As a seasoned researcher with over two decades of experience in financial markets, I’ve witnessed numerous bull runs and market corrections. The current surge in Bitcoin’s price is indeed intriguing. While it’s natural to feel a sense of excitement, I’ve learned throughout my career that the crypto market can be unpredictable and volatile.

Recently, Bitcoin surpassed its highest previous record following a period where it was hovering below the $70,000 mark during the last seven days.

Currently, Bitcoin (BTC) has surged by 9.2% over the past day and is being traded at approximately $74,550. At one point, it reached an all-time high (ATH) of $75,011 with a total market capitalization of about $1.48 trillion.

The asset’s previous ATH of $73,750 was marked in March.

Currently, Bitcoin has a 59.4% dominance over the broader crypto market.

One significant factor contributing to the surge in Bitcoin’s price is the ongoing U.S. Presidential election, with the Republican candidate, Donald Trump, currently leading.

Based on information from the prediction market platform Polymarket, former President Trump’s likelihood of victory increased to approximately 96.5%, while Vice President Kamala Harris’s probability of winning dropped significantly to only 3.4%.

Old wallets coming to life

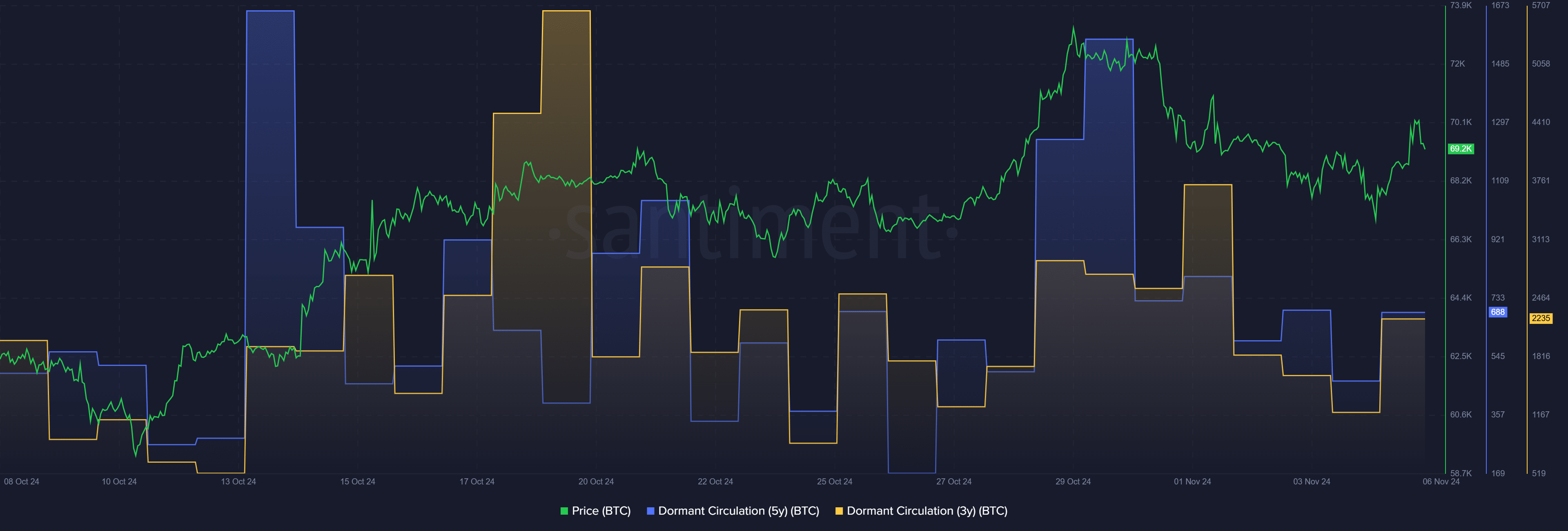

Based on information from Santiment, the amount of Bitcoin (BTC) that hasn’t been active for five years increased from 467 BTC to 688 BTC within the last 24 hours.

In the last day, the amount of Bitcoin stored in wallets for more than three years has significantly increased from approximately 1,199 Bitcoin to about 2,235 Bitcoin, as reported by Santiment’s data.

It’s quite normal for investors to sell their assets when they reach a new all-time high (ATH), whether they’ve held them for the long term or just a short period. This selling activity might cause a temporary drop in price, often followed by another surge as the market regains its upward momentum.

Bitcoin’s price jump has sparked a broad rally across the cryptocurrency market. As per CoinGecko’s statistics, the total crypto market capitalization experienced a 6.2% growth over the last day, reaching an impressive $2.57 trillion. This surge in demand has resulted in approximately $193 billion being invested into the cryptocurrency sector during the election period.

Read More

- Ludus promo codes (April 2025)

- Cookie Run: Kingdom Topping Tart guide – delicious details

- Unleash the Ultimate Warrior: Top 10 Armor Sets in The First Berserker: Khazan

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

- Grand Outlaws brings chaos, crime, and car chases as it soft launches on Android

- Grimguard Tactics tier list – Ranking the main classes

- Tap Force tier list of all characters that you can pick

- ZEREBRO/USD

- Fortress Saga tier list – Ranking every hero

- Seven Deadly Sins Idle tier list and a reroll guide

2024-11-06 08:52