As a seasoned crypto investor with a decade of experience navigating the volatile world of digital assets, I wholeheartedly agree with Matt Hougan’s perspective. The idea that Bitcoin requires a U.S. dollar crash to hit six figures is a misconception that overlooks the growing demand for store-of-value assets and persistent government spending.

According to Bitwise CIO Matt Hougan, Bitcoin isn’t necessarily dependent on the U.S. dollar plummeting in order to reach six figures as an asset class.

Bitcoins (BTC) are frequently praised for their role as a safeguard against the falling buying power of the US dollar and as a possible winner in the event of a massive collapse of traditional currencies.

Certain advocates propose that Bitcoin could surge past $200,000 per coin if the U.S. dollar experiences a catastrophic crash. Yet, Hougan contends that this premise is flawed on two primary grounds: the escalating desire for assets used as a store of value and the continuous spending habits of governments.

Based on what a Bitwise executive stated, these elements tend to strengthen an investor’s confidence when they decide to invest in Bitcoin. Moreover, Hougan contended that the market for storing value has experienced growth because of governments overstepping bounds with their currencies.

1/ Over our recent dinner, a financial consultant posed an intriguing question: Is it essential for the U.S. dollar to fail for bitcoin to reach $200,000?

— Matt Hougan (@Matt_Hougan) October 29, 2024

In recent times, U.S. spending has been increasing significantly, and the total debt of the nation now exceeds $35 trillion. Experts predict that, given the present rate, the national debt increases by roughly a trillion dollars approximately every 100 days.

Furthermore, Bob Elliott, the Chief Investment Officer at Unlimited Funds, pointed to information suggesting that traditional “sovereign debts” of developed nations like U.S. Treasuries might no longer be reliable for bailouts. This could possibly lean towards a favorable perspective on Bitcoin.

The decline in U.S. bonds has led to a worldwide sell-off of government bonds from developed nations.

— Bob Elliott (@BobEUnlimited) October 29, 2024

According to Hougan’s prediction, this trend is likely to persist, resulting in a maturation of Bitcoin markets, wider adoption, and a rise in the value of the top digital currency.

So, no, the dollar doesn’t need to collapse for bitcoin to hit $200k. All you need is Bitcoin to continue on its current path of maturing as an institutional asset. But it’s increasingly looking like both parts of the argument will come true. That’s why Bitcoin is surging toward all-time highs.

Matt Hougan, Bitwise CIO

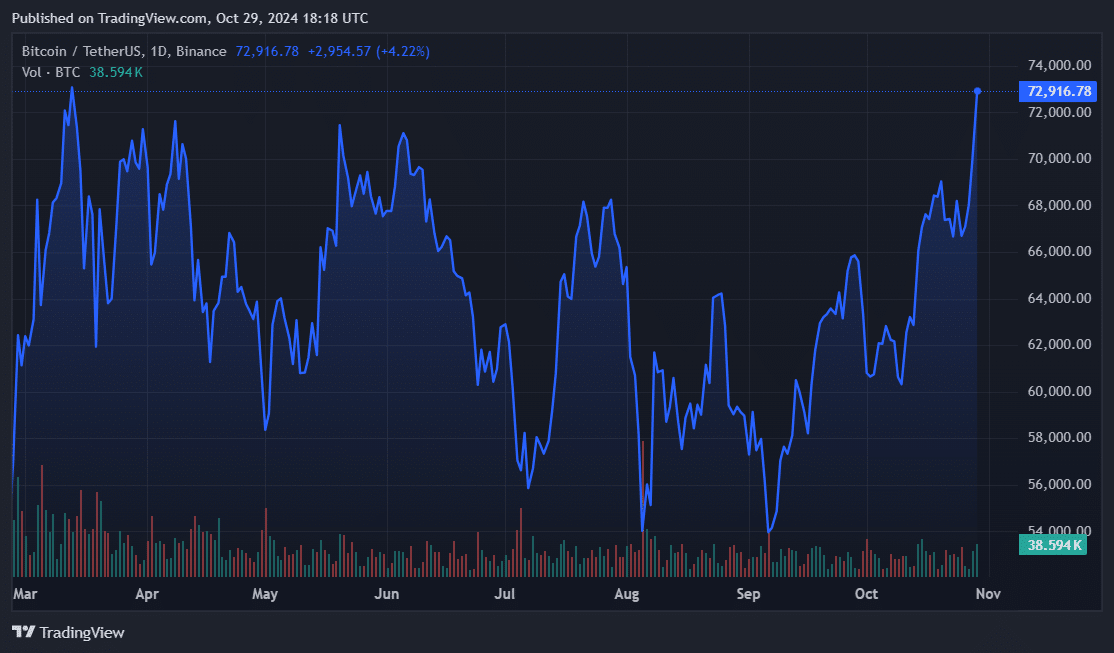

On October 29th, Hougan made his comments as Bitcoin approached its previous record high from March. In the past day, Bitcoin had surged by 5%, reaching $72,756. Although technical signs suggested a possible Bitcoin surge, historical trends indicate increased volatility as American citizens prepare for the upcoming presidential election, which could potentially cause fluctuations.

Read More

- Roblox: Project Egoist codes (June 2025)

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Run! Goddess tier list – All the Valkyries including the SR ones

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Brown Dust 2 celebrates second anniversary with live broadcast offering a peek at upcoming content

2024-10-29 22:10