As a seasoned researcher with years of experience delving into the cryptosphere, I find myself increasingly intrigued by the latest developments in Ethereum. The surge in ETH accumulation addresses to nearly 20 million and the expectation that it will surpass 20 million by year’s end is a testament to the growing confidence in Ethereum, particularly following the approval of Ethereum Spot ETFs.

A substantial portion of Ethereum is being stored by entities who are currently neither using nor transferring their assets.

Based on recent figures from CryptoQuant, we’ve seen that more than 19 million Ethereum (ETH) have been stored in addresses used for accumulation.

By October 18th, the total Ethereum held in accumulation wallets had nearly doubled compared to the amount from early January 2024.

In January 2024, we recorded a figure of approximately 11.5 million for this particular metric. At least one expert predicts that this total could climb above 20 million by December 2024.

Why? Ethereum ETF approval

According to the analyst, by early 2024, Ethereum Spot Exchange-Traded Funds (ETFs) had been given official approval, heralding a new phase. The regulatory framework provided a sense of security, leading to widespread acceptance of Ethereum as a mainstream asset.

According to the analysis by CryptoQuant, following the Securities and Exchange Commission’s approval of Ethereum spot ETFs, both institutions and individual investors have started to invest in Ethereum.

According to our assessment, it’s anticipated that by the year-end in 2024, when there are approximately 20 million ETH held in accumulation addresses, these addresses could amass a value comparable to the world’s most significant corporations.

According to the analyst’s prediction, the combined worth of these assets is anticipated to reach a staggering $80 billion, while Ethereum could potentially be valued at approximately $4,000.

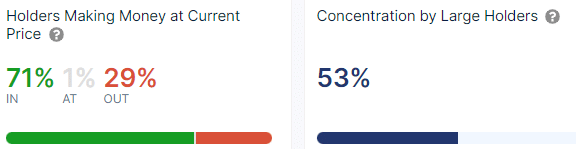

71% of Ethereum holders in profit

Based on recent figures from IntoTheBlock, approximately 71% of Ethereum owners are currently seeing a return on their investment.

The data also shows that 29% of the holders are in loss, with roughly 1% in neutral.

As a researcher, I’ve delved deeper into the makeup of Ethereum (ETH) holders, and it’s fascinating to note that more than three-quarters (74%) of these holders have been holding onto their ETH for well over a year.

Approximately 23% of Ethereum (ETH) owners have been holding onto their coins for a period of 1 to 12 months, while just 3% of the owners have had their ETH for fewer than 30 days.

In just the past day, the value of Ethereum has significantly increased by more than 2%. Moreover, in the last week, its price has climbed by more than 10%, and it currently stands above the $2,700 mark.

Read More

2024-10-21 01:06