As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless bull runs and corrections. The current rally of XRP, along with other leading cryptocurrencies, is reminiscent of the 2017-2018 bull run, albeit on a smaller scale thus far.

On November 29th, XRPLedger’s built-in token, XRP, experienced a 12% increase, maintaining its position above $1.7300. This surge coincided with Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and other major cryptocurrencies, as they all rallied together.

Table of Contents

XRP on-chain indicators signal price growth

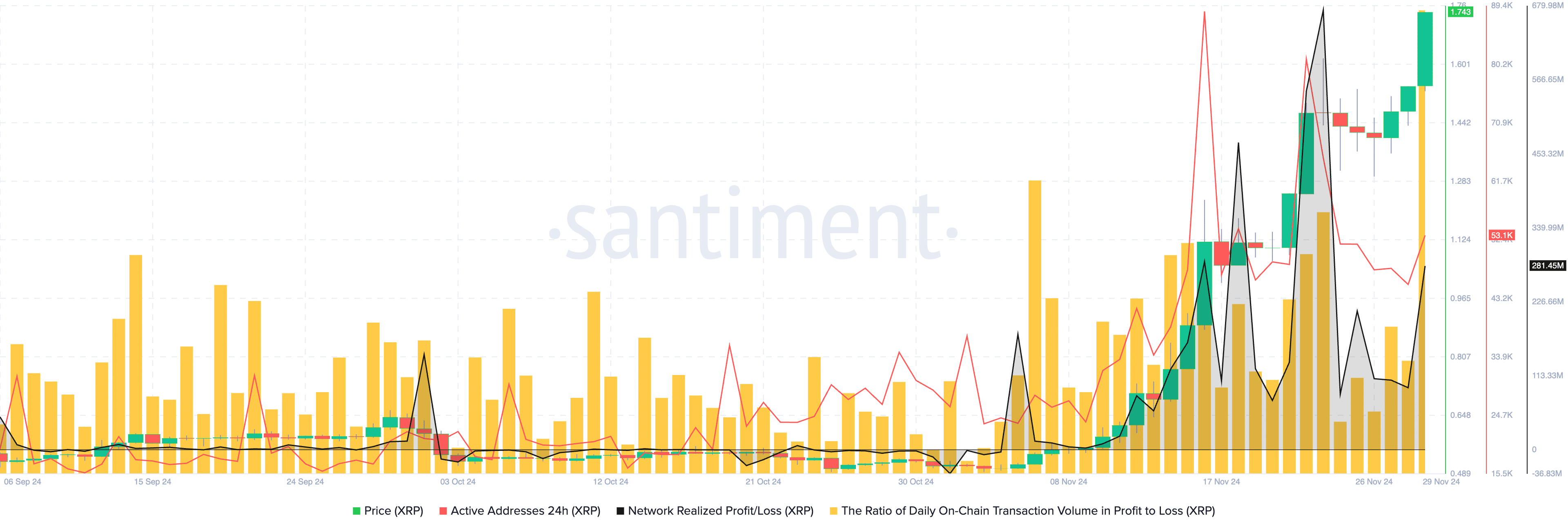

As an analyst, I observed a surge in on-chain activity related to XRP trading between November 16th and 29th. Notably, Santiment’s data showed several peaks in the active addresses metric, which suggest heightened engagement within the network. These peaks correlate with a rise in transaction volume across various exchange platforms, further indicating an increase in trading activity.

On November 4, it was observed that XRP traders have consistently made a profit according to the daily net profit/loss metric used by the network, as positive fluctuations above the neutral line suggest profitable transactions.

Generally speaking, significant increases (spikes) in XRP’s price often indicate increased selling activity. Traders should keep a close eye on this indicator for possible changes in the trend direction.

As a researcher examining the data, I can share that the daily on-chain transaction volume ratio between profitable and loss-making trades stands at approximately 6.73. This indicates that more transactions associated with profit are taking place as XRP’s price surges.

Based on the data recorded on the blockchain, there’s strong evidence pointing towards an optimistic outlook for XRP’s price, when considering both technological and additional factors.

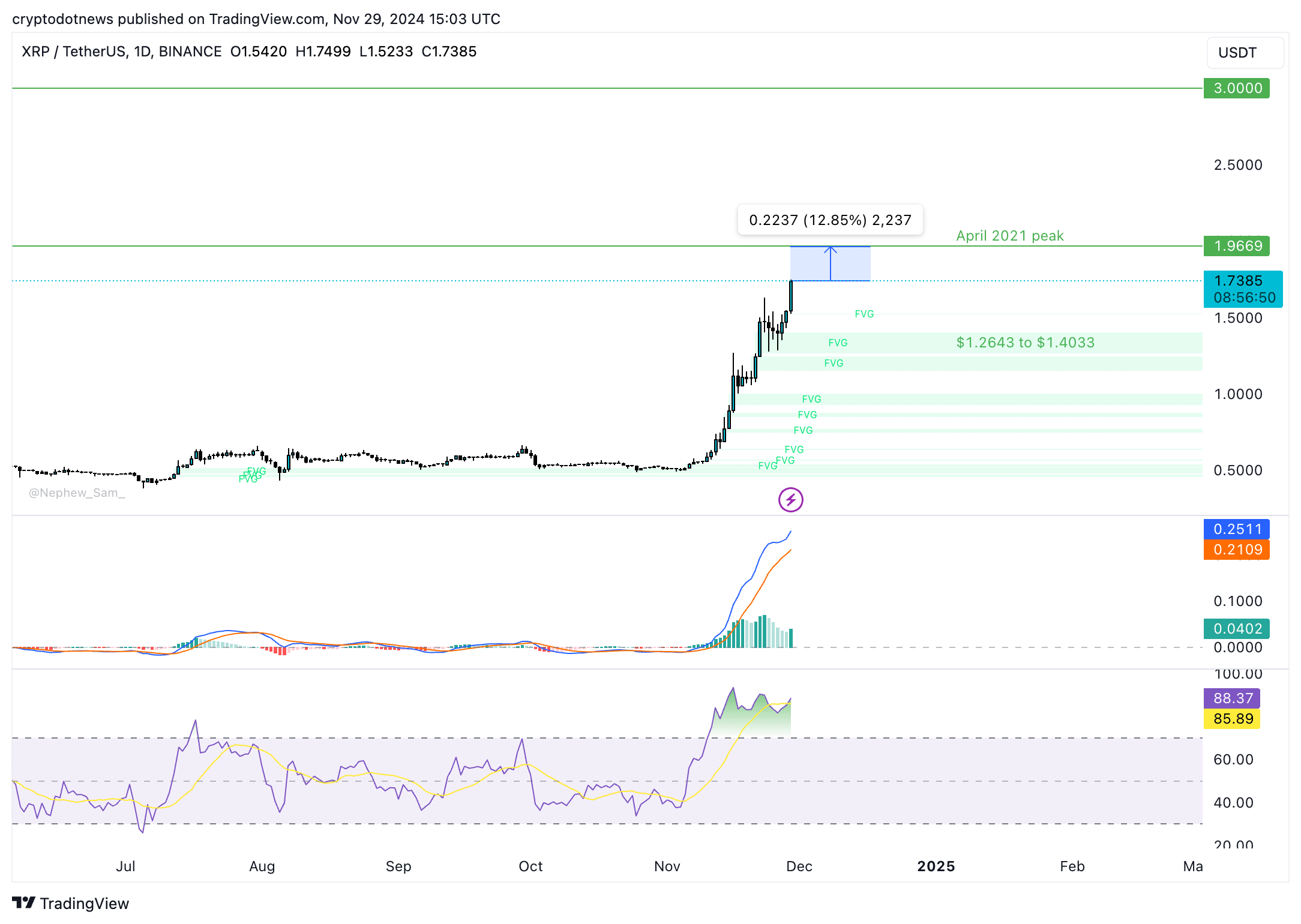

XRP eyes retest of April 2021 peak

The technical analysis suggests that there’s a high probability of further price growth towards $1.9669, which was the peak in April 2021 for this altcoin. This represents a potential increase of 12.85% from its current value. If the price manages to surpass this level, traders could potentially recover losses they’ve experienced over the past three years.

In simpler terms, the Relative Strength Index (RSI) shows that XRP’s value currently stands at 88, suggesting it might be overvalued. This often triggers a ‘sell’ signal and could potentially predict a future adjustment in XRP prices. However, the Moving Average Convergence Divergence (MACD) indicator hints that there may still be more price increases ahead.

Green histogram bars above the neutral line support a thesis of XRP price rally.

The $3 target is a psychologically important level for XRP; in January 2018, the altcoin hit a record high at $3. The altcoin has yet to revisit the level in the past six years.

XRP could find support between $1.2643 and $1.4033 in the imbalance zone. A correction could send the altcoin to this support zone before further correction. Once the fair value gap is filled, XRP could resume its climb toward the April 2021 peak of $1.9669.

XRP derivatives traders turn bullish

Data from Coinglass indicates that traders dealing with XRP derivatives, specifically on Binance and OKX, exhibit a positive sentiment towards the altcoin. It’s possible we could see a surge in the open market as the ratio of these traders’ long positions to short positions exceeds 1 across major trading platforms, suggesting a bullish trend.

On November 29th, the total amount of outstanding contracts for XRP futures reached an impressive $2.41 billion. An increase in open interest indicates that the XRP token is becoming more significant within the market and demonstrates a growing interest from traders.

Strategic considerations

Based on data from Macroaxis.com, there’s a strong connection between XRP and Bitcoin over a three-month period, with a correlation coefficient of 0.82. This suggests that substantial fluctuations in Bitcoin’s price might influence XRP’s value as well.

After hitting a low of around $90,700 on Tuesday, Bitcoin has begun its bounce back. However, if Bitcoin experiences a significant drop in value over the next few weeks, it might cause harm to the future trend of XRP prices.

The developments impacting XRP’s market include the ongoing lawsuit by the U.S. Securities and Exchange Commission against Ripple, as well as advancements in cryptocurrency regulations across various U.S. states.

Read More

- Fortress Saga tier list – Ranking every hero

- Cookie Run Kingdom Town Square Vault password

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

- Castle Duels tier list – Best Legendary and Epic cards

- Cookie Run Kingdom: Shadow Milk Cookie Toppings and Beascuits guide

2024-11-30 15:16