As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the recent rollercoaster ride that is the cryptocurrency market. The latest Bitcoin price drop to $96,000, following a failed attempt at breaching the coveted $100,000 mark, has triggered one of the biggest crypto liquidation events in over six months. It’s a stark reminder that even the most promising investments can be subject to sudden and significant shifts.

The price of Bitcoin dipped to around $96,000 following its unsuccessful attempt to surpass $100,000, resulting in a major cryptocurrency liquidation incident that hasn’t been seen for over half a year. Over the last day, approximately $500 million worth of cryptocurrency positions have been erased.

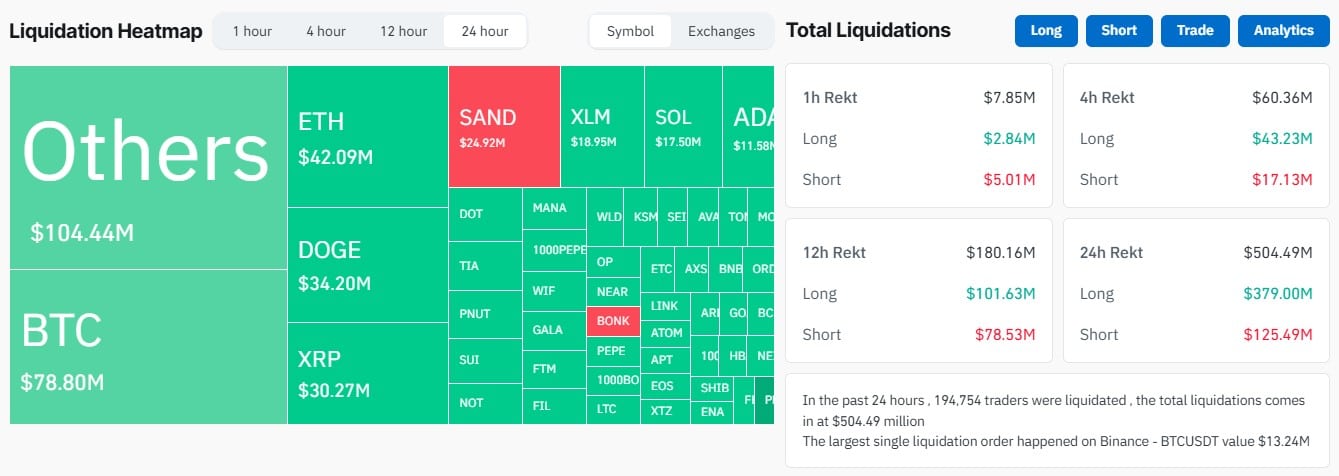

Based on CoinGlass’s latest findings, I analyzed the market and found that long liquidations amounted to approximately $379 million, while short liquidations accounted for around $125.49 million. Notably, Bitcoin and Ether were responsible for a significant portion of these positions, with a total value of about $121 million being liquidated.

Additionally, notable altcoins such as Dogecoin, Ripple (XRP), and Stellar experienced substantial liquidation events, totaling approximately $34.20 million for Dogecoin, $30.27 million for XRP, and $18.95 million for Stellar.

After an unexpected surge in various altcoins, such as XLM, that increased by 50% between November 23 and 24, there has been a significant decrease. In the same timeframe, Dogecoin reached its highest price point since May 2021 – a level it hadn’t attained since its peak in the past.

According to analyst Miles Deutscher, it’s thought that numerous traders from past market cycles are re-entering and putting money into tokens they recognize. This situation is viewed as a potential chance by some, particularly since utility tokens are currently being traded at prices lower than their perceived worth.

At the moment, a single Bitcoin is valued around $97,790, just a small decrease from its peak record of $99,645. Even with this minor setback, Bitcoin has experienced an impressive increase of approximately 44% since early November. The control that Bitcoin holds within the entire cryptocurrency market is currently at 56.2%, which equates to a whopping $3.46 trillion in total value.

Read More

- Castle Duels tier list – Best Legendary and Epic cards

- AOC 25G42E Gaming Monitor – Our Review

- CRK Boss Rush guide – Best cookies for each stage of the event

- Mini Heroes Magic Throne tier list

- Kingdom Come: Deliverance 2 Patch 1.3 Is Causing Flickering Issues

- Athena: Blood Twins is an upcoming MMORPG from Efun, pre-registration now open

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Outerplane tier list and reroll guide

2024-11-25 08:04