As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed countless market fluctuations and learned to read between the lines. The recent downturn in the cryptocurrency market, triggered by Bitcoin‘s drop below $100,000, is not an unusual event but rather a reminder of the volatile nature of this burgeoning asset class.

On December 20th, the crypto market experienced a decline as key factors contributed to this trend. These included Bitcoin falling beneath $100,000, a general decrease in market value across all coins, and an outflow of funding from positions.

After the U.S. Federal Reserve declared they would decrease the pace of rate reductions due to rising inflation worries, the prices of cryptocurrencies adjusted swiftly. Following a 0.25% interest rate decrease, Bitcoin (BTC) dipped below $97,000, pulling down the entire digital currency market as reported by crypto.news price tracking pages.

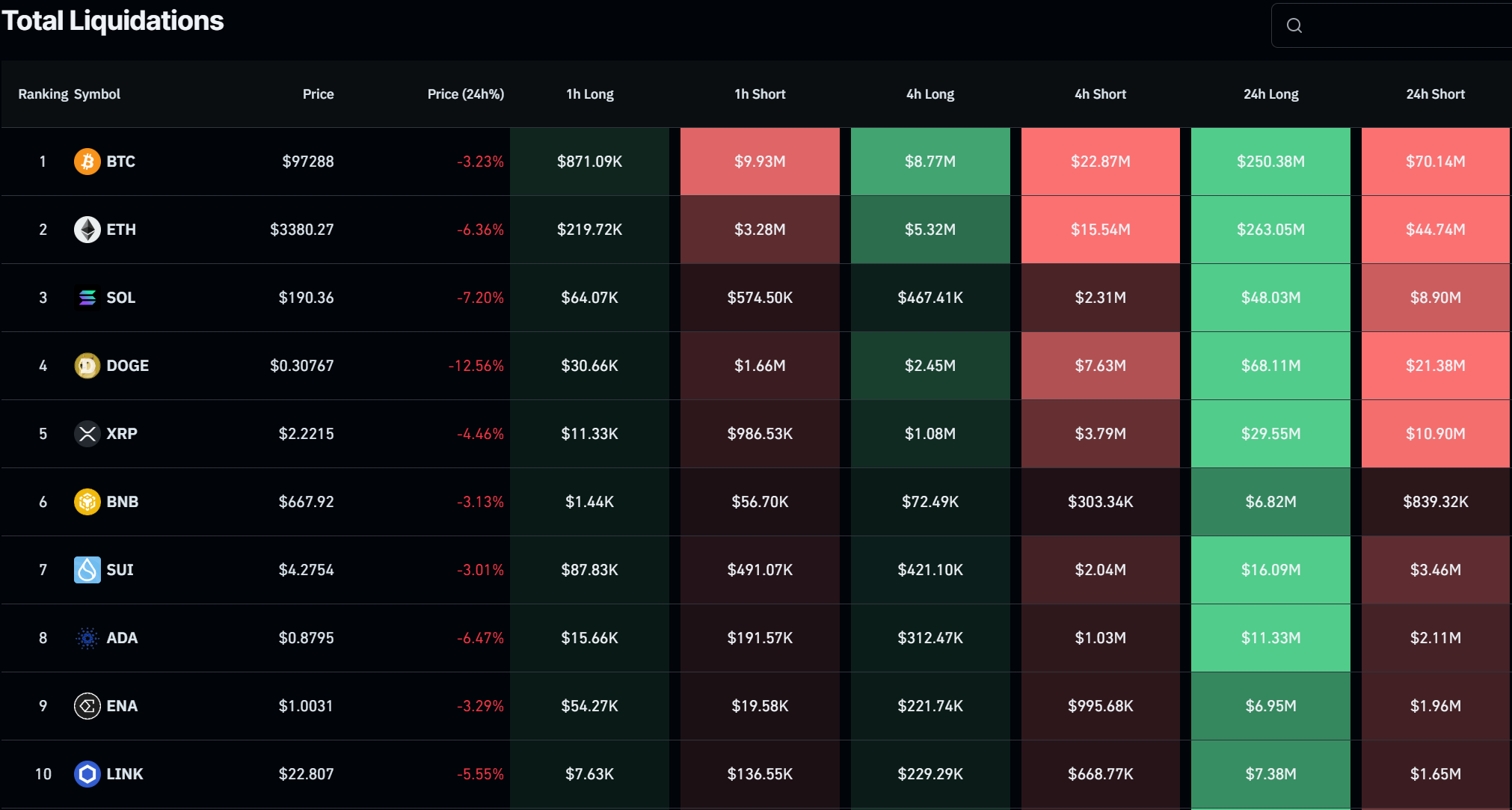

Based on CoinGlass data, a sudden drop in Bitcoin’s value led to a massive liquidation event worth approximately $1.4 billion, which happened over the span of 24 hours. This event primarily affected leveraged long positions. The biggest single liquidated trade was a $15.8 million Ethereum (ETH) position on Binance, but the trader’s details and their initial investment remain undisclosed.

Refreshes or resets the open interest and funding rates at leading trading platforms such as CME, Binance, and Bybit, ensuring they start afresh.

Over the past week, popular alternative cryptocurrencies such as Solana (SOL) and Dogecoin (DOGE) experienced significant setbacks due to increased selling, erasing the gains they made during the “Trump win” rally and recording losses exceeding 10%.

Regardless of the criticism aimed at the Federal Reserve, it appears that many experts predict the market slump was unavoidable after the post-U.S. election stock surge. There’s growing advice for Bitcoin to stabilize within the $85,000 and $95,000 range as a more solid base of support.

According to QCP Capital, an overly optimistic mood within the market led to the recent correction. As of now, the overall crypto market value, which was nearly reaching $4 trillion for the first time, has dropped to around $3.4 trillion, marking a decrease of about 7.6% in just one day.

Instead of attributing the selloff solely to the Fed’s aggressive rate cut, we think the primary reason for this morning’s downturn is the overly optimistic stance of the market. Since the election, risky assets have experienced a remarkable unidirectional surge, making the market highly susceptible to any unexpected events.

QCP Capital

Read More

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Gold Rate Forecast

- EUR CNY PREDICTION

- EUR NZD PREDICTION

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Pop Mart’s CEO Is China’s 10th Richest Person Thanks to Labubu

- Why The Final Destination 4 Title Sequence Is Actually Brilliant Despite The Movie’s Flaws

- Hero Tale best builds – One for melee, one for ranged characters

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

2024-12-20 19:26