As an analyst with over two decades of experience in the crypto market, I’ve seen my fair share of parabolic rises and falls. The recent surge of Sui (SUI) has certainly caught my attention, especially given its impressive performance during periods of industry “greed.

On October 29th, Sui, a rapidly developing competitor to Ethereum and Solana, experienced a dramatic increase (went parabolic), as it continues to gain ground in significant sectors within the blockchain industry, expanding its market share.

The SUI token increased by 13% and reached a significant hurdle at $2.01, marking the first instance since October 24th.

The event unfolded when Bitcoin (BTC) surpassed the notable $71,000 threshold, and as the Crypto Fear & Greed Index reached 60, signaling a “greed” sentiment among investors. Typically, altcoins such as Sui tend to thrive in an environment where there’s heightened enthusiasm within the crypto sector.

Due to Sui’s rally, there was a significant surge in short sellers being forced to close their positions. According to CoinGlass, these liquidations amounted to over $3 million, marking the highest level since October 16th. Furthermore, the open interest in the futures market increased to $516 million, which is substantially higher than the previous week’s low of $448 million.

Over the past few months, Sui has displayed significant expansion. According to DeFi Llama’s data, decentralized exchanges on its platform handled transactions worth approximately $4.47 billion this month, positioning it as the seventh-largest player in the sector. This is the first time that Sui has made an appearance in the top ten rankings, which it achieved in October.

In addition to standing among the leading blockchains within the decentralized finance sector, Sui now boasts a locked-in value of approximately $944 million. Some of the most prominent dApps found in its ecosystem are NAVI Protocol, Suiland, Cetus, and Scallop Lend.

After the developers unveiled Sui Bridge on October 26, it’s anticipated that this momentum will persist. With Sui Bridge, assets from other Ethereum-compatible networks can now interact with Sui’s decentralized applications such as Cetus and Scallop.

This indigenous system operates using Sui technology’s security and power – essentially, it is protected by the very validators who maintain the network’s integrity, guaranteeing secure transactions for your assets.

— Sui (@SuiNetwork) October 25, 2024

Sui is starting to make a big impact in the gaming world as well. In fact, MemeFi, a leading name in gaming on Telegram, has revealed intentions to broaden its platform on the Sui network.

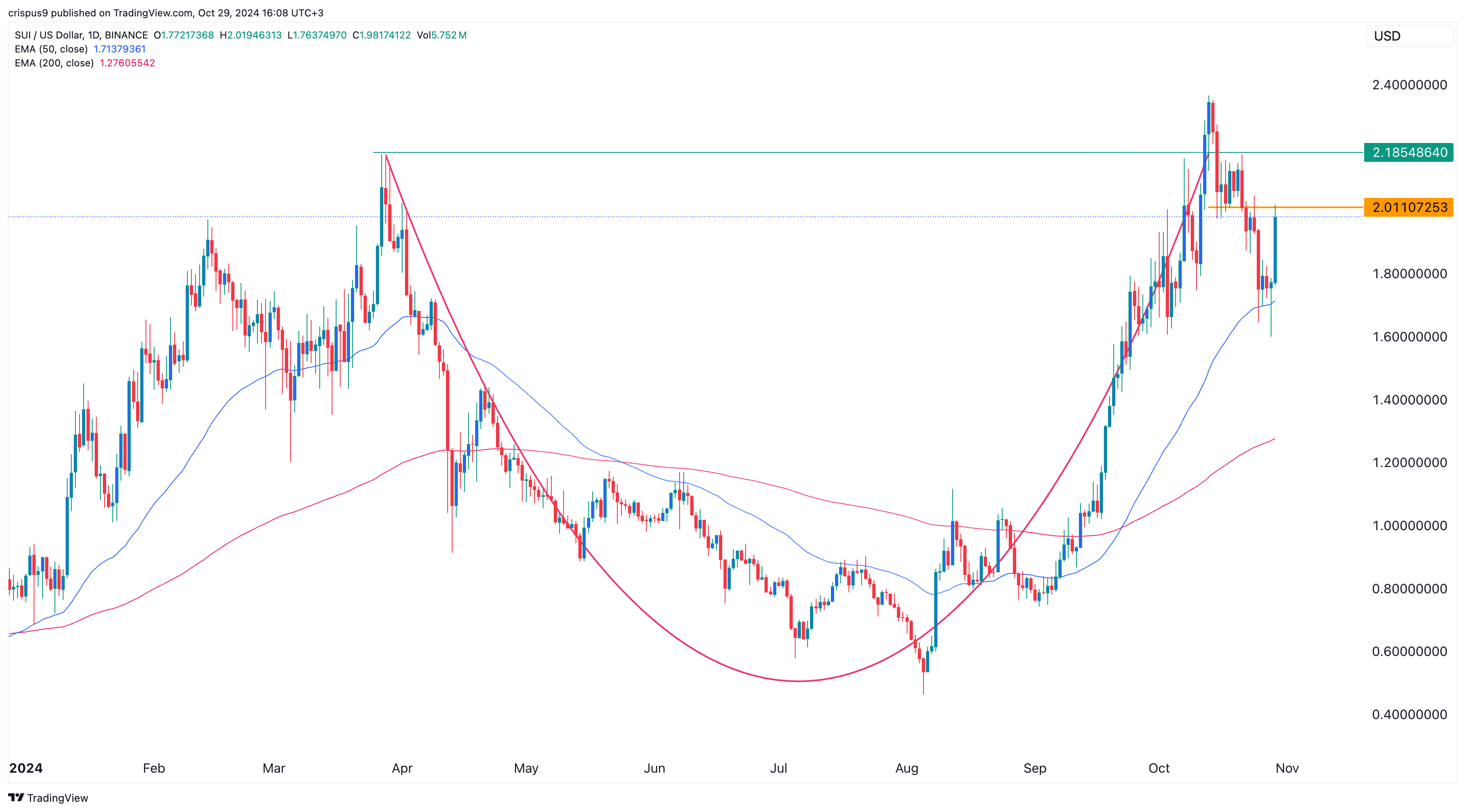

Sui price formed a hammer pattern

Based on Sui’s daily trend, we can expect an upward movement in the next few months. On September 22nd, a golden cross formation occurred when the 200-day moving average crossed above the 50-day moving average.

Additionally, it developed a hammer shape, recognized by a compact head and an extended lower tail, often signifying a potential bullish reversal in the market.

Beyond this, Sui appears to have developed a cup and handle chart configuration. This suggests that its price might keep increasing, with the potential next peak being around $2.185 – the upper boundary of the cup. If it surpasses this level, additional growth may follow.

Read More

- Maiden Academy tier list

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Cookie Run Kingdom Town Square Vault password

- Girls Frontline 2 Exilium tier list

- 10 Hardest Bosses In The First Berserker: Khazan

- `H&M’s Wild White Lotus Getaway`

- Tap Force tier list of all characters that you can pick

- Wizardry Variants Daphne tier list and a reroll guide

- ‘White Lotus’ Fans React to That Incest Kiss: “My Jaw Is On The Floor”

- ‘Bachelor’ Co-Executive Producers Exit Franchise

2024-10-29 17:01