As a seasoned researcher with years of experience navigating the dynamic world of cryptocurrencies, I find it fascinating to witness the rapid growth and shifts in the market. Last week was particularly exciting, with the global crypto market cap surging by $140 billion, pushing past the two-month peak. Bitcoin’s rally above $68,000 ignited a strong response across the altcoin market, and several assets capitalized on this recovery.

The global crypto market cap added $140 billion, spiking 6.3% to close the week above a two-month peak of $2.35 trillion.

The price of Bitcoin (BTC) surged over $68,000, leading to an upward trend in the altcoin market, indicating robust growth.

Here are some of the assets that leveraged this rebound campaign and how they performed:

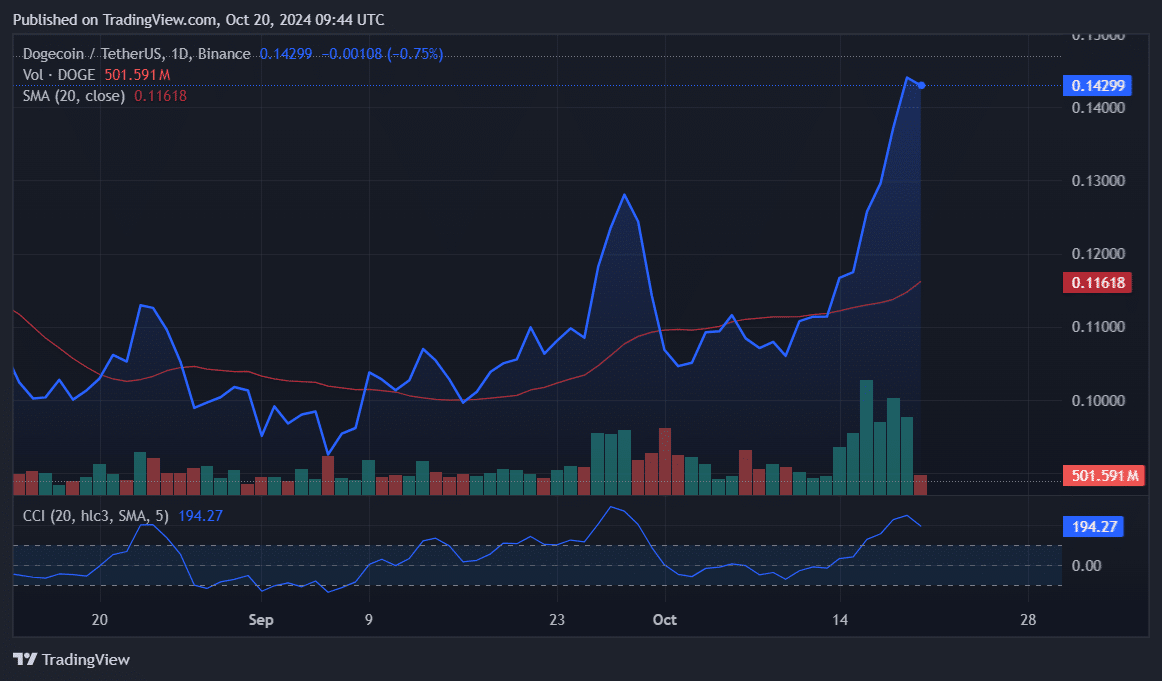

DOGE records seven straight intraday gains

Last week, Dogecoin (DOGE) experienced significant growth, with a streak of daily increases for seven straight days.

Over the course of the week, the meme coin based on dogs reached an impressive peak of $0.144 – a four-month high. Remarkably, this represents a 27% increase in its value. This outstanding weekly performance is Dogecoin’s best since late February, during the surge of the broader market for meme coins.

Consequently, the recent upward trend has encountered an obstacle due to a surge in Dogecoin’s Composite Cloud Index (CCI) to 247. If this week brings more downward pressure, Dogecoin (DOGE) must maintain above $0.137 to prevent the 20-day Simple Moving Average (SMA) support from being breached at $0.116.

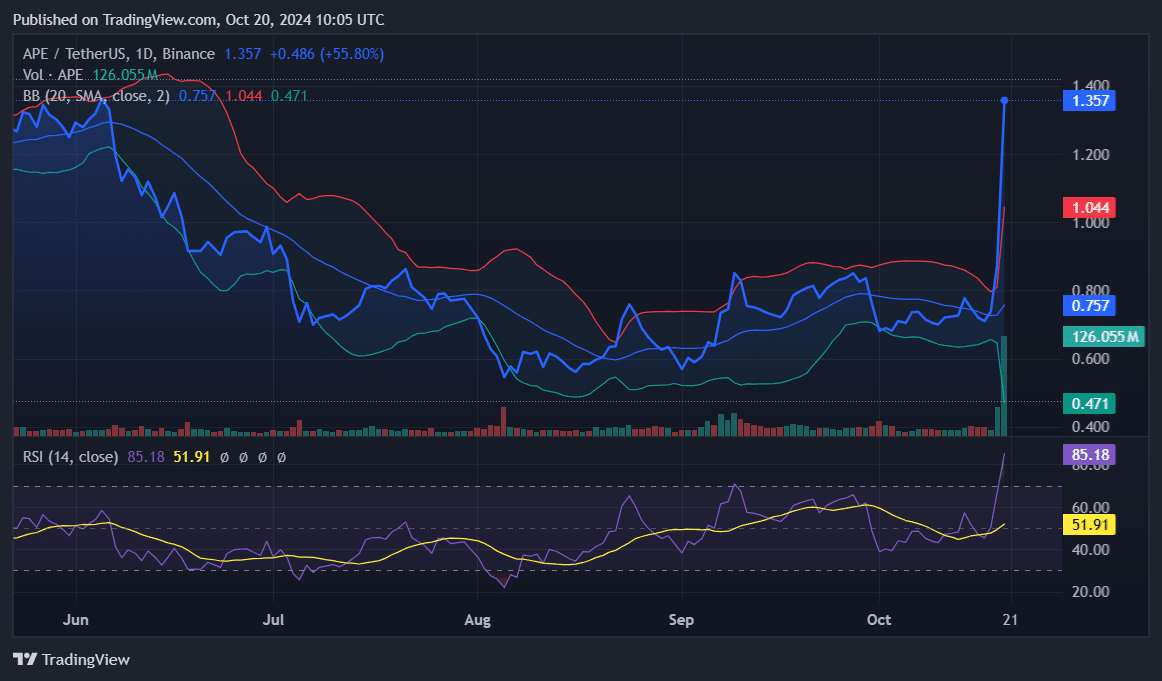

APE spikes 54% on mainnet launch

Despite underperforming throughout last week, ApeCoin (APE) engineered a last-minute rally that saw it close the week at $0.87 amid a 20% gain.

The primary cause for this increase was the deployment of ApeChain’s mainnet, our project’s blockchain, which took place the day before.

Friends, please consider sharing the following message independently and pin it somewhere:

— ApeCoin (@apecoin) October 19, 2024

Yesterday, after reaching $0.92, Ape (APE) encountered significant resistance near the upper Bollinger Band. Yet, the upward trend picked up again at the start of this week, propelling APE by a staggering 54%, allowing it to surpass the $1 mark for the first time in four months.

Currently, the Relative Strength Index (RSI) is above 85, indicating that the asset has entered overbought territory. This condition implies that the current rally may be running out of steam unless more buying activity occurs. If the price falls below $1, it could lead to a more significant downward trend.

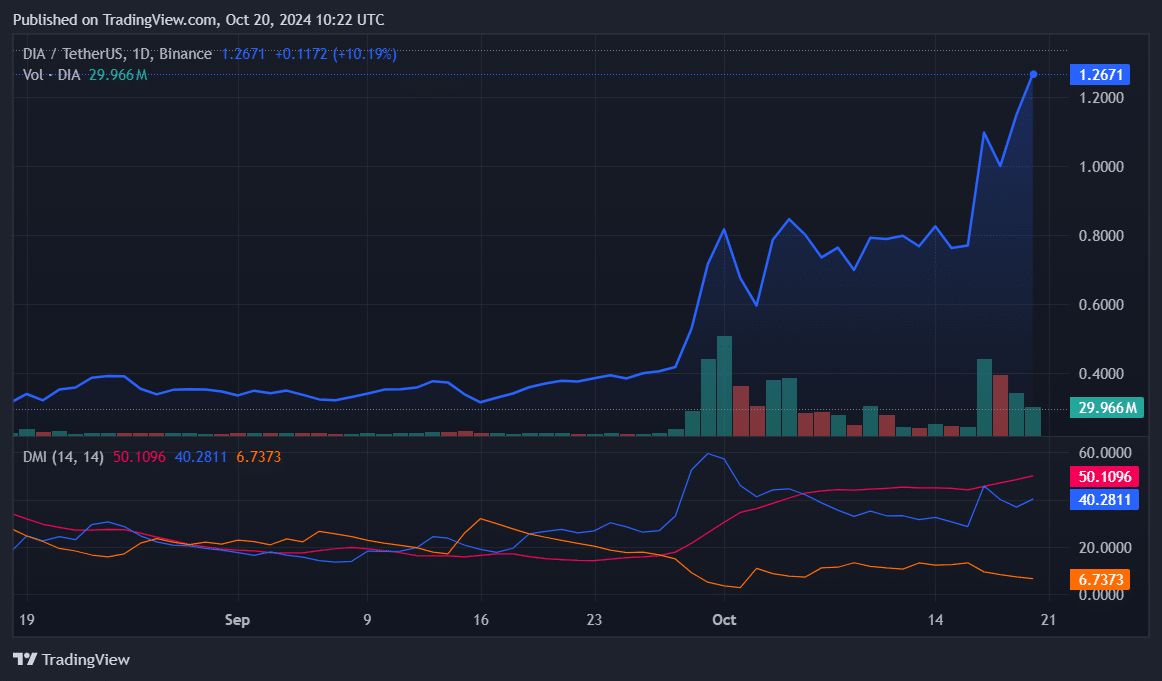

DIA hits 32-month peak

To start the week, DIA showed a downward trend (bearish), but managed to exceed most other assets by the end of it. After fluctuating with varied results, DIA experienced an extraordinary surge of approximately 42% on October 17th, marking $1 as its value for the first time in two years.

After experiencing an 8% decrease on the following day, DIA recovered and increased by another 14% on October 19th. This resulted in a total weekly gain of 44%, marking its highest trading level in 32 months. Moreover, its monthly volume surged to a record-breaking 716 million DIA, which is the highest it has ever been.

currently, the Plus Directional Indicator (DI) for the token has surged to 40.28, showing robust bullish energy. Meanwhile, the ADX stands at 50.19, hinting at an exceptionally powerful trend. Yet, this could potentially signal a stretch in the rally, possibly predicting a corrective phase ahead.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Outerplane tier list and reroll guide

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Call of Antia tier list of best heroes

- Best teams for Seven Deadly Sins Idle

2024-10-20 17:39