As a seasoned crypto investor with a decade of experience navigating the rollercoaster ride that is the cryptocurrency market, I have learned to expect the unexpected and remain calm during turbulent times like these. The recent 6% drop in Bitcoin‘s price is not unfamiliar territory for me, and I have seen similar scenarios play out numerous times before.

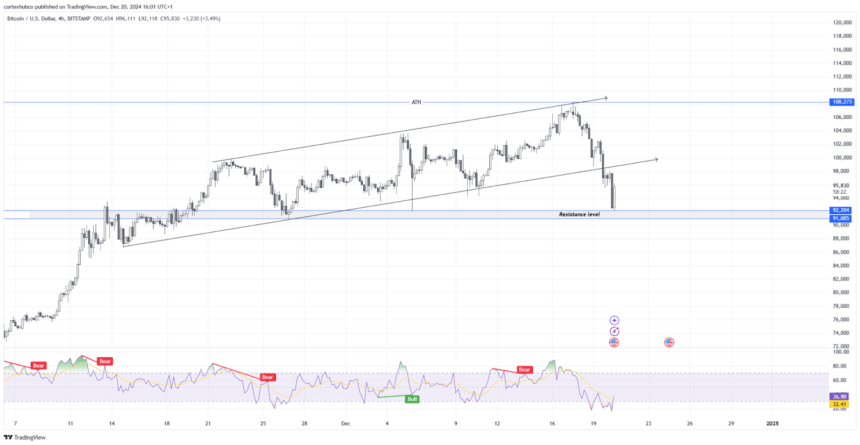

Currently, Bitcoin has dropped by more than 6% in trading, hovering slightly above the $95,000 mark. This sudden drop follows the Federal Reserve’s decision to lower interest rates by 0.25%.

In my analysis, Jerome Powell’s statement that the Federal Reserve won’t purchase or hold Bitcoin sparked a wave of apprehension among crypto investors, intensifying their existing concerns.

As an analyst, I’ve identified crucial support levels for Bitcoin around $91,000 to $92,000. Should there be additional declines, we might see prices sliding down to approximately $82,500. This downturn transpired during a period of elevated trading activity, resulting in over $1 billion in liquidated leveraged positions. The price drop follows the recent record high of $108,000 for Bitcoin.

Previously, the market showed strong performance as it was boosted by Mara Holdings’ acquisition of 15,757 Bitcoins and growing enthusiasm towards Bitcoin mining equipment. Furthermore, investors were buoyed by President Donald Trump’s election victory and his favorable stance on cryptocurrencies. However, the market’s resilience was tested unexpectedly by the Federal Reserve’s aggressive interest policy, causing a sudden decline in the market despite these positive indicators.

This statement bears a strong resemblance to Changpeng Zhao’s prediction made in 2020, when he tweeted on December 17th saying: “Anticipating the next headline: #Bitcoin ‘DROPS’ from $101,000 to $85,000. Save the tweet.

The drop in question served as proof supporting CZ’s forecast, sparking fresh discussions among experts regarding the volatile and uncertain behavior of the crypto market.

Simultaneously, this decline is causing debate among cryptocurrency enthusiasts, with some viewing it as a typical correction, while others see it as the beginning of a prolonged downtrend. According to a financial expert, “Reaching the $100,000 mark has proven challenging for Bitcoin.

Read More

- Kendrick Lamar Earned The Most No. 1 Hits on The Billboard Hot 100 in 2024

- Roblox: Project Egoist codes (June 2025)

- Hero Tale best builds – One for melee, one for ranged characters

- Run! Goddess tier list – All the Valkyries including the SR ones

- How Angel Studios Is Spreading the Gospel of “Faith-Friendly” Cinema

- Castle Duels tier list – Best Legendary and Epic cards

- Jerry Trainor Details How He Went “Nuclear” to Land Crazy Steve Role on ‘Drake & Josh’

- Comparing the Switch 2’s Battery Life to Other Handheld Consoles

- Brown Dust 2 celebrates second anniversary with live broadcast offering a peek at upcoming content

- Mini Heroes Magic Throne tier list

2024-12-20 19:49