As a seasoned financial analyst with over two decades of experience, I have witnessed numerous paradigm shifts and market phenomena that defy conventional wisdom. The intertwined trajectory of MicroStrategy (MSTR) and Bitcoin (BTC), however, stands out as one of the most intriguing developments in recent years.

MicroStrategy’s groundbreaking advancement is propelled by Bitcoin, while simultaneously boosting Bitcoin as well. What’s the mechanism that continues to drive both upward?

Table of Contents

MicroStrategy joins the top 100 Club

As a crypto investor, I’m thrilled to share that MicroStrategy (MSTR), known for its significant role in Bitcoin’s (BTC) dynamic adventure, has achieved a significant milestone recently. In just two trading days, it soared up the ranks, now sitting comfortably at the 85th spot among the elite group of the top 100 U.S. publicly traded companies, based on market capitalization. This impressive leap is a testament to its resilience and strategic moves in the ever-evolving world of crypto and finance.

On November 20th, the market capitalization of MSTR has almost reached $111 billion. This significant rise came after a 12% increase in its stock price on November 19th, and an additional 15% gain as we speak. At this moment, each share is being traded at approximately $482, signifying a spectacular end to a highly prosperous year of growth for the company.

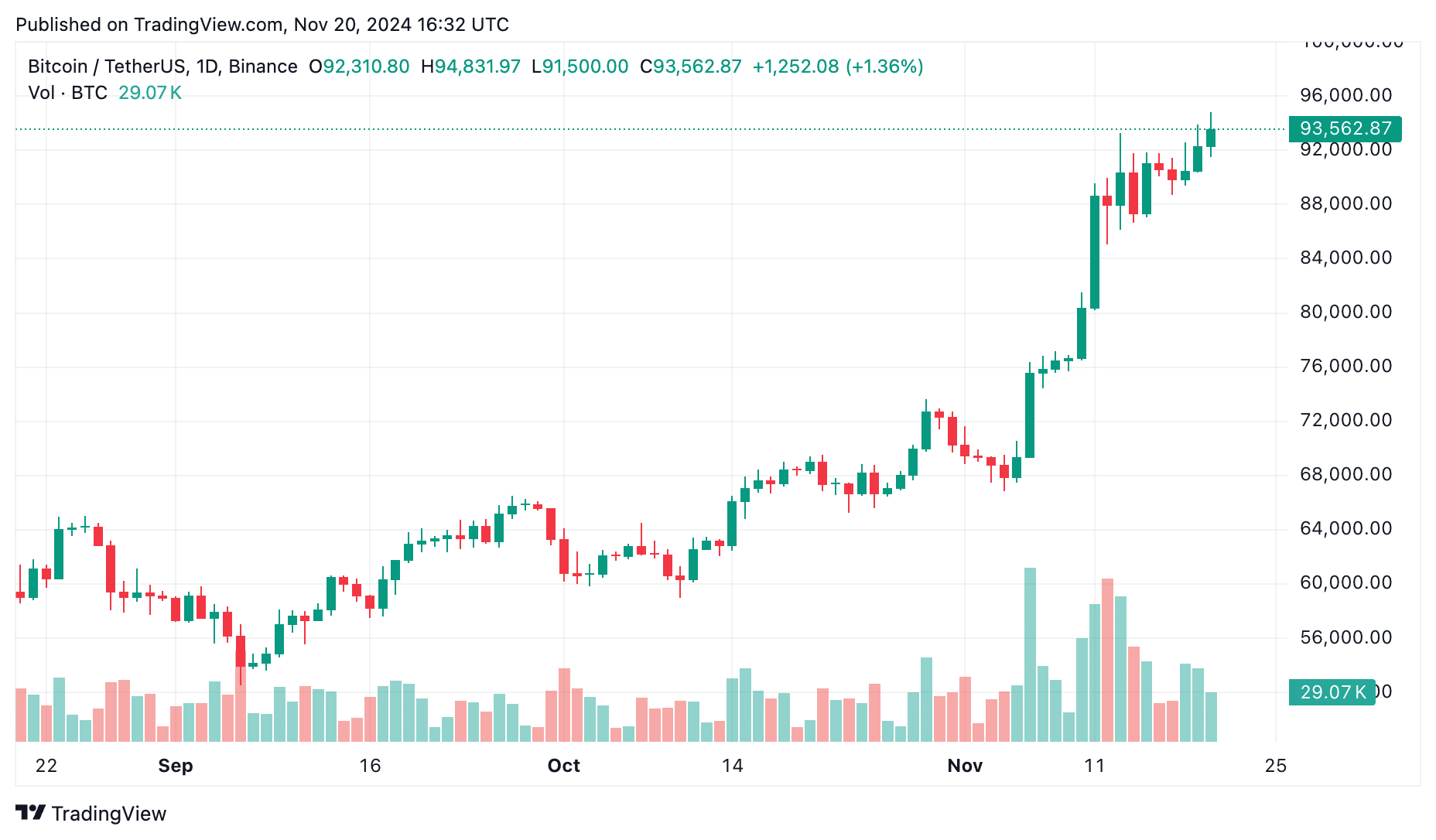

At the same time, Bitcoin, a key component of MicroStrategy’s business approach, has reached a new record peak, surpassing $94,000 and currently trading at $94,850 on November 20th.

In the current scenario, MicroStrategy’s shares have soared an impressive 620% between January and now in 2024. On the other hand, Bitcoin has also experienced a significant increase, rising more than 125% during the same period.

After incorporating Bitcoin as part of its treasury reserves in 2020, MicroStrategy’s stock has experienced an extraordinary increase of approximately 2,739%. This growth just barely outpaces NVIDIA’s (NVDA) impressive 2,688% rise during the same timeframe. This remarkable performance suggests that Bitcoin-focused strategies are propelling MicroStrategy into a sphere typically inhabited by tech titans, financial institutions, and energy conglomerates.

In terms of performance over the past five years, Mastercard (MSTR) surpasses Nvidia (NVDA), which is currently the world’s largest publicly traded company with a market capitalization more than $3.6 trillion and known for its leadership in artificial intelligence and gaming innovation.

To put it simply, what are the implications of all this for Bitcoin? Let’s delve further into the connection between MicroStrategy (MSTR) and Bitcoin, examining how their trajectories may be shaping a new chapter in financial history by influencing each other in intriguing ways.

How MicroStrategy became Bitcoin’s biggest backer

Over the last few years, MicroStrategy has transformed its brand, shifting from a traditional business software provider to a pioneer in corporate Bitcoin integration. Their approach is simple yet strategic: amass as much Bitcoin as they can, utilizing it as a long-term investment.

As an analyst, I’ve observed that since my initial investment in Bitcoin in 2020 with MicroStrategy, the company has consistently grown its Bitcoin holdings by making daring purchases and implementing creative financing strategies. This strategic move aligns our growth significantly with the fluctuations in the value of BTC.

Currently, the company is in possession of around 331,200 Bitcoins, which they obtained for a total expense of about $16.5 billion. This equates to an average price of approximately $49,874 per Bitcoin.

During this ongoing surge in cryptocurrency prices, the firm acquired a total of 51,780 Bitcoins worth approximately $4.6 billion, with each Bitcoin costing on average around $88,627, between November 11 and November 17.

The digital currency reserves that MSTR owns in Bitcoin, currently worth over $31 billion, outstrip Marathon Digital (MARA) – the second-largest public holder – who possess roughly 27,000 Bitcoins, by more than tenfold. Additionally, this substantial amount surpasses Tesla’s holding of 11,500 Bitcoins as well.

MicroStrategy often leans on various fundraising methods to finance its acquisition endeavors. As recently disclosed in an SEC filing dated Nov. 18, the company offloaded around 13.6 million shares, raising a net total of about $4.6 billion under a previously established contract.

Regardless, there are yet $15.3 billion worth of shares that can be issued in the future, offering a substantial room for further investment in Bitcoin, demonstrating its flexibility.

Furthermore, the company is continuing to push boundaries. As recent as two days past, MicroStrategy announced a $1.75 billion convertible senior note offering, due for maturity in December 2029, featuring a zero percent interest rate.

Convertible senior notes represent a distinctive form of borrowing tool used by companies, enabling investors to loan funds while retaining the choice to transform that debt into company shares at a future point in time, usually based on a previously agreed price.

It’s interesting to note that MicroStrategy’s bonds don’t offer any regular interest payments to investors, as their rate is set at zero (0%).

In an unexpected turn of events, MicroStrategy has revealed that they’ve increased their convertible bond issuance due to high interest, from $1.75 billion to $2.6 billion. This includes a $400 million additional option, known as a greenshoe, with a 55% premium for conversion.

To meet increased market interest, we’ve expanded our issuance of Mastercraft Inc.’s zero-percent convertible bonds maturing in 2029 from an initial $1.75 billion to a total of $2.6 billion. This expansion includes a $400 million over-allotment option, and the offering was priced with a conversion premium of 55%.

— Michael Saylor⚡️ (@saylor) November 20, 2024

In simpler terms, the greenshoe provision allows underwriters to offer more bonds than initially planned if there’s high demand. This additional bond amount is sold to meet excess demand. On the other hand, a 55% conversion premium signifies the price level above MicroStrategy’s current share price at which these bonds can be exchanged for company shares.

It shows that investors are willing to pay a substantial premium to bet on the company’s long-term growth, even as its stock continues to rise — essentially tying their fortunes to the company’s Bitcoin-driven strategy.

A vision beyond Bitcoin holdings

MicroStrategy’s tale has a long way to go, and the upcoming chapter promises to be as bold and daring as the one before it.

As an analyst, I find myself aligned with MicroStrategy’s bold approach spearheaded by their Executive Chairman, Michael Saylor. Instead of merely incorporating Bitcoin into our own strategic framework, we are actively striving to disseminate this forward-thinking vision across the wider corporate landscape.

On November 19th, Saylor indicated during a VanEck-hosted event at X Spaces that he plans to make a three-minute case to Microsoft’s board about incorporating Bitcoin into their financial strategies.

— VanEck (@vaneck_us) November 8, 2024

Saylor clearly advocates that Bitcoin should be a topic of discussion for leading companies such as Apple, Meta, and Berkshire Hathaway.

Saylor posits that having Bitcoin as a physical asset might aid companies in maintaining the stability of their share prices, especially when contrasted with over-reliance on the results of quarterly earnings reports.

To illustrate, Microsoft’s current enterprise value is heavily connected to nearly all (98.5%) of its earnings, while just a minimal percentage depends on tangible assets. Ray Dalio suggests that Bitcoin might provide a more equitable strategy, possibly safeguarding shareholder value in the long run.

MicroStrategy is not only affecting others but also intensifying its own Bitcoin approach through an ambitious plan titled “The 21/21 Initiative.

In October’s closing days, a substantial initiative was unveiled with an objective to amass approximately $42 billion within the next three years. This target sum will be achieved by securing $21 billion in equity and another equivalent amount through debt. The ultimate intention is to acquire more Bitcoin, thereby strengthening its status as the world’s preeminent Bitcoin reserve company.

As per CEO Phong Le’s statement, the funds we’ve acquired will enable MicroStrategy to use its Bitcoin investments in a more tactical manner, potentially generating greater profits while still preserving a substantial reserve.

The Bitcoin-MSTR feedback loop

The approach taken by MicroStrategy links its own performance closely with that of Bitcoin’s price movement, a connection that has sparked debate. This interdependence serves to boost the value of both entities simultaneously.

As MicroStrategy continues to accumulate more Bitcoins, the available supply in circulation shrinks, which tends to drive up Bitcoin’s market price, particularly during bullish market conditions. The growing worth of its Bitcoin holdings also elevates the company’s stock value, sparking increased investor curiosity, thereby pushing up the stock’s price as well.

An increased stock price gives MicroStrategy the opportunity to procure additional capital via share offerings or borrowing, which funds are then utilized for purchasing even greater amounts of Bitcoin.

This self-reinforcing process has shown remarkable results up until now, but it also stirs up critical concerns about its long-term viability.

Concerns are arising that this approach might not be long-term viable. To illustrate, Peter Schiff – a notable Bitcoin critic – has raised doubts about whether the self-perpetuating trend could be inflating an unstable economic bubble.

As the cost of MicroStrategy’s (MSTR) shares increases, it allows Saylor to sell more of them. Each additional share he sells means he can acquire more Bitcoins. The greater number of Bitcoins he acquires, the more likely their price will rise. In turn, a surge in Bitcoin’s price tends to boost MSTR’s share price even further. At what point does this cycle end? That remains uncertain.

— Peter Schiff (@PeterSchiff) November 19, 2024

As a data analyst, I find that the distinctiveness and possibly perilous aspect of this feedback loop lies in the magnitude of MicroStrategy’s Bitcoin investments.

Currently, the company holds more than 1% of all existing Bitcoins, which is an impressive amount that significantly boosts its power in the Bitcoin market. Each significant acquisition could decrease the circulating supply, possibly causing a rise in Bitcoin’s price due to increased demand.

If MicroStrategy’s approach proves effective, it might inspire other corporations to mimic this strategy, creating a self-reinforcing trend. Conversely, if the value of Bitcoin decreases, the entire system could unravel, potentially leading to losses for both the company’s stock and Bitcoin.

In simpler terms, this implies that the value of Bitcoin is becoming more dependent on the moves made by big institutional investors such as MicroStrategy, unlike in its early days when it was primarily a decentralized asset with minimal influence from large institutions.

The main point for consideration is if the mutually advantageous bond between MicroStrategy and Bitcoin will continue to be profitable over the long haul, or if it’s an unstable setup that relies excessively on continuous growth.

Read More

2024-11-20 19:51