As a seasoned crypto investor who has weathered numerous market storms, I find myself once again navigating choppy waters with the recent downturn of Stellar Lumens (XLM). The sea of red that has enveloped the crypto industry is reminiscent of a stormy night at sea, where even the most sturdy ships can be tossed about.

The price of Stellar experienced a significant downturn when its previous positive trend weakened, leaving a wave of crimson across the cryptocurrency market.

As a cryptocurrency investor, I’ve witnessed the Stellar Lumens (XLM) plunge to an all-time low of $0.3570 since November 23, marking a 45% drop from its peak this year.

The drop in value that we’re witnessing is a continuation of the downward trend affecting the cryptocurrency market as a whole. Notably, Bitcoin (BTC) has dipped to around $97,700, which is much lower than its peak last week at approximately $104,000.

Simultaneously with Stellar’s recession, Ripple (XRP) fell to a crucial support point of $2, marking a 25% decline from its peak. It is worth noting that Lumen (XLM) tends to have larger price fluctuations than XRP. To illustrate, in November alone, XLM soared by more than 500%, while XRP only increased by approximately 450%.

Although the market is experiencing a decline at present, there’s a possibility that certain positive factors could boost Stellar’s price in the future. One of these factors includes growing speculation that the Trump administration might adopt a more supportive stance towards cryptocurrencies.

This week, Eric Trump stated that his father aims to establish the United States as the global leader in cryptocurrency. He has also put forward Paul Atkins, a respected regulatory figure, for consideration as the next Chair of the Securities and Exchange Commission.

Moving on, there’s a growing sense of expectation that an XLM ETF might become available by 2025, potentially drawing substantial investments from large institutional players. Furthermore, it’s observed that more programmers are choosing to work with the Stellar blockchain, leading to a surge in the value locked within its decentralized finance system to around $46 million. At present, the market cap of Stellar’s stablecoins exceeds $146 million.

Stellar price analysis

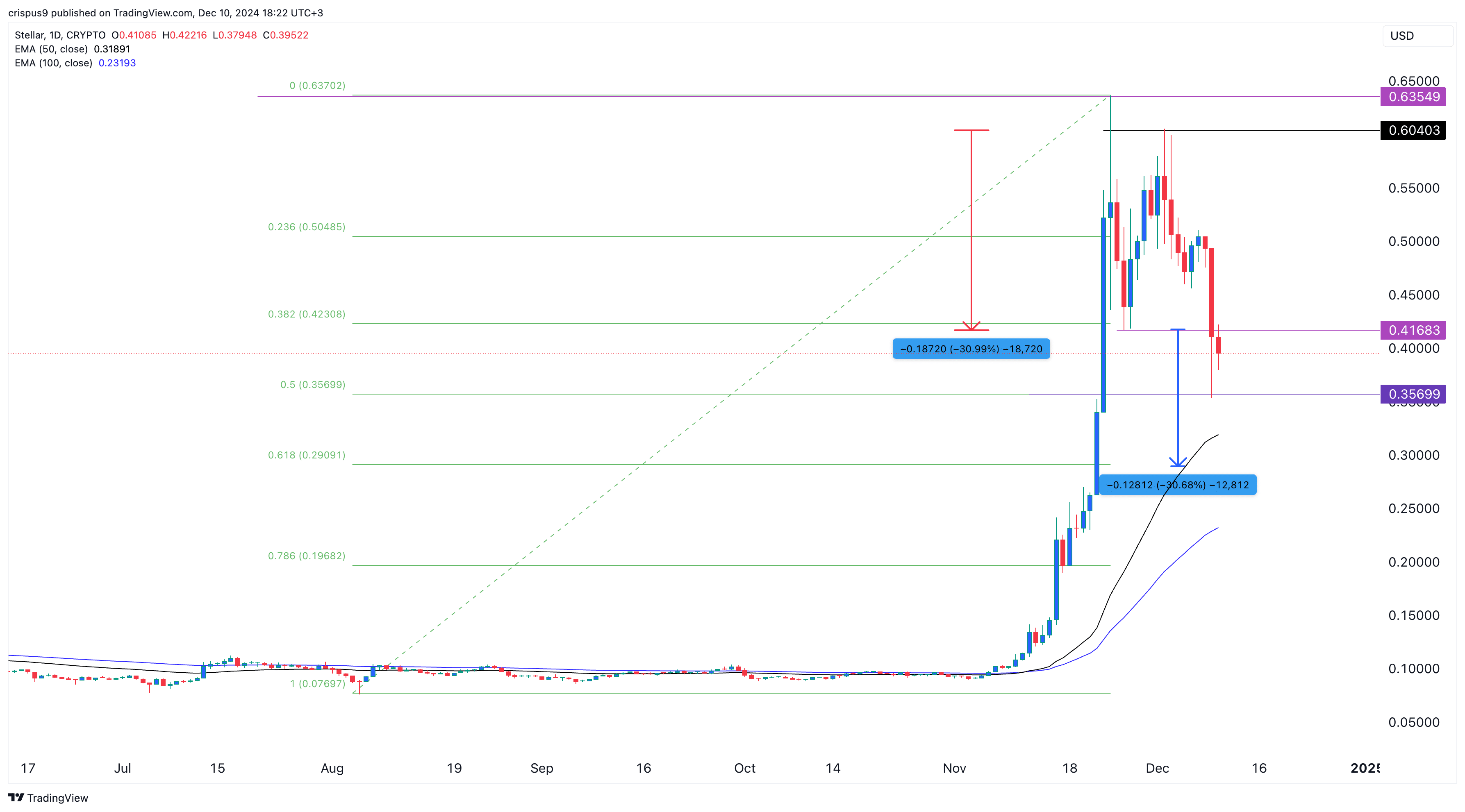

Based on the day’s analysis, it appears that the XLM price has experienced a significant downturn, consistent with our earlier forecasts. This decline came after the development of a nearly double top formation at $0.6040, a pattern often associated with bearish market tendencies.

Stellar’s price has fallen below the neckline at $0.4168 and the 38.2% Fibonacci retracement level.

This drop can be partly explained by the coin moving into the ‘markdown’ stage of the Wyckoff Method, a theory that categorizes assets into four stages. During this ‘markdown’ phase, demand typically falls short of supply.

Should this pattern persist, a key level to keep an eye on could be around $0.2900. This level is significant because it represents approximately a 61.8% Fibonacci retracement and also lines up with our double-top measurement.

Looking ahead, it’s possible that the price of Stellar could eventually recover and potentially hit the $1 mark. This prediction would hold true if it manages to surpass its current year-to-date peak at approximately $0.6355.

Read More

- Castle Duels tier list – Best Legendary and Epic cards

- CRK Boss Rush guide – Best cookies for each stage of the event

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Kingdom Come: Deliverance 2 Patch 1.3 Is Causing Flickering Issues

- Grimguard Tactics tier list – Ranking the main classes

- Athena: Blood Twins is an upcoming MMORPG from Efun, pre-registration now open

- Fortress Saga tier list – Ranking every hero

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Outerplane tier list and reroll guide

2024-12-10 18:52