As a seasoned crypto investor with a few battle scars from market volatility, I can confidently say that the recent surge of Cronos (CRO) to a 30-month high is nothing short of exhilarating. With over two decades of experience under my belt, I’ve seen many bull runs and bear markets, but this one feels different.

The indigenous currency of Crypto.com, known as Cronos, experienced a significant rise to a 30-month peak at $0.23, primarily due to an uptick in large investor (whale) engagement.

As a researcher, I’m excited to report that in the last seven days, Cronos (CRO) has experienced an impressive 186% surge. In the past 24 hours alone, this asset has seen a 45% increase and is currently trading at $0.205. At the moment of writing, CRO’s market capitalization stands at a substantial $5.46 billion, positioning it as the 24th-largest digital asset in the market.

This is the first time for Cronos to reach this level since May 2022.

Additionally, there was a significant increase in its daily trading volume, soaring up by an impressive 340% to reach a staggering $1.21 billion. This surge was primarily driven by the rise in whale activity.

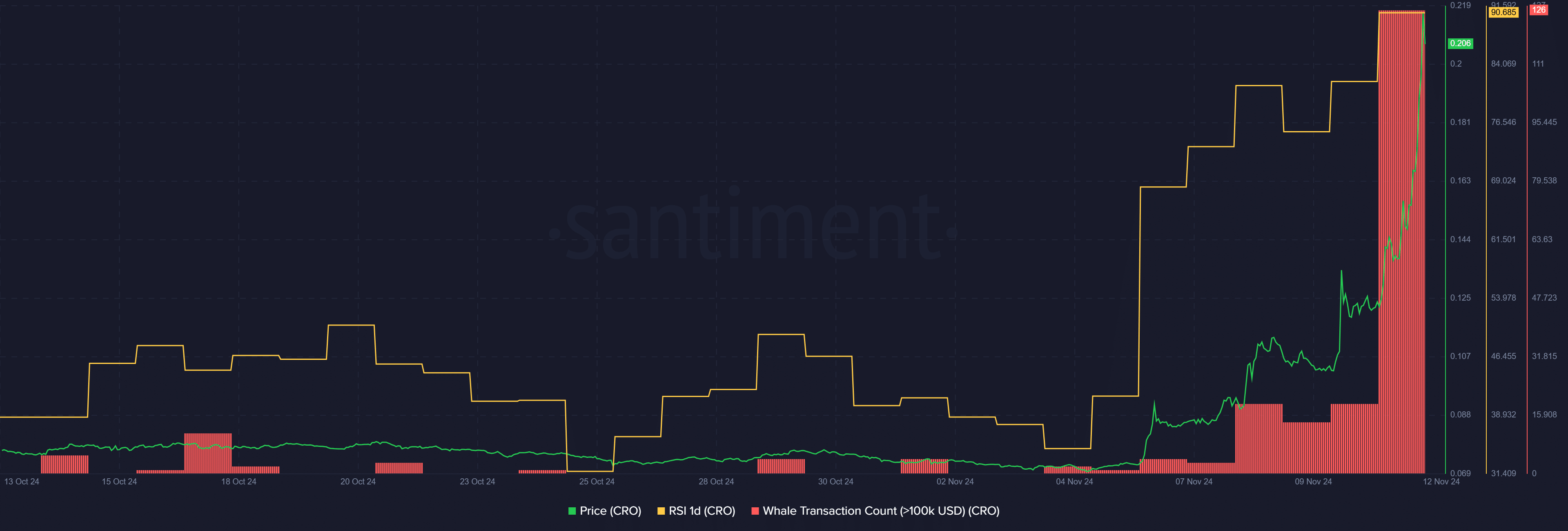

As per data from Santiment, there has been a significant increase in the number of large-value CRO token transactions, specifically those exceeding $100,000. Yesterday, this figure stood at 19 transactions, but today it has surged to 126.

A rise in whale behavior often suggests optimistic market attitudes among investors, leading to increased price fluctuations.

Nevertheless, the Comparative Ratio Strength Index (CRO RSI) surged up to 90, according to Santiment. This signifies that the asset is currently extremely overbought, indicating a possible cool-down period for Cronos before it continues its upward trend.

Sentiment remains positive

According to data from Santiment, there’s a considerable optimism surrounding Cronos since it remains 78% below its peak value ($0.969) reached in November 2021.

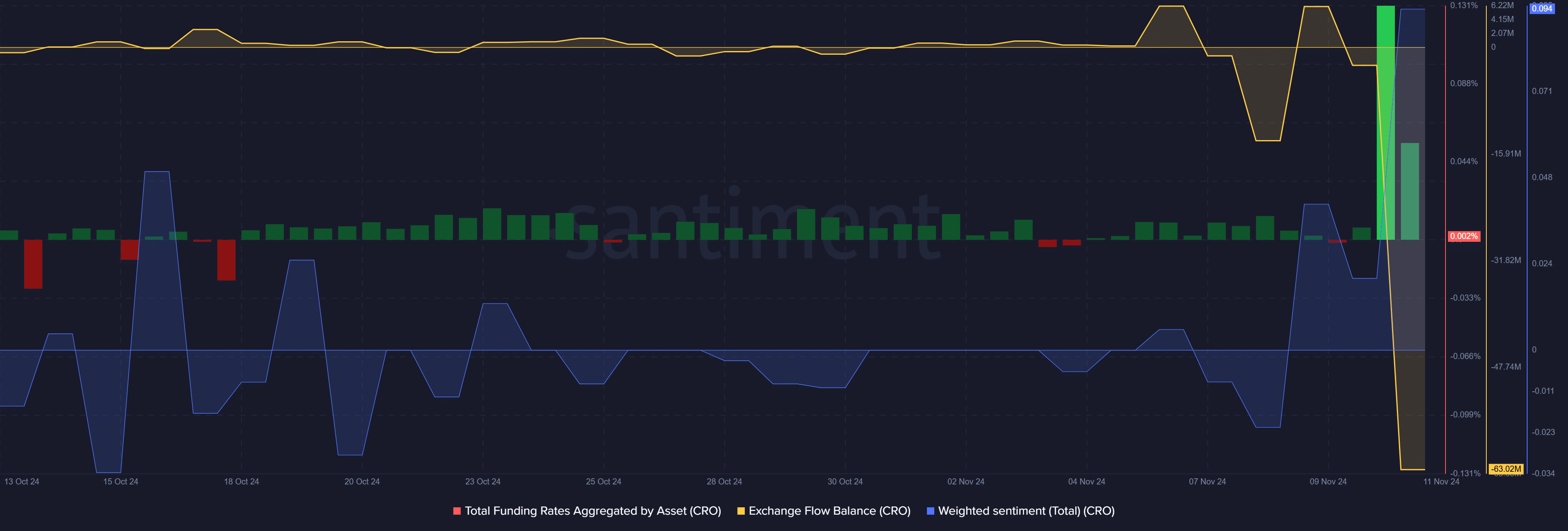

Over the last two days, the combined funding rate managed by CRO has decreased significantly, going from 0.13% to just 0.001%. This could indicate a slowdown in the pace of activity within the derivatives market.

In typical market scenarios, a modest onset of liquidation sales might cause an increase in the price of CRO (Crypto.com Coin).

Furthermore, it was observed that Cronos experienced a withdrawal of approximately 63 million tokens from its exchange network over the last 24 hours, indicating higher token hoarding, based on data from a market analysis platform.

A significant factor fueling the increase in CRO’s price is its strategic partnership with Google Cloud, where it serves as the main validator on the platform.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-11-12 11:38