ethereum managed $9.69 billion during the same period.

Given the current trajectory, it’s possible that Solana could overtake Ethereum in terms of value by the end of this month. As of now, Solana has processed transactions worth approximately $23.9 billion, while Ethereum stands at around $24 billion.

The surge in this performance can primarily be attributed to the rising trend of meme tokens based on Solana (SOL), such as Dogwifhat, Bonk, and Popcat. These meme coins have garnered significant attention among traders, resulting in a collective market capitalization exceeding $10 billion.

Moreover, noteworthy Ethereum investors such as Vitalik Buterin and the Ethereum Foundation have been disposing of a substantial number of their Ether holdings in recent times.

2 hours ago, the wallet associated with DiscussFish (@bitfish1) made deposits of 2,044 ETH (approximately $5.45 million) and 155,720 LINK (around $1.85 million) into Binance. To date, this wallet has deposited a grand total of 12,347 ETH ($30.4 million) into Binance since October 2nd.

— Lookonchain (@lookonchain) October 15, 2024

Consequently, a mix of poor underlying factors and technical aspects might lead to Ether experiencing a decline in the forthcoming weeks.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Fortress Saga tier list – Ranking every hero

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom Town Square Vault password

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Seven Deadly Sins Idle tier list and a reroll guide

- Overwatch Stadium Tier List: All Heroes Ranked

2024-10-17 15:54