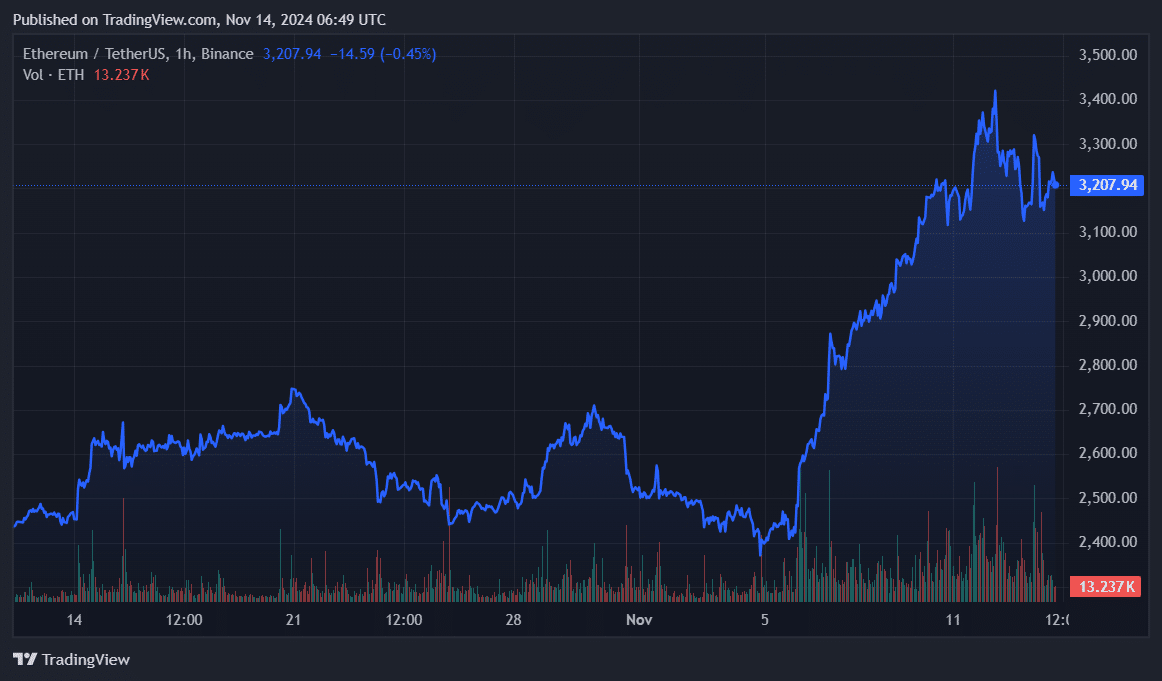

As a seasoned researcher with a background in blockchain and cryptocurrencies, I’ve witnessed the rollercoaster ride that is the crypto market. Currently, Ethereum (ETH) seems to be hovering around its local highs, struggling to break through the $4,000 barrier set back in March. However, despite the price volatility, the fundamentals of Ethereum remain strong.

Despite efforts, Ethereum has yet to match its peak of $4,000 hit in March, and even surpassing its record high of $4,891 from November 2021 still seems a challenge at this point.

The activity on Ethereum’s blockchain, including its decentralized finance segment, has maintained strength, even as the price of Ethereum experiences significant fluctuations due to market instability.

On November 12th, ETH momentarily reached a peak not seen in four months at $3,444. Since then, it has been stabilizing within a range of around $3,120 to $3,290 for the past two days following its decline from this local high.

While Ethereum is still down by 34% from its ATH, its fundamentals remain strong.

ETF inflows

U.S.-listed Ethereum exchange-traded funds (ETFs) have seen continuous investments following the U.S. elections a week ago.

As a crypto investor, I kicked off the week witnessing an unprecedented net inflow of approximately $295.5 million into our investment products. Notably, Fidelity’s FETH fund contributed around $115.5 million, while BlackRock’s ETHA fund added a significant $101.1 million to the pile.

On Wednesday, Ethereum ETFs experienced a net investment of approximately $146.9 million, bringing their overall inflow since inception to around $241.7 million.

Since they were introduced in July, these ETH-based investment products have experienced significant interest for the first time.

Whale accumulation

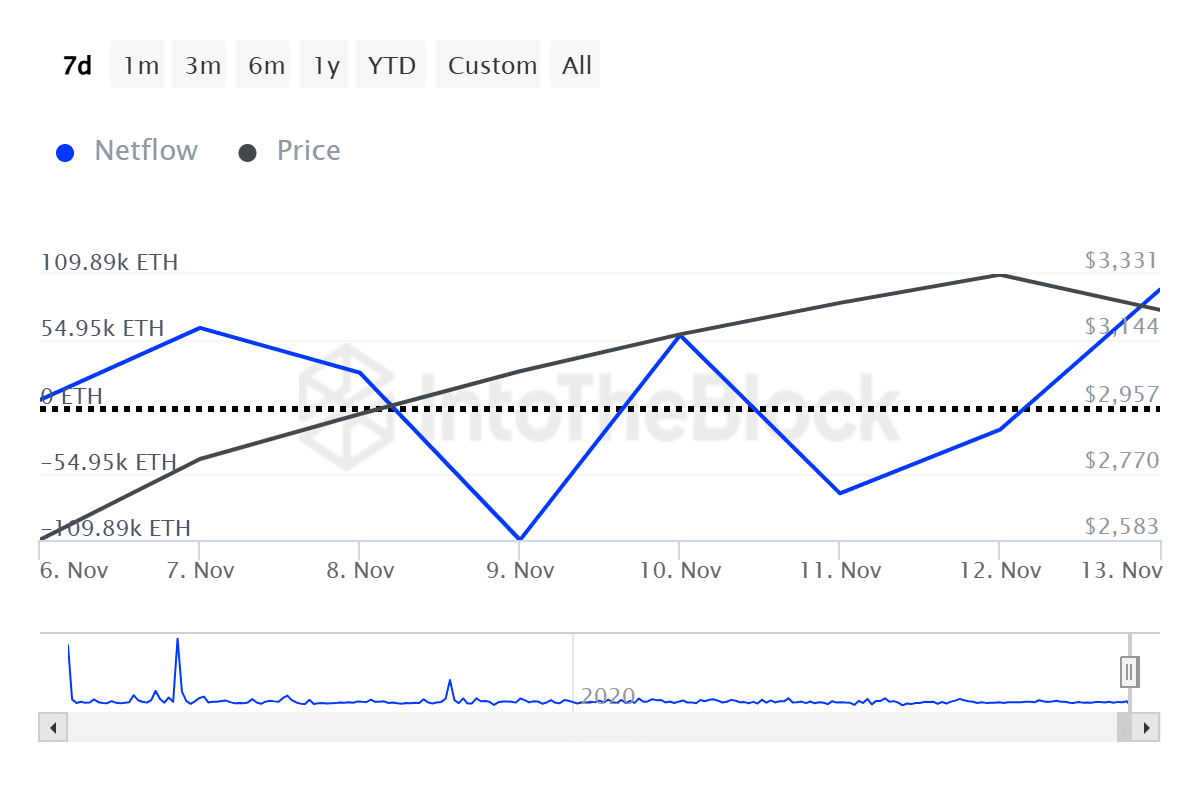

It appears that Ethereum is experiencing a rise in large-scale investments by ‘whales’ (large investors) as market participants find themselves caught up in conditions of excessive greed.

Yesterday, significant Ethereum holders experienced an overall increase of more than 97,000 ETH, equivalent to approximately $310 million, as per data supplied by IntoTheBlock.

As an analyst, I’ve observed that the accumulation of whales, large market participants, can spark a sense of FOMO (Fear of Missing Out) amongst retail investors. This often results in increased price volatility before a consistent uptrend sets in.

Exchange outflows

In addition to whales, retail investors have also been busy accumulating Ethereum.

Last week, a total of $1.12 billion worth of ETH was moved out from exchanges to individual wallets, according to ITB’s data. The high percentage of large holders transferring their ETH to exchanges indicates substantial buying by retail investors on November 9th, 11th, and 12th.

As a crypto investor, I find that when funds are withdrawn from an exchange (exchange outflows), it often signals a long-term holding strategy among investors. This approach can lay the foundation for consistent growth in the long run.

DeFi growth

Ethereum’s DeFi sector has also been surging.

The total value locked in Ethereum-based protocols increased by roughly $10 billion after the crypto market gained bullish momentum on Donald Trump’s win in the U.S. presidential election, according to data provided by Defi Llama.

As a researcher delving into the world of Decentralized Finance (DeFi), I’ve observed an interesting trend: The cumulative fees amassed by DeFi platforms on the Ethereum network have tripled within the last seven days, reaching a staggering $18 million. Over the past day alone, these protocols have generated a total revenue of approximately $15.5 million.

Hitting $4k before 2025?

According to Amberdata, a market research company, they estimate that Ethereum may reach a price of $4,000 by the end of this year with approximately an 18% likelihood.

18% probability that Ethereum could reach $4000k by the end of this year is taken into account for the December 27 expiration. This means we might still have some potential growth ahead, but remember, not financial advice.

— Amberdata (@Amberdataio) November 12, 2024

We’ve yet to reach ETH’s peak value, suggesting there might be more potential for growth ahead.

Amberdata wrote in an X post.

Boosting ETH ETF investments and the rising trend of large investors buying Ethereum might strengthen its upward price trend.

As a crypto investor, I must acknowledge the possibility that larger global events might divert the market’s attention away from bullish on-chain indicators, even though I remain optimistic about their significance.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Cookie Run Kingdom Town Square Vault password

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2024-11-14 12:38