As a researcher with a keen interest and over two years of immersion in the dynamic world of blockchain and non-fungible tokens (NFTs), I find myself both excited and intrigued by the recent surge in NFT trading volume. The 22% increase in November, as reported by DappRadar, is a clear indication that the market is bouncing back, fueled by increased engagement with blue-chip collections like those from Yuga Labs.

As a researcher, I’ve noticed an encouraging resurgence in the NFT market over the past few months. The trading volume has spiked by a substantial 22%, as observed in November, which is undeniably promising. This surge can be attributed to heightened prices and frenzied activity within the prestigious blue-chip collections.

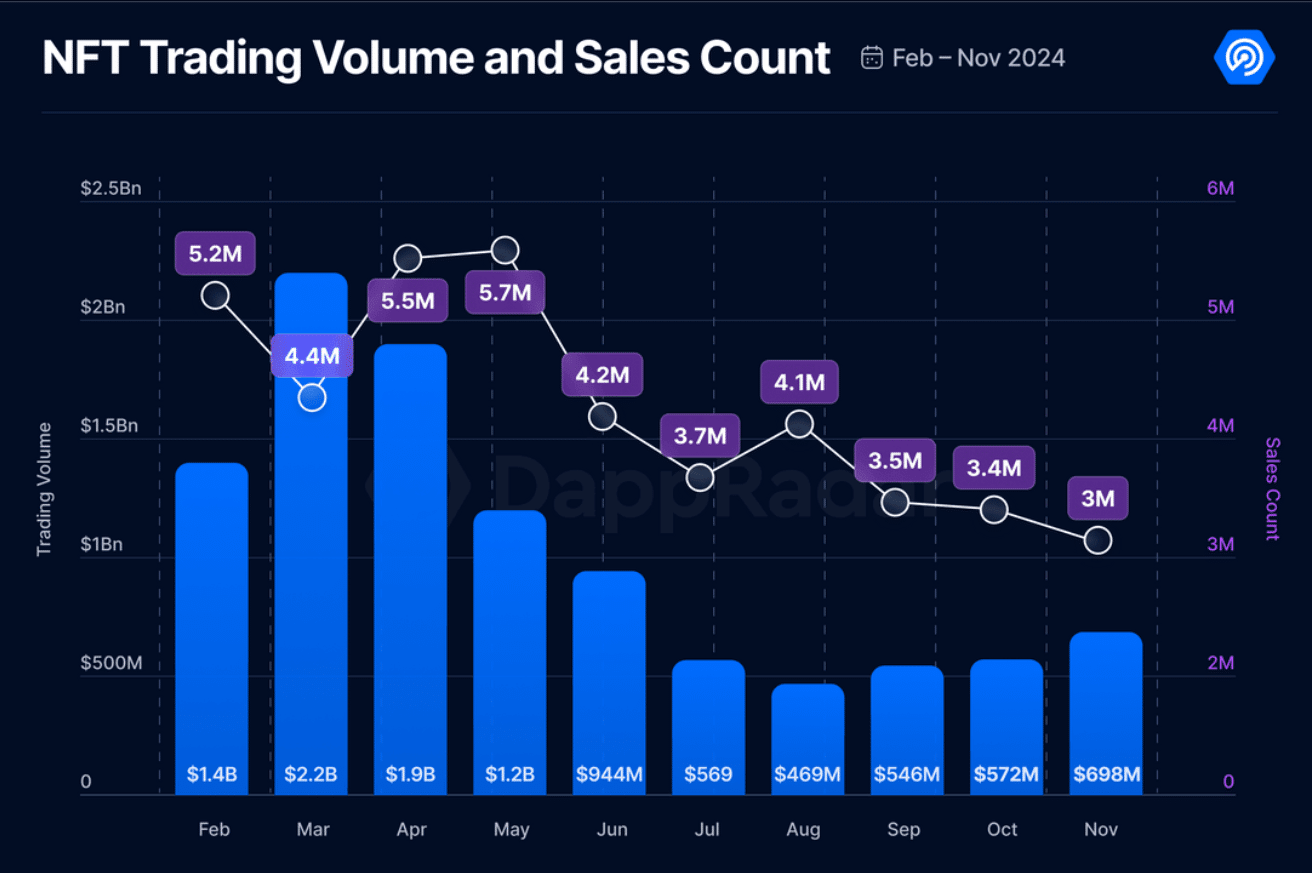

It appears that the market for non-fungible tokens is on an upward trend, as indicated by a significant jump of over 20% in trading activity during November, according to DappRadar’s report. The data reveals that NFT trading volume hit $698 million last month, representing a 22% rise from the previous month, October.

According to DappRadar’s analyst, Sara Gherghelas, the expansion is due to heightened user involvement in prestigious collections such as those by Yuga Labs, coupled with escalating token values, enhanced liquidity, and growing investor assurance.

Enhanced liquidity and heightened interaction with premium collection NFTs are boosting trust among collectors and financiers. Now, these individuals consider Non-Fungible Tokens (NFTs) not just as investment opportunities but also as valuable pieces of culture.

Sara Gherghelas

Despite the growth in trading volume, sales volume declined by 11% to 3 million units, which might be signaling a shift toward more valuable transactions.

The recovery also comes amid broader market trends. As reported by NFTevening, November also saw a rise in the overall NFT market value, which grew to $8.8 billion. At the same time, daily trading volume across all chains rose by almost 50%.

It appears that high-value NFT collections such as CryptoPunks and Bored Ape Yacht Club played a significant role in the market’s recovery. Notably, trading volume for CryptoPunks soared by 392%, while BAYC experienced robust demand, with its weekly floor price surging by 75.79% to reach $79,727.

According to Gherghelas, Ethereum (ETH) continues to dominate in trading activity, while Polygon (POL) claims the title for the highest number of Non-Fungible Token (NFT) sales. Moreover, he notes that the emergence of platforms like Blur, which recently outpaced OpenSea in trading volume, underscores the fast-paced development and transformation within the NFT marketplace sector.

Read More

2024-12-06 12:17