As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of election cycles and their impact on various asset classes. The recent decline in Bitcoin whale activity and liquidations, coupled with the close distance between longs and shorts, suggests an air of uncertainty among investors. This is not uncommon during political uncertainty, especially as we approach major elections like the one in the U.S.

In the run-up to the U.S. presidential election, which is now only eight days away, activity among significant Bitcoin holders, or ‘whales’, has noticeably decreased.

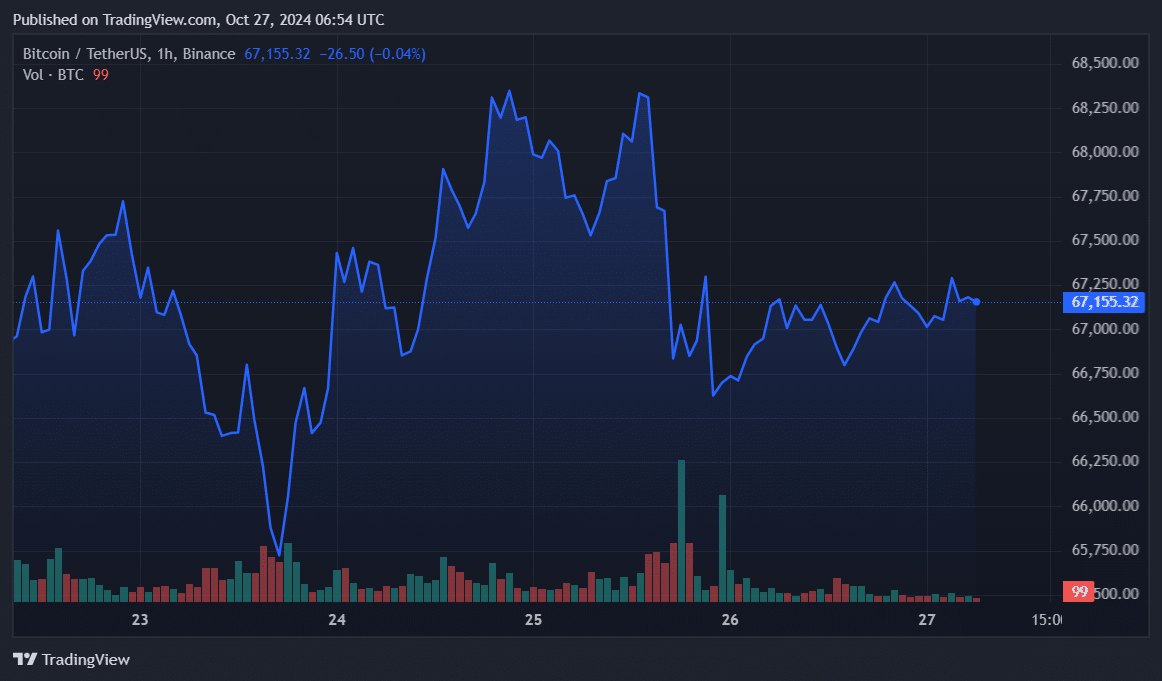

The asset’s price has consolidated around $67,000.

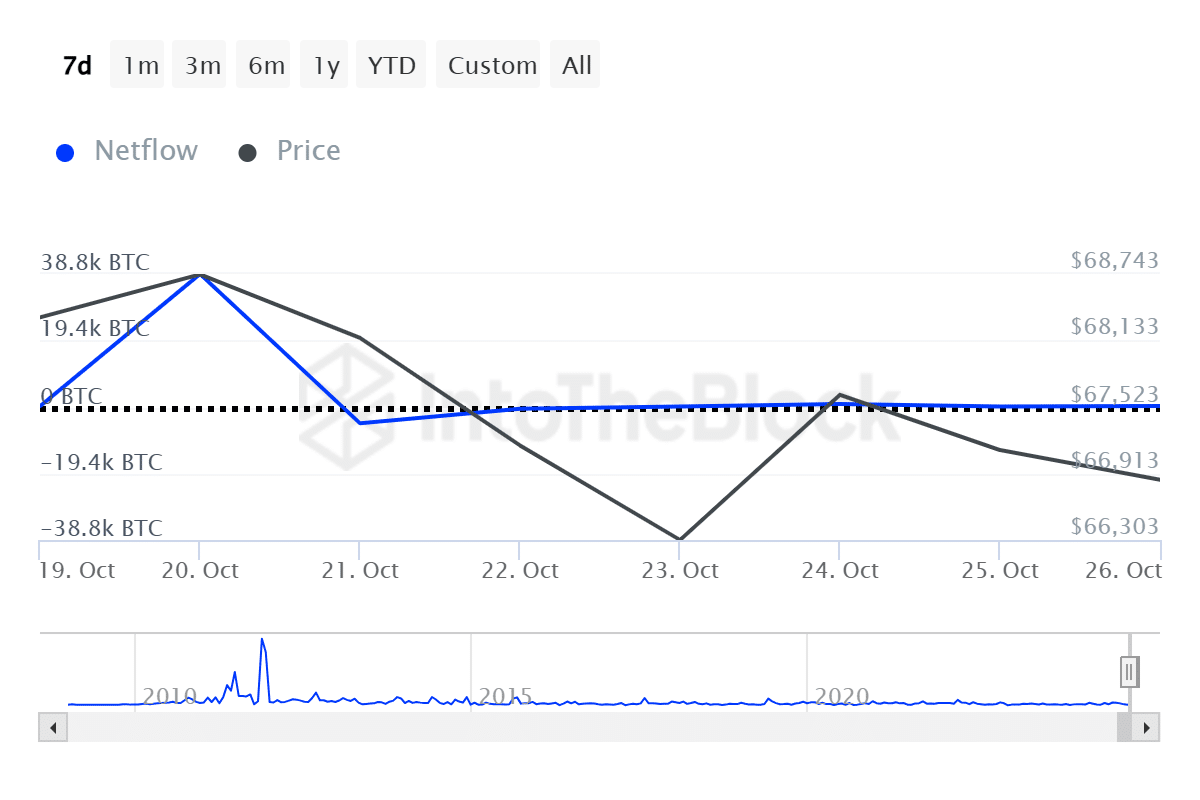

Based on information from IntoTheBlock, the outflow of Bitcoin (BTC) held by large investors significantly decreased from approximately 38,800 BTC on October 20 to just 258 BTC on October 26. This drop could suggest that these major investors are becoming more cautious as the U.S. Election Day, scheduled for November 5, draws near.

On October 21st and 22nd, it’s worth mentioning that there was a significant decrease in the ownership of Bitcoins by whales, amounting to approximately 4,750 BTC and 533 BTC respectively. This mass selling caused the Bitcoin price to dip momentarily below $66,000 on October 23rd.

Liquidations cool down

In my exploration as a researcher, I’ve observed a significant 85% drop in crypto liquidations over the past day, with the total amount currently sitting at approximately $59 million, as reported by Coinglass. Interestingly, due to the market-wide cooling down, the gap between long positions ($28.7 million) and short positions ($30.5 million) has narrowed substantially.

Bitcoin saw $5.6 million in liquidations—$2.2 million longs and $3.4 million shorts.

Bitcoin has been consolidating close to the $67,000 mark over the past week with a total market cap of $1.33 trillion. Its daily trading volume decreased by 63% in the past 24 hours, currently sitting at $15.5 billion.

The reduction in Bitcoin transactions, fewer large-scale trades by big investors, and lower market liquidations suggest that investors are feeling uncertain.

ETFs remain strong

In other words, even though things might seem chaotic, it’s worth mentioning that the market hasn’t reached a state of full-blown panic because U.S.-based Bitcoin exchange-traded funds are still seeing positive inflows.

As per a recent report from crypto news sources, these investment products have accumulated over $3 billion in just this month. On Friday, there was a significant inflow of $402 million into spot Bitcoin Exchange-Traded Funds (ETFs), with the majority coming from BlackRock’s iShares Bitcoin Trust ETF, which contributed $292 million to the total.

Despite Grayscale’s $20 billion worth of net outflows, the overall influx of money into these ETFs exceeded the $22 billion threshold.

Bitcoin whales and 2024 elections

2024 sees increased importance of significant Bitcoin transactions (whales) during the worldwide “mega election year.” Large investors are keeping a close eye on and adjusting their strategies based on international political events.

In nations such as the United States, India, Mexico, Indonesia, and Taiwan, elections can lead to increased market volatility, often resulting in substantial shifts within the cryptocurrency market, particularly among large-scale investors known as “whales.

As various significant economies conduct their elections, causing fluctuations in the markets, Bitcoin – being a decentralized financial instrument – is perceived by certain large investors as a protective measure against potential risks associated with fiat currencies due to election results, economic policies, and political unrest.

In nations where elections are particularly disputed, like the U.S., some whales (large investors) may strategically prepare for market volatility following an election by moving their investments into cryptocurrencies. This could be especially true if there’s a sense of currency devaluation or tightened capital controls on the horizon.

Trump vs. Harris

In the United States, the forthcoming presidential race between Vice President Kamala Harris and former President Donald Trump may result in fresh or revised policies regarding cryptocurrencies.

If there’s a hint of stricter regulations, large Bitcoin investors (referred to as “whales”) might move their Bitcoin assets to regions with more advantageous regulations, or they could choose to liquidate some parts of their holdings in preparation for potential market declines.

If elected, Harris promised to eliminate “excessive government bureaucracy and burdensome regulations” related to cryptocurrencies. On the other hand, Trump has been attracting crypto billionaires, earning income from non-fungible tokens, advocating for a “Bitcoin and Cryptocurrency Advisory Committee”, and even planning to launch his own digital token. (Paraphrased in a more conversational style)

Bitcoin Sales by Whales and the Fear of Missing Out: In significant political events, some large Bitcoin holders might choose to sell their coins in anticipation of price fluctuations caused by the elections. This could trigger a frenzy among smaller investors who monitor whale transactions, leading them to buy quickly due to fear of missing out on potential profits.

In 2024, it appears that significant Bitcoin investors, or ‘whales’, are exercising greater prudence and long-term planning due to the heightened political climate and its potential effects on international financial systems.

Read More

2024-10-27 13:40