As a seasoned analyst with years of experience in the cryptocurrency market, I have seen my fair share of bull runs and bear markets. The current situation with Cardano (ADA) is particularly intriguing, given the warning from legendary trader Peter Brandt. His technical analysis, based on the Head and Shoulders pattern, suggests a potential crash to $0.629, which is a significant drop from the current price.

As an analyst, I’ve observed a significant drop in the value of Cardano, with a fall of approximately 20% from its peak this year. One renowned trader predicts that there might be further declines yet to come.

In simpler terms, the value of Cardano (ADA), a widely recognized layer-1 cryptocurrency, has dropped to approximately $0.90, significantly lower than its highest point this year at $1.326.

According to well-known trader Peter Brandt, known for his extensive writings on technical analysis, there’s a possibility that the value of the coin could potentially drop over the short term.

He indicated the Head and Shoulders chart structure on both the daily and four-hour charts that Cardano has developed. This Head and Shoulders configuration consists of two shoulders at approximately $1.153, with a head at around $1.327. Additionally, there’s a neckline drawn at $0.914.

CAR_dano $ADA

Looks like a potential

CAR_crash— Peter Brandt (@PeterLBrandt) December 19, 2024

Typically, when an Head and Shoulders (H&S) pattern forms and breaks down, it often signals a significant drop in price. The projected decline from this breakdown tends to be equivalent to the distance between the head of the H&S and its neckline. If the H&S pattern on Cardano’s chart is correct, then it suggests that the Cardano price could plummet to approximately $0.629, which represents a decrease of around 32% from its current level and falls just shy of the 61.8% Fibonacci Retracement level.

Cardano has weak fundamentals

Independent analysis indicates that Cardano’s core attributes appear less robust compared to other tier-1 platforms such as Solana and Ethereum, potentially accounting for its slower progress.

According to data from DeFi Llama, the total value locked in Cardano’s DeFi sector has dropped significantly over time. In November, it was above $700 million, but currently, it stands at around $478 million. This decrease is also reflected in ADA terms, as the Total Value Locked (TVL) has fallen from its year-to-date high of 670 million ADA to approximately 494 million ADA now.

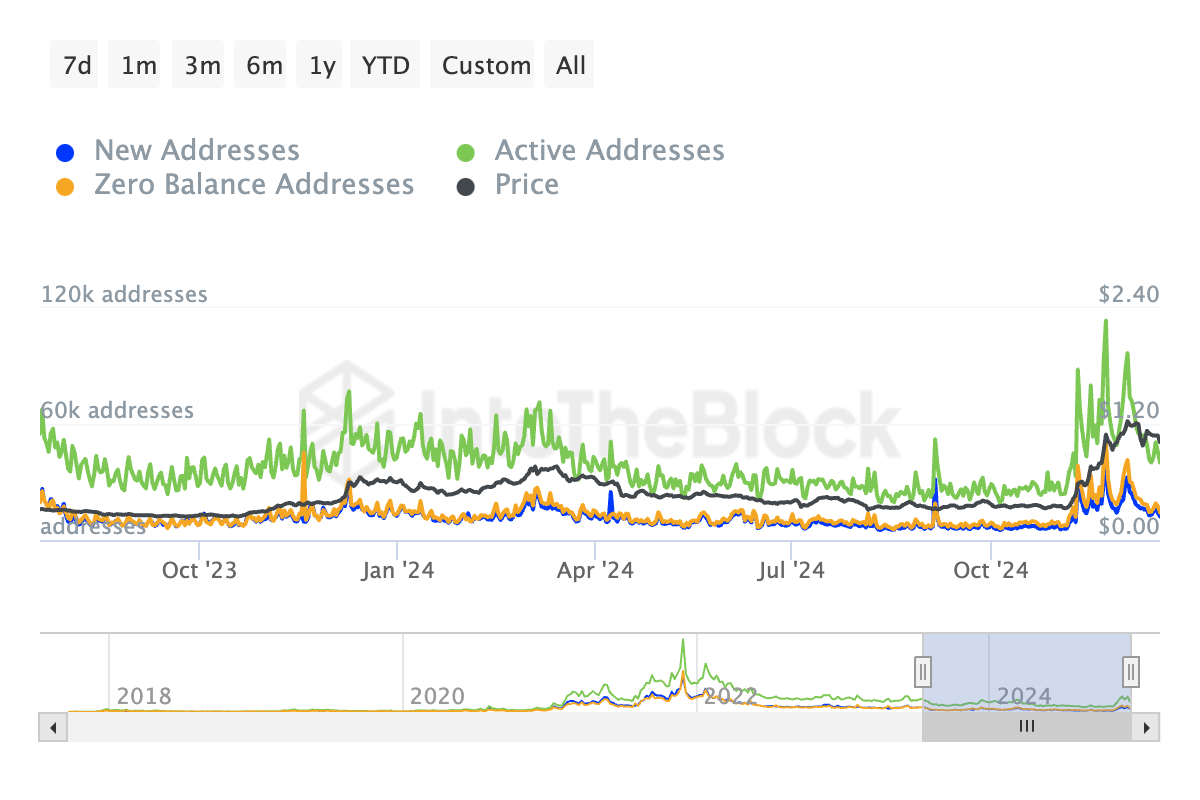

Currently, data from IntoTheBlock indicates a decline in the number of active Cardano addresses following a peak in November. In November 2023, there were nearly 210,000 daily active Cardano addresses, a figure that has now dropped to approximately 66,500.

Cardano’s futures open interest has also been in a downward trend, a sign that its demand in the futures market is falling. Its interest fell to $775 million on Thursday, down from the year-to-date high of over $1.1 billion.

Futures open interest is an important metric that looks at the volume of unfilled put and call options orders in the futures market. The figure often rises when there is substantial demand for a coin.

Read More

2024-12-19 21:58