As a seasoned crypto investor with over a decade of experience in this volatile market, I’ve learned to take news like Binance’s token burn with a grain of salt. While it’s always good to see a platform taking steps towards reducing supply and potentially boosting value, the immediate impact on BNB‘s price is often minimal.

Binance has burned over 1.7 million BNB tokens as a part of its quarterly burning initiative.

On November 1st, Binance – currently the global leader among cryptocurrency exchanges in terms of trading volume – declared their 29th quarterly burn of the BNB token. This process resulted in the removal of a total of 1,772,712.363 BNB tokens from circulation.

In summary, the complete burn consisted of two components: Initially, an amount equivalent to 1,710,142.733 BNB was automatically removed from circulation via Binance’s routine auto-burn procedure, which is a quarterly process designed to decrease the overall supply of BNB tokens.

Next, it’s worth noting that an extra 62,569.63 BNB was destroyed as a means of resolving problems related to BTokens. These tokens are generated when assets migrate onto the Binance Smart Chain. Unfortunately, some users unintentionally transferred these BTokens to inactive accounts, essentially rendering them immovable.

To make up for the missing tokens, Binance refunded users via their Pioneer Burn Program and added the remaining unburnt amount to the burn this quarter.

22% of the entire altcoin’s circulation was represented by this specific account, given that the worth of the transaction was approximately $1.07 billion at the present market prices.

Previously, Binance took out around 1.64 million BNB tokens worth roughly $971 million in the month of July.

BNB unfazed

In simpler terms, during the token burn event, Binance Coin (BNB) didn’t benefit as expected because it decreased by 1%, with each coin valued at approximately $576.98. Simultaneously, the total market capitalization of BNB reduced by about 2.1% to a staggering $83.27 billion.

On September 28, BNB soared to its highest point in three months, reaching $615.50, following the release of Binance’s former CEO, Changpeng Zhao, from prison after serving a four-month term for not enforcing adequate anti-money laundering and sanctions rules at Binance.

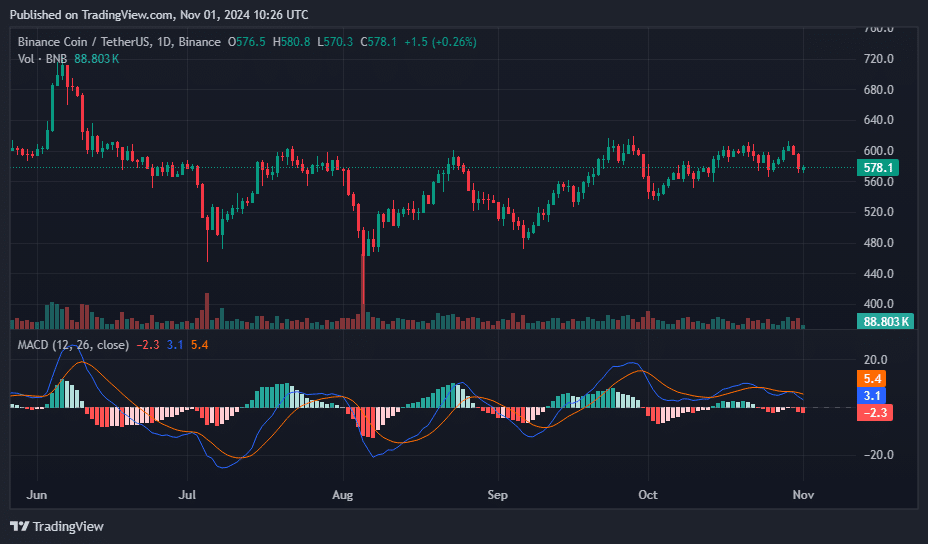

After that attempt, the altcoin hasn’t managed to surpass its previous levels of around $610, instead facing rejection at this level twice. At present, technical indicators hint that the price of BNB may be in a phase of temporary price stability.

According to the 1-day BNB/USDT price chart, the Relative Strength Index (RSI) for BNB was 47, suggesting a relatively weak trend. Additionally, the Average Directional Index (ADX) showed a reading of 11, indicating that the altcoin might continue to trade within a narrow range.

Currently, a bearish crossover is occurring on the Moving Average Convergence Divergence chart where the MACD line falls beneath the signal line. This pattern suggests there might be increasing downward pressure, but since more definitive trend indicators are absent, significant price shifts in either direction seem improbable at this time.

As a researcher delving into Binance Coin’s (BNB) market movements, I find myself echoing the sentiments of the anonymous trader, Crypto Yapper. His observation that BNB’s price is “compressing into an apex” resonates with me, as this term refers to a critical juncture where both support and resistance levels converge, signifying a narrowing price range. This convergence could potentially signal significant shifts in the market dynamics for BNB, making it an intriguing subject of study.

The analyst noted that while such a situation usually indicates an impending surge, it’s also possible for the price to trend either upwards towards a peak or downwards.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Grimguard Tactics tier list – Ranking the main classes

- Mini Heroes Magic Throne tier list

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- CRK Boss Rush guide – Best cookies for each stage of the event

2024-11-01 14:05