As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by this recent Ethereum whale behavior. The accumulation of ETH, particularly after the Oct. 23 price drop, is reminiscent of a squirrel stowing away acorns for winter – only in this case, the acorns are worth billions!

Large-scale Ethereum investors (Ethereum whales) have seized the chance presented by the October 23 price decline, purchasing more of the asset as it offers an attractive buying opportunity.

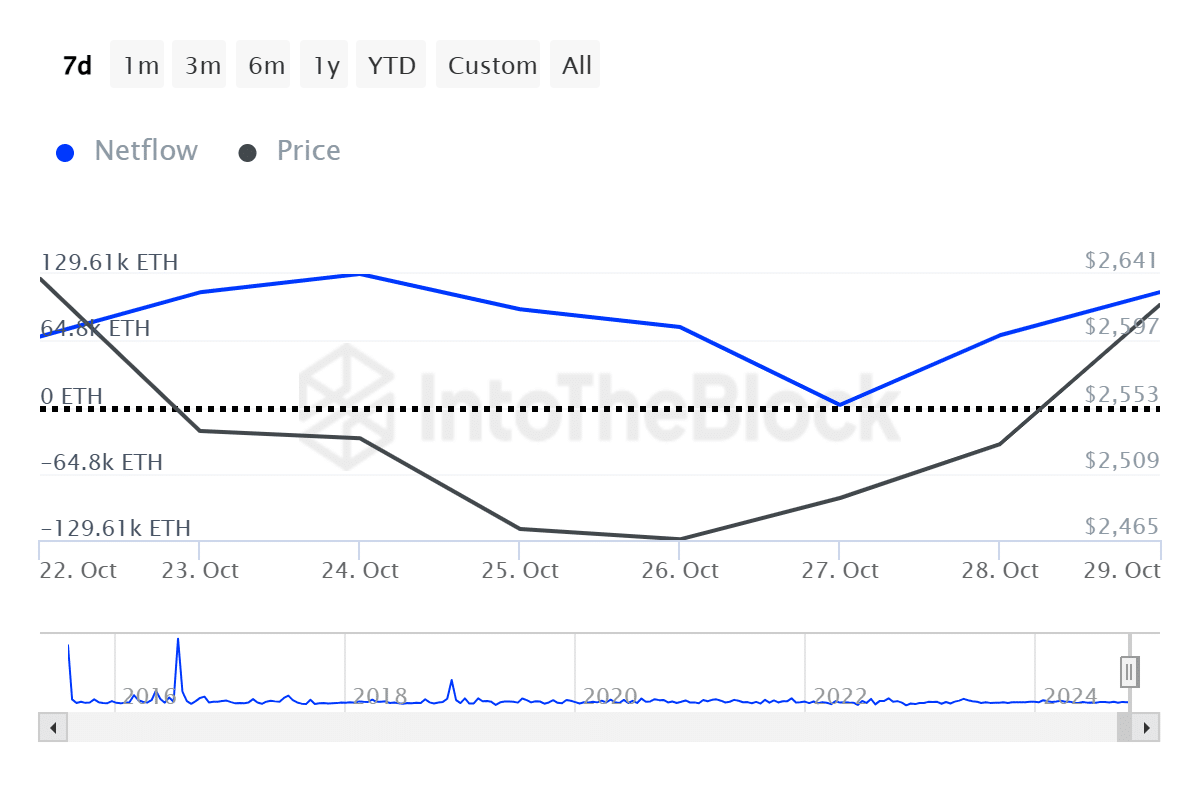

Over the last seven days, as reported by IntoTheBlock, substantial Ethereum (ETH) wallets received a total of approximately 598,000 ETH, equivalent to around $1.6 billion at current values. This influx began following a significant drop in ETH’s price from its recent peak of $2,765 between October 21st and 23rd, leading to increased accumulation.

As a researcher, I’m reporting that Ethereum has experienced a 4% increase over the past week and is currently being traded at approximately $2,685. At this moment, its market capitalization is roughly $323 billion, with daily trading volumes reaching around $21.5 billion.

The data indicates that an increase in whale holdings has been associated with a rise in exchange withdrawals. According to ITB’s findings, Ethereum experienced a net withdrawal of approximately $277 million on October 29 and a cumulative net withdrawal of $315 million over the past week.

The proportion of Ether (ETH) from significant investors (whales) being transferred to exchanges relative to total holders has risen to 10%. This indicates that whales are more actively involved compared to regular investors as the price surges beyond $2,600.

Furthermore, according to ITB data, Ethereum processed approximately $38 billion worth of significant transactions during the last week.

A significant increase in the number of whales (large investors) might stir up a sense of anxiety, often known as ‘Fear of Missing Out’ (FOMO), among smaller token holders. This apprehension could lead to an escalation in demand for ETH, potentially boosting its price.

On the other hand, Ethereum seems to be lacking a significant bullish catalyst. Furthermore, Ethereum-based exchange-traded funds in the U.S., which were launched in July, have faced difficulties, as they’ve seen a total net outflow of $485.4 million since then.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- EUR CNY PREDICTION

2024-10-30 15:10