As an analyst with over two decades of experience in the financial markets, I must admit that the current state of the crypto market, particularly Bitcoin (BTC), is nothing short of breathtaking. The recent rally has not only pushed BTC to an all-time high but also triggered a positive sentiment across the broader sector, reminiscent of the dot-com boom in the late 90s.

After the U.S. elections, Bitcoin‘s upward trend persists, pushing the overall cryptocurrency market capitalization to an unprecedented peak for the first time.

On Tuesday morning, the record high for Bitcoin (BTC) was set at a staggering $89,604, giving it a total market worth of approximately $1.77 trillion. However, after a period of mild decline, this premier digital currency began to show signs of movement among long-term investors.

At the moment I’m jotting this down, Bitcoin is being traded at an impressive $88,400. Remarkably, its daily trading volume continues to surge, reaching a staggering $133 billion as we speak.

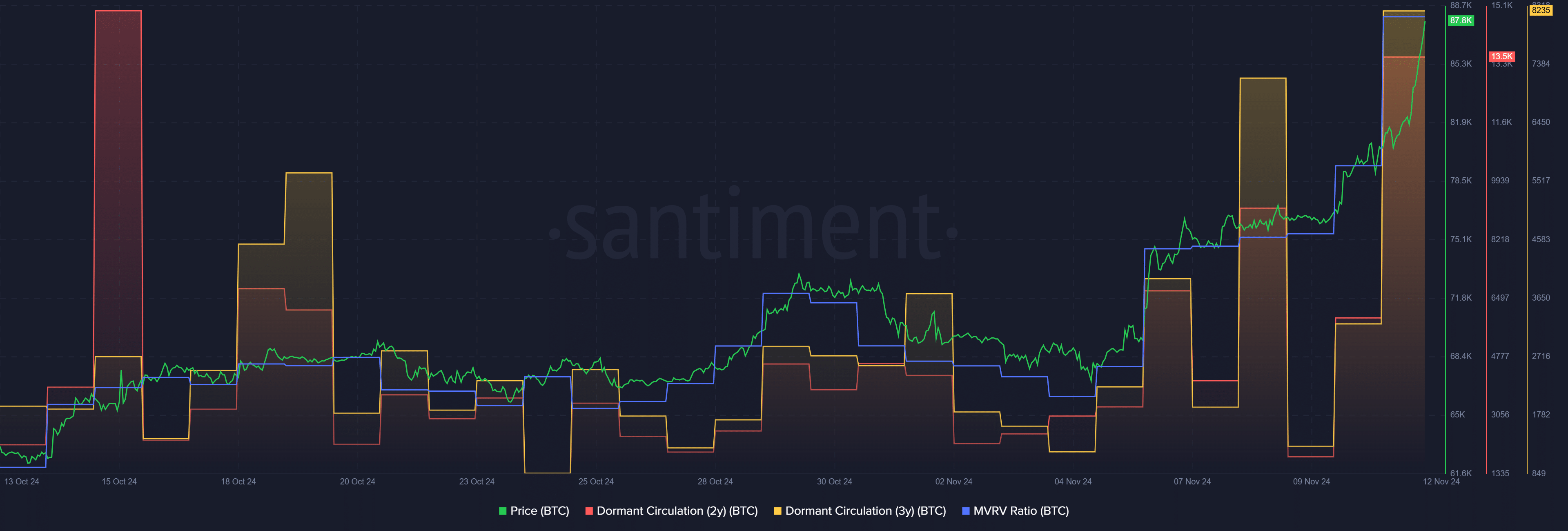

Yesterday, I observed a significant increase in Bitcoin’s two-year dormant circulation as per data from Santiment. The figure jumped by an impressive 130%, reaching approximately 13,589 Bitcoins. Additionally, the number of addresses holding Bitcoin as digital gold for over three years experienced a dramatic surge of 154%. This resulted in a movement of around 8,235 Bitcoins within a 24-hour period.

Currently, the latest all-time high (ATH) of Bitcoin has driven up its MVRV (Momentum Reversal Indicator for Value) ratio to approximately 178%, as indicated by Santiment’s data. This means that the typical Bitcoin holder is currently realizing a profit of around 178% at this price point.

Previously, Bitcoin circulation that hasn’t been active for two or three years increased simultaneously on August 29th. As a result, the asset’s price dropped from $60,000 to $54,000 over the course of a week due to long-term holders cashing out their profits, according to data from a market intelligence platform.

Triggering market-wide push again

Bitcoin’s latest rally brought positive sentiment to the broader sector again.

In the last day, the total value of the world’s cryptocurrency markets has risen by approximately 4.7%, now reaching a new all-time high of around $3.11 trillion, as reported by data from CoinGecko.

Moreover, the cryptocurrency market witnessed a $765 billion surge over the past week.

As an analyst, I’ve noticed a significant surge in the investments made in crypto-related products as reported by crypto.news on Monday. The inflow for this year has peaked at an impressive $31.3 billion, and the total value of assets under my management now stands at $116 billion.

Following Donald Trump’s victory in the U.S. presidential election, there was a noticeable rise in investment enthusiasm from institutional players, which coincided with the market shifting to a positive trajectory.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Hero Tale best builds – One for melee, one for ranged characters

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Gold Rate Forecast

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Castle Duels tier list – Best Legendary and Epic cards

- 9 Most Underrated Jeff Goldblum Movies

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- EUR CNY PREDICTION

2024-11-12 10:01