As a seasoned crypto investor who’s been through the wild rollercoaster ride that is this industry, I must admit the recent events surrounding Wrapped Bitcoin (WBTC) have left me a bit shaken. The sudden price crash below $6,000 on Binance just days after Coinbase’s announcement to delist it due to liquidity concerns was quite the shocker.

On Binance, the cost of Wrapped Bitcoin dropped significantly below $6,000, only a few days following its removal by Coinbase due to issues regarding market liquidity.

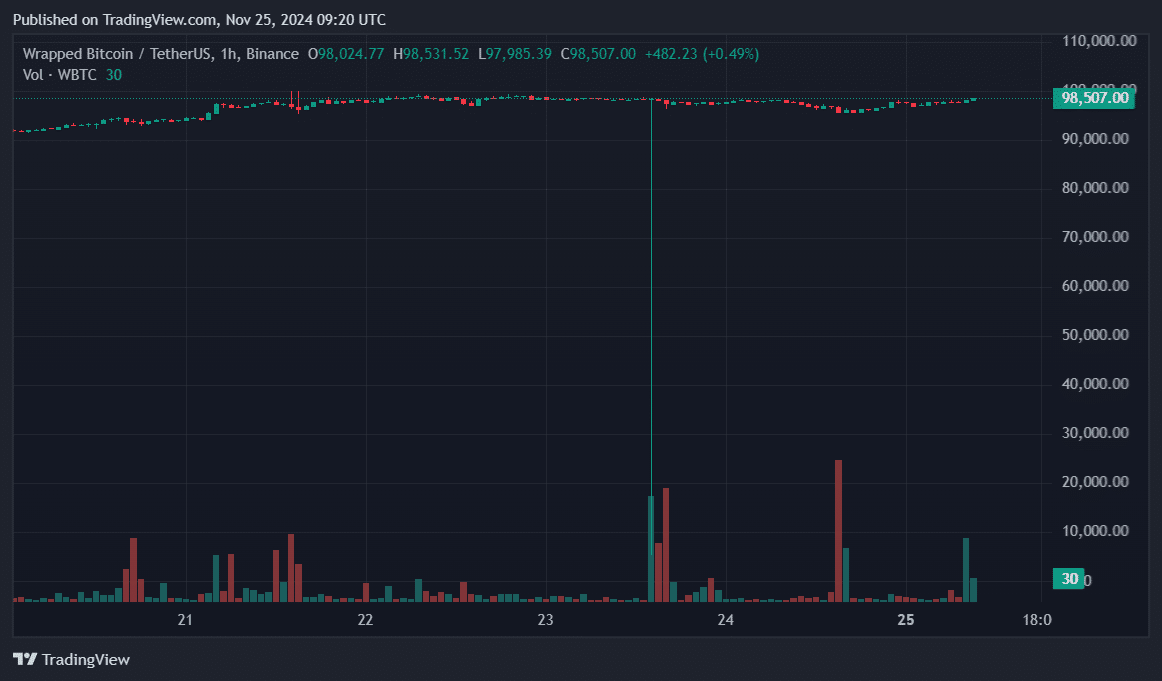

In just about an hour on the Binance platform, the value of Wrapped Bitcoin (WBTC), a digital currency issued by BitGo, plummeted by almost 95%, dropping from approximately $98,500 to $5,209. However, it quickly bounced back and stabilized around its original price of about $98,000 on November 23rd.

The cause of WBTC’s sharp price drop remains unknown, with neither BitGo nor the WBTC team commenting on the flash crash. The incident comes just days after Coinbase announced it would delist WBTC due to liquidity concerns, effective Dec.19.

At the same time, Coinbase is broadening its involvement in the market for Wrapped Bitcoin by introducing its own alternative, known as Coinbase Wrapped Bitcoin (or cbBTC).

The action adds an extra layer of complexity to the partnership between Coinbase and Justin Sun’s custodial partner for WBTC, as he entered the scene through a business alliance between BitGo and his corporations. In August, it was revealed that BitGo had formed a strategic partnership with BiTGlobal, a Hong Kong-based trust company associated with Sun.

Due to Sun’s participation in WBTC, various alternative tokens have emerged. Among these alternatives are cBTC and kBTC, which was launched by crypto exchange Kraken. In response to the rising competition, Sun criticized Coinbase for not yet finalizing a proof-of-reserves process for cbBTC.

#Cryptobanking Token (CBBT) doesn’t provide Proof of Reserves, isn’t audited, and holds the power to freeze any user’s balance at their discretion. In essence, it relies solely on trust, much like dealing with a central bank. Any U.S. government subpoena could potentially seize all your Bitcoin stored in CBTT. This scenario encapsulates the essence of centrally controlled Bitcoin more than any other. It’s a disheartening day for Bitcoin advocates.

— H.E. Justin Sun 🍌 (@justinsuntron) September 12, 2024

2019 saw the debut of WBTC, a mechanism that facilitates the movement of Bitcoin’s liquidity into decentralized financial environments by converting Bitcoin (BTC) into tokens. Each token is equivalent in value to one Bitcoin and its current market capitalization hovers around $14 billion.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Gold Rate Forecast

- EUR CNY PREDICTION

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- EUR NZD PREDICTION

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- Grimguard Tactics tier list – Ranking the main classes

2024-11-25 13:28