As a seasoned crypto investor with over a decade of experience navigating the volatile and ever-changing landscape of digital currencies, I can’t help but feel a mix of amusement and frustration when it comes to the latest Cardano fiasco. The false SEC lawsuit against ADA was yet another example of how easily misinformation can spread in this fast-paced industry.

On Sunday, it was erroneously announced that the trading of Cardano (ADA) would be suspended across all platforms starting from Monday, Dec. 9. However, this information turned out to be incorrect.

It appears that the Cardano Foundation’s account was compromised, as stated by Cardano CEO Charles Hoskinson in a recent post. He encouraged the hackers to put more effort into their attempts.

Looks like the CF account got hacked. Try harder hackers

— Charles Hoskinson (@IOHK_Charles) December 8, 2024

After the Cardano Foundation’s X account shared an enigmatic post, suggesting they would no longer provide assistance for the digital currency, ADA, Charles Hoskinson later commented on this sudden decision.

The false claim states that the organization faced an “unforeseen lawsuit” initiated by the United States Securities and Exchange Commission (SEC).

It appears the foundation announced that they will stop all assistance for the ADA token right away, in order to adhere to regulatory standards,” suggests the hacker’s statement.

Notice from Cardano Foundation:

— Cardano Foundation (@Cardano_CF) December 8, 2024

All ADA tokens will “consequently be burned,” community members were wrongfully told.

Background on Cardano and Its CEO

Hoskinson founded Cardano in 2017 and became a prominent figure in the crypto industry.

This platform functions using a consensus mechanism called Proof-of-Stake, which is recognized for prioritizing scalability, durability, and safety. Notably, Cardano is often referred to as a “third-generation” blockchain, designed to tackle the shortcomings of previous networks such as Bitcoin and Ethereum.

It appeared as if the foundation had stopped supporting ADA, which might indicate a focus on complying with regulations, possibly with the aim of avoiding future fines.

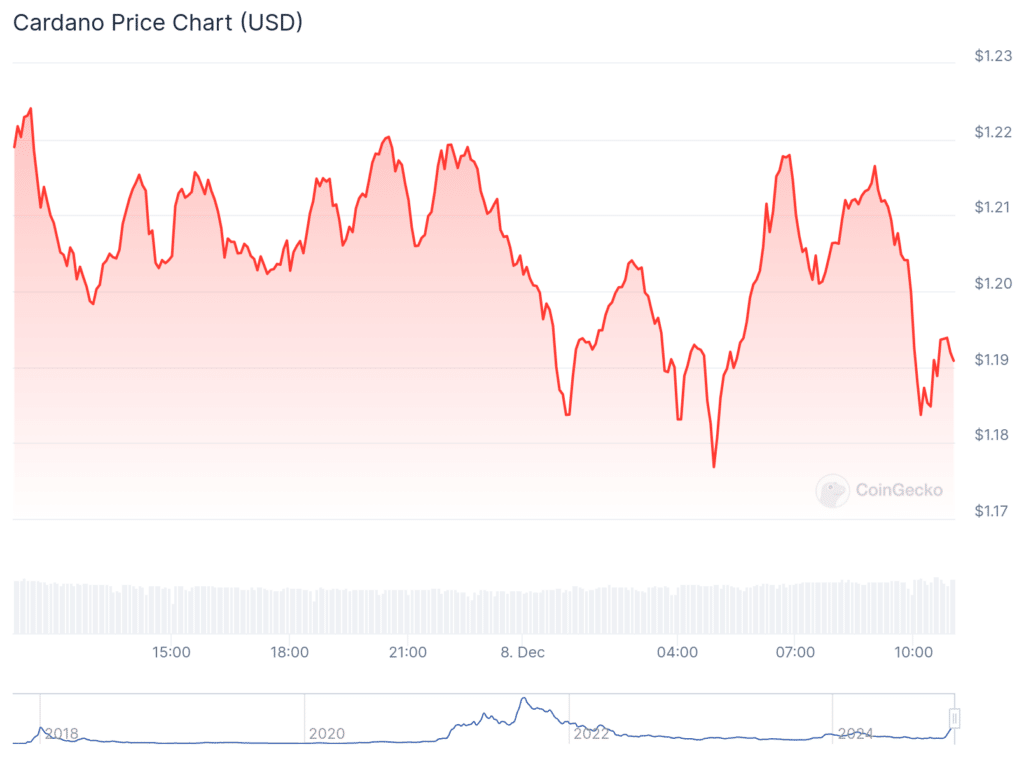

Cardano price chart

A fake lawsuit by the Securities and Exchange Commission (SEC) hit Cardano just as its token’s price was struggling. This news added to the frustration of those deceived investors who view it as another legal setback for the crypto industry, which faced increased regulatory attention throughout 2024.

It was quite obvious that the lawsuit wasn’t genuine because the crucial accusations hadn’t been revealed yet.

At first sight, the bogus lawsuit appeared authentic given that numerous comparable lawsuits have been filed against other blockchain initiatives and cryptocurrency businesses.

- CryptoFX ($300 million Ponzi scheme): Seventeen individuals were charged for their roles in a fraudulent scheme targeting the Latino community. The scheme falsely promised high returns from crypto and forex investments but instead diverted funds to pay earlier investors and enrich organizers.

- Maverick Protocol: The SEC alleged that this decentralized finance (DeFi) platform offered unregistered securities. The charges highlighted the ongoing scrutiny of DeFi projects that may bypass traditional regulatory frameworks.

- Gemini Earn Program: The SEC sued Gemini for its Earn program, claiming the product was an unregistered securities offering. The case emphasized investor protections for crypto-lending products

Furthermore, the Securities and Exchange Commission (SEC) has previously reviewed Cardano. In 2023, the SEC incorporated ADA into its lawsuits against Binance and Kraken, asserting that the token was being used as an unregistered security under U.S. securities legislation.

Placing ADA under the Securities and Exchange Commission’s (SEC) regulatory jurisdiction means that ADA may be obligated to comply with broker-dealer regulations and securities registration requirements, assuming this classification is confirmed by the courts.

Currently, ADA maintains its position as one of the leading cryptocurrencies in terms of market value. Its current market capitalization surpasses 42.7 billion dollars.

X security to blame?

Following Elon Musk’s takeover of what was previously known as Twitter, there has been a rising apprehension regarding potential escalations in security vulnerabilities.

High-profile incidents include the compromise of the SEC’s official X account earlier this year.

Concerns have been voiced about the platform’s capacity to safeguard user data and ensure account safety, with some pointing the finger at Elon Musk’s substantial reductions in staff, particularly in the area of information security.

Under Musk’s management, the platform has continued to grapple with security issues, leading some critics to express concern that these vulnerabilities may damage the platform’s reputation in the long run. This is particularly relevant given that the platform serves government entities, businesses, and prominent individuals, potentially raising questions about its reliability.

These worries are further intensified by Elon Musk’s past legal issues, such as a lawsuit from the SEC regarding his impact on Dogecoin‘s price fluctuations, contributing to the platform’s volatility.

Read More

- Hero Tale best builds – One for melee, one for ranged characters

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Gold Rate Forecast

- 9 Most Underrated Jeff Goldblum Movies

- Castle Duels tier list – Best Legendary and Epic cards

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Stellar Blade Steam Deck Impressions – Recommended Settings, PC Port Features, & ROG Ally Performance

- Mini Heroes Magic Throne tier list

- USD CNY PREDICTION

- Can the Switch 2 Use a Switch 1 Charger?

2024-12-08 19:30