As an analyst with over two decades of experience in the financial markets, I find myself intrigued by the current dynamics unfolding in the Bitcoin market. The data presented by CryptoQuant CEO Ki Young Ju suggests that institutional demand is indeed on the rise, but it’s interesting to note that whales seem to be controlling the majority of the supply. This is not unlike the old adage “the more things change, the more they stay the same,” where even in the digital world, a few key players hold significant influence.

As reported by CryptoQuant CEO Ki Young Ju, there’s been a rise in institutional interest in Bitcoin since the beginning of the year.

As per Young Ju’s recent post, it’s been reported that U.S.-based Bitcoin (BTC) exchange-traded funds have seen a net increase of approximately 278,000 BTC since their debut in January. Around 80% of these inflows are attributed to individual investors, commonly known as retail investors.

Institutional interest in Bitcoin, held in custodial wallets, has been growing significantly. Over the past year, approximately 670,000 Bitcoins have moved into large-scale wallets (those holding over 1,000 Bitcoins, excluding exchanges and mining pools), while only about 278,000 Bitcoin flowed into U.S. spot ETFs, with around 80% of these being retail investors’ holdings. Essentially, institutional demand for Bitcoin in custodial wallets is more than double that of retail investors.

— Ki Young Ju (@ki_young_ju) October 29, 2024

However, whale addresses holding at least 1,000 BTC—excluding crypto exchanges and mining pools—saw an inflow of 670,000 BTC over the past year.

As a researcher delving into cryptocurrency trends, I recently discovered an intriguing piece of information: The CEO of CryptoQuant, a prominent platform for market analysis, has reported that institutional demand for self-custodial wallets is approximately double the retail demand.

Whales control the majority

Approximately 40% of all Bitcoins are stored in wallets belonging to “whales,” which are accounts that have a balance of 1,000 or more Bitcoins, as suggested by the data from IntoTheBlock.

The most recent addition to our list is the Japanese investment firm, Metaplanet. According to a report from crypto.news, on October 28th, Metaplanet added 156.7 Bitcoins to its holdings, bringing the total to 1,018 Bitcoins. At the time of reporting, this amount was equivalent to over $70 million.

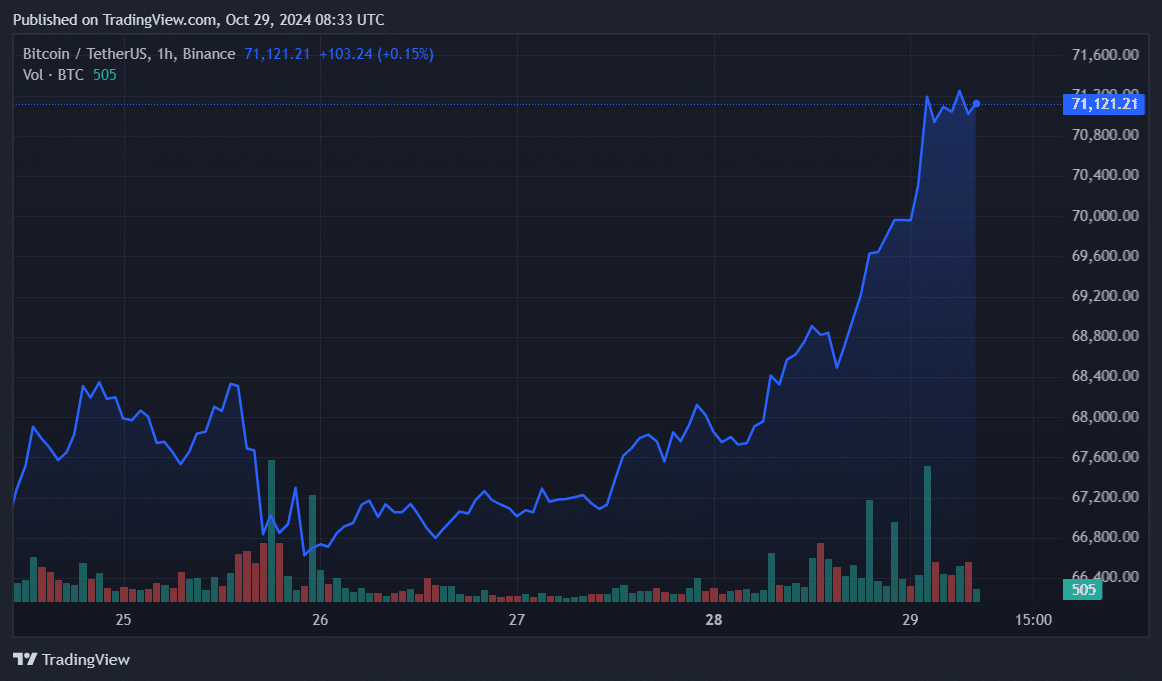

In the last 24 hours, Bitcoin saw an increase of 4%. As I’m writing this, it’s being traded at approximately $70,950. Earlier today, it reached a five-month peak of around $71,475. At the moment, Bitcoin is just about 3.5% below its record high of $73,750.

In just one day, the main digital currency’s trading activity significantly increased by 123%, amounting to a staggering $47 billion. This surge in value propelled Bitcoin’s overall market capitalization beyond the impressive milestone of $1.4 trillion as a result of its recent price rise.

As a researcher delving into the world of cryptocurrency, I’ve come across an intriguing finding from ITB: more than 99% of Bitcoin holders are presently in the black. This statistic might suggest a trend of short-term profit-taking, potentially foreshadowing a possible price correction in the near future.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2024-10-29 11:52