As a seasoned researcher with over a decade of experience in the dynamic world of finance and technology, I have witnessed firsthand the evolution of digital assets from a niche interest to a mainstream investment class. The surge in trading volumes across centralized exchanges, as seen in November, is not just a blip on the radar but a clear indication of the growing maturity and acceptance of cryptocurrencies.

The trading volume of cryptocurrencies on platforms such as Binance, Kraken, and Coinbase significantly increased by more than double during the month of November.

After Donald Trump’s second term began, there was a notable rise in the number of trades for cryptocurrency spots and derivatives across various digital asset exchanges. Last month, Upbit from South Korea took the lead with an impressive 386% jump in crypto spot trading activity. BitMart and Bitfinex also experienced considerable growth, posting increases of 242% and 218%, respectively.

In the month of November, Binance’s trading volume surged by an impressive 131%, nearing the $1 trillion mark. Meanwhile, Coinbase nearly trebled its spot trading statistics, registering a significant jump of 189% in user activity. Moreover, a surge in retail interest was suggested by the rise in website traffic, with Crypto.com, Coinbase, and Upbit all experiencing traffic influxes exceeding 82%.

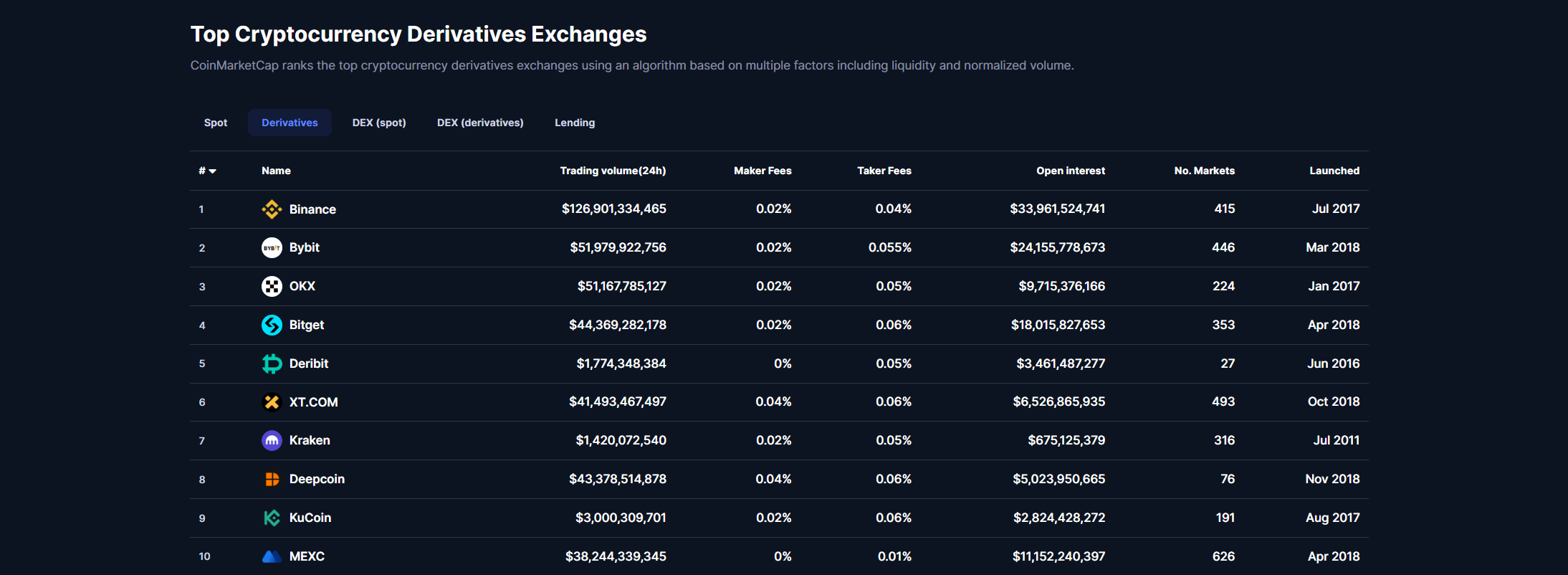

In November, there was an influx of investment from experts and market speculators into derivative contracts compared to October. These derivatives, financial instruments that mimic the value of other assets, experienced a tripling in the volume of perpetual contract trading on platforms such as MEXC, Kraken, and Deribit – one of the top five derivative exchanges ranked by CoinMarketCap.

The surge in crypto spot trading, the rise in volume for digital asset derivatives, and the increase in traffic on exchange websites clearly indicate a strong bullish trend that emerged following the U.S. elections. This renewed interest in cryptocurrency trading resulted in significant investments flowing into major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Ripple (XRP), and Binance Coin (BNB).

Stablecoin circulating supply crossed $200 billion, grown by demand for fiat-pegged tokens issued by firms like Tether (USDT) and Circle (USDC).

For the first time last month, the combined value of the crypto market surpassed $3.2 trillion. This milestone was reached as Bitcoin joined the six-figure club and outperformed traditional assets such as Silver. The surge in crypto markets remained unabated even after Bitcoin achieved a fresh record high in early December, sparking profit-taking. By month’s end, the overall digital asset market stood firm at approximately $3.6 trillion, reflecting widespread cryptocurrency gains.

Read More

- Gold Rate Forecast

- USD CNY PREDICTION

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Pi Network (PI) Price Prediction for 2025

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Roblox: Project Egoist codes (June 2025)

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Run! Goddess tier list – All the Valkyries including the SR ones

2024-12-11 17:58