As a seasoned financial analyst with over two decades of experience, I have witnessed the evolution of the global financial market from the dot-com boom to the 2008 recession and beyond. The surge in U.S. spot bitcoin ETFs is an unprecedented event that has caught my attention. With a career marked by observing bullish and bearish markets, I must admit, this streak of high inflows into Bitcoin ETFs is quite impressive.

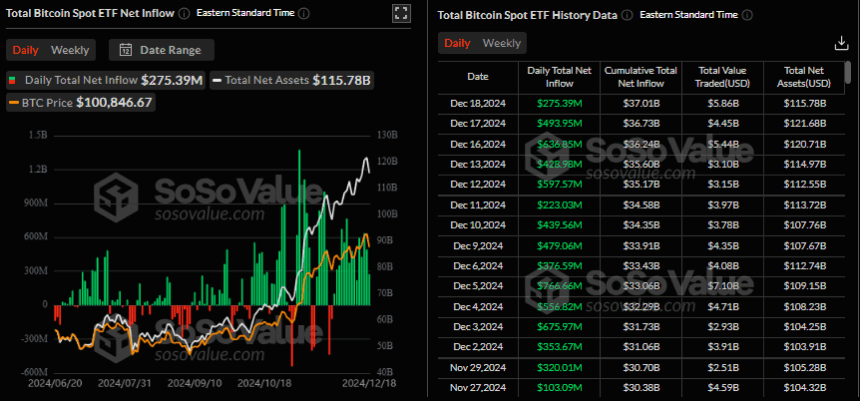

In a favorable development, U.S. spot bitcoin ETFs have seen an unprecedented surge for fifteen consecutive days, attracting inflows totaling over $6.7 billion as of November 27 – December 18. This impressive run has undoubtedly contributed to Bitcoin’s price reaching new heights.

Over this period, a new high of $766.66 million in inflows was observed on December 5, primarily through Bitcoin Exchange-Traded Funds (ETFs).

As a researcher, I observed an unprecedented spike in interest that mirrored Bitcoin’s historic leap beyond the $100,000 threshold for the first time. This significant milestone not only fueled increased trading activity but also propelled the total assets under management in Bitcoin ETFs to a staggering $115.78 billion, marking a substantial increase from its previous figure of $104.32 billion.

The surge in Bitcoin’s value, largely driven by factors like escalating global political conflicts and potential victory of former President Donald Trump in the 2024 US elections, has played a significant role in the expansion of Bitcoin Exchange-Traded Funds (ETFs).

In January 2024, the introduction of Bitcoin ETFs helped draw traditional investors towards the cryptocurrency market.

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Gold Rate Forecast

- EUR CNY PREDICTION

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- EUR NZD PREDICTION

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- Grimguard Tactics tier list – Ranking the main classes

2024-12-19 10:12