As a seasoned analyst with over two decades of experience observing and dissecting financial markets, I must say that Bitcoin’s current market cycle is proving to be a fascinating study in investor behavior. The contrast between long-term holders and short-term traders is reminiscent of the classic tale of the tortoise and the hare – one steady and patient, the other swift but impulsive.

As an analyst, I observe that long-term Bitcoin investors (referred to as ‘HODLers’) are maintaining their positions, while shorter-term investors are realizing their gains. This pattern suggests a stable or consolidating phase in Bitcoin’s price movement.

As reported by CryptoQuant, Bitcoin’s (BTC) current market cycle is proving to be intriguing due to its insights into the actions of long-term investors and short-term traders. These two categories play crucial roles in determining Bitcoin’s future price trends, as their activities often reflect the overall market mood.

Long-term Holders Are Holding On:

The data shows that long-term Bitcoin holders have been keeping a low profile, as evidenced by the gradual decline in the Coin Days Destroyed (CDD) measure. This implies that these stable market participants, who are typically seen as anchors within the Bitcoin market, remain steadfast in their decision to hold onto their BTC amidst recent price surges.

When investors holding for the long term choose not to sell during a price surge, it’s often a positive sign. This could imply that there’s no widespread panic selling and instead, many people think the prices may keep climbing further.

In past cycles, a similar pattern was observed, particularly towards the end of 2020 and beginning of 2021. During this time, long-term holders consistently bought and held their Bitcoin as it approached new record highs (peak prices). These long-term investors generally contribute to market stability by preventing sudden shifts in supply from causing dramatic price swings for the asset.

Short-term realized profits on the rise:

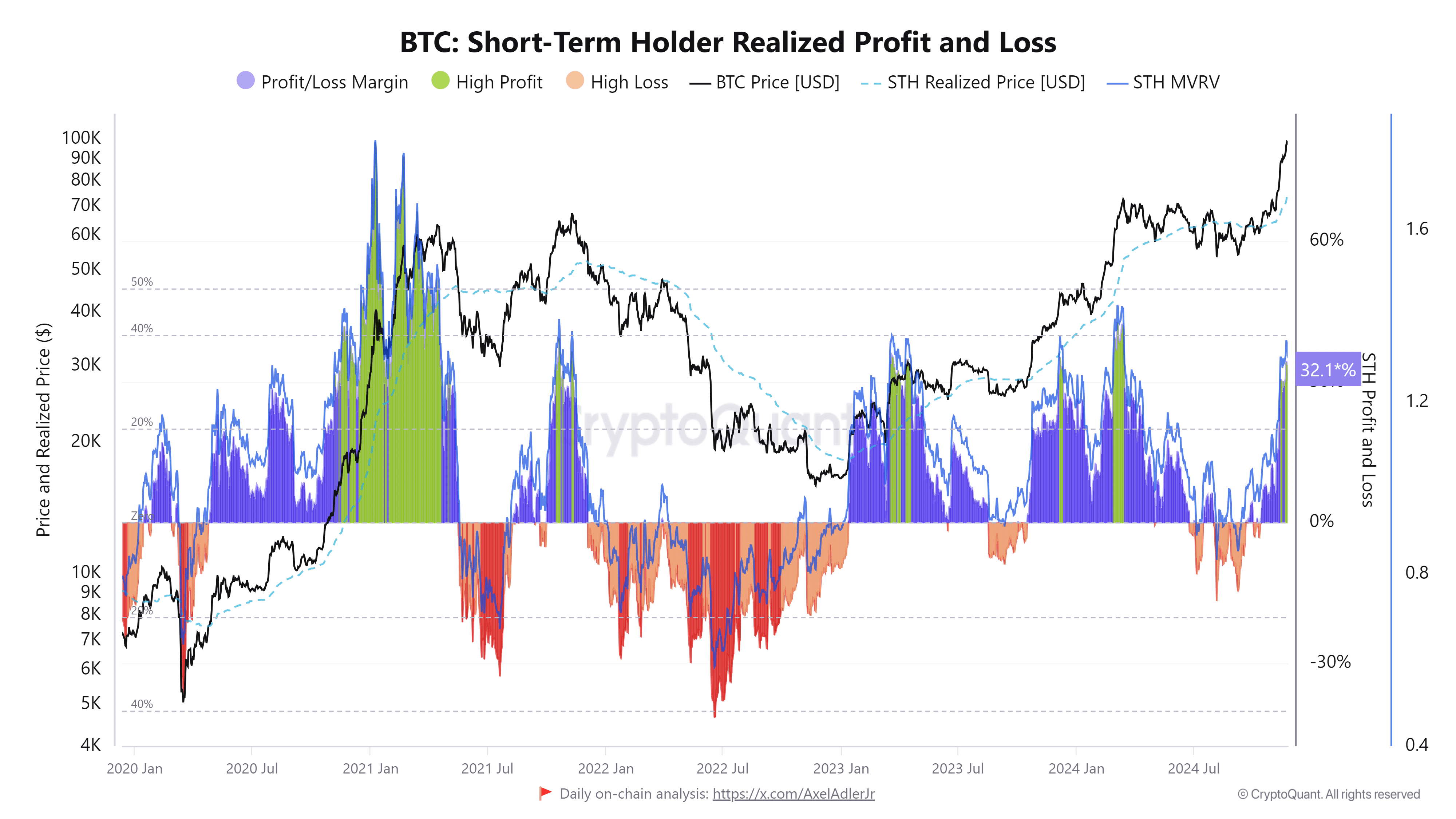

Short-term Bitcoin investors are cashing in on the current price surge more than long-term holders. The data suggests that they’re realizing profits of approximately 32.1% and then leaving the market. This behavior, where investors cash out their gains, is quite typical in financial markets. Typically, we observe peaks in realized profits near market highs as they attempt to secure their earnings, while significant realized losses take place at market lows when investors decide to sell off their assets.

Critical Juncture Ahead!

Given the latest market information showing BTC at a critical point, it seems like the recent surge in price is primarily fueled by short-term speculative traders looking to cash out quickly. Yet, there’s a noticeable faith among long-term investors in the asset, implying that this rally has solid backing. However, if short-term holders keep raking in profits at the current rate, it increases the likelihood of a market stabilization period. If long-term holders start selling, though, a price adjustment could potentially occur. In other words, a possible correction might occur if long-term investors decide to offload their assets.

Currently, the significant psychological barrier lies at $100,000 for Bitcoin (BTC). If BTC surpasses this figure, increased media coverage, institutional interest, and retail participation could follow suit, potentially pushing prices even higher. Conversely, if BTC fails to breach this level, there’s a likelihood of a period of stabilization, as it will function as a strong resistance point for numerous traders, making further growth difficult.

Read More

- Gold Rate Forecast

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Mini Heroes Magic Throne tier list

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- EUR NZD PREDICTION

2024-11-25 13:14