As a seasoned crypto investor with a knack for spotting trends and deciphering market signals, I find the recent surge of Cardano (ADA) intriguing. After years of navigating the volatile crypto landscape, I’ve learned to read between the lines of whale activity and open interest, both of which are currently pointing towards a bullish ADA movement.

There’s been significant attention from big investors towards Cardano, as it bucked the general market turmoil by experiencing a rise in price.

Sure enough, Cardano (ADA) reached a peak of $0.80, its highest point in nearly 18 months, during early Wednesday trading. The positive momentum for ADA emerged while the overall crypto market experienced a downturn – resulting in a decrease of 1.2% in the total cryptocurrency market cap over the past day, to approximately $3.22 trillion as per CoinGecko data.

Currently, Cardano has risen by approximately 4.1% in the last 24 hours, with its price standing at around $0.79. During this period, the daily trading volume for Cardano surged by 24%, totaling a significant $2.27 billion.

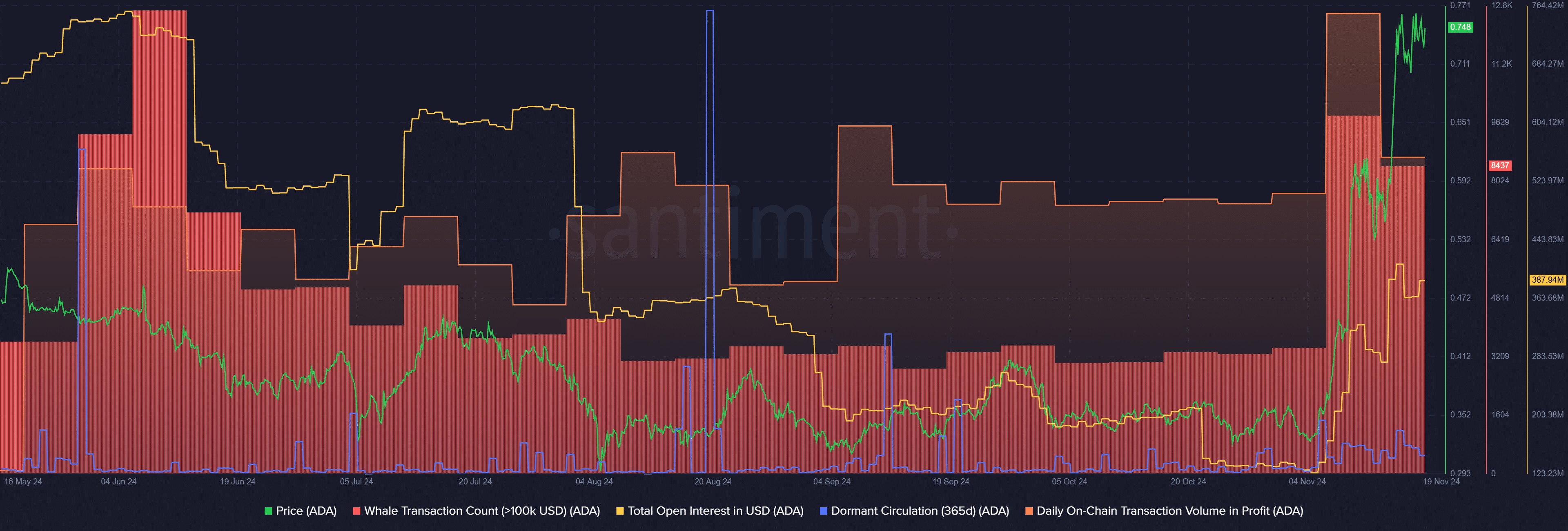

Last week saw an increase in significant Cardano transactions (ADA), leading to the surge. There were approximately 9,824 large transactions valued at over $100,000 each, which represents a five-month peak, as per data from Santiment.

Additionally, according to Santiment’s data, the total open interest of Cardano surpassed $400 million for the first time since early August. This suggests a heightened level of engagement from derivative traders, as indicated by the indicator.

Despite the price surge, long-term Cardano holders with positive returns have declined. Data from the market intelligence platform shows that the asset’s one-year dormant circulation dropped from 69.3 million ADA on Nov. 16 to 30.5 million ADA on Tuesday.

Over the past fortnight, the amount of daily transactions involving profits on the Cardano blockchain has dropped significantly, decreasing from approximately 36.4 billion ADA to 29.6 billion ADA.

The change in investor behavior indicates that the phase of cashing out profits may have slowed for now, as those holding ADA might be anticipating additional price increases.

Keep in mind that as the trading activity, large transactions by ‘whales’, and open interest grow, Cardano might find itself in a very unpredictable price range. Additionally, the escalation between Ukraine and Russia could further fuel market instability.

Read More

- Silver Rate Forecast

- Gods & Demons codes (January 2025)

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Former SNL Star Reveals Surprising Comeback After 24 Years

- USD CNY PREDICTION

- Honor of Kings returns for the 2025 Esports World Cup with a whopping $3 million prize pool

- PUBG Mobile heads back to Riyadh for EWC 2025

- Maiden Academy tier list

- Superman: DCU Movie Has Already Broken 3 Box Office Records

2024-11-20 11:12