As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull runs and bear markets. The current rally of Ripple (XRP) is undeniably impressive, with its four-week streak pushing the price to levels not seen since May 2021. However, my cautious side is sounding an alarm.

The cost of Ripple is surging significantly due to a robust upward trend driven by optimistic market sentiment and encouraging advancements within its ecosystem.

For the past four weeks in a row, Ripple’s XRP token has increased to reach $1.70, which is its highest point since May 2021. This month alone, the token has skyrocketed by more than 240%, elevating its market value to over $96 billion.

The surge in XRP’s value can be attributed to robust foundations, such as notable legal triumphs and advantageous political circumstances. For instance, Ripple emerged victorious in a significant lawsuit against the SEC in July of last year, with a court subsequently ordering the company to pay $250 million. This amount is significantly less than the $2 billion initially demanded by the SEC.

There’s a possibility that the SEC might challenge their decision, but there’s increasing hope that the new SEC Chairman, who may be Paul Atkins (a former commissioner known for his supportive stance on cryptocurrency), won’t take additional action in this matter. Reports indicate that President-elect Donald Trump is contemplating Atkins for the position of SEC Chair.

Investors are equally optimistic about forthcoming events that could drive growth. These significant factors might be:

Moreover, Ripple is working on creating a digital currency named RLUSD that holds equal value with the U.S. dollar. It’s anticipated that this project may substantially increase the system’s income.

XRP price is getting overbought

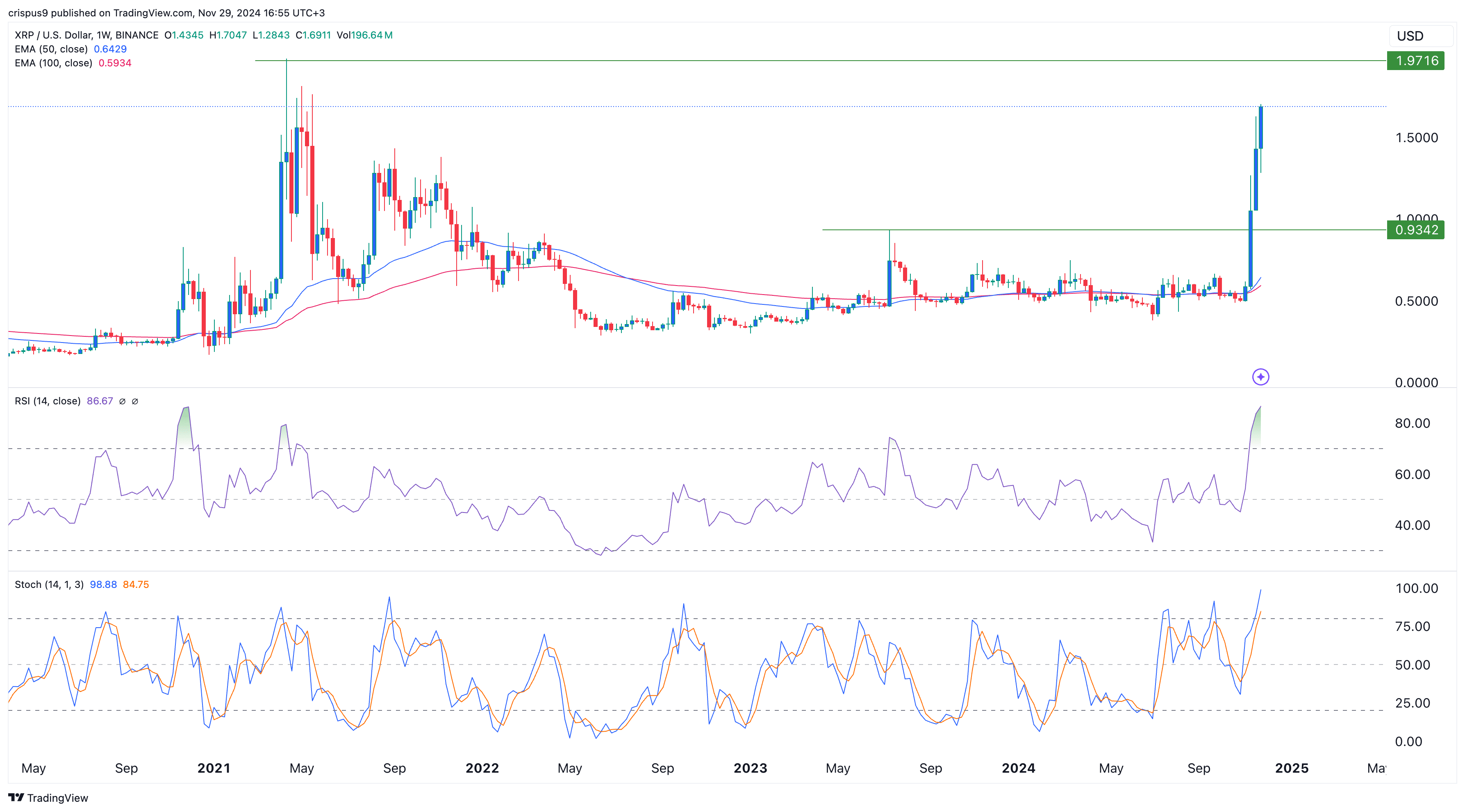

Over the past few weeks, I’ve noticed a robust upward trajectory for Ripple on my weekly chart. Not long ago, its token burst through a significant barrier at $0.9340, reaching heights not seen since July 2023. It didn’t stop there; it even surpassed the symbolic $1 mark and both the 50-week and 100-week moving averages, signaling a promising outlook for this digital currency.

It appears that the technical indicators are giving a warning signal. Specifically, the Relative Strength Index and Stochastic Oscillator have climbed into an area suggesting they may be overbought. This could mean that a temporary pullback might occur within the next few days.

The next potential target for the XRP price is $1.9716, its April 2021 high, followed by $2. In the long term, as Bitcoin (BTC) has done, Ripple could jump to a record high of $3.5, which is about 110% above the current level.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-11-29 18:03