As a seasoned researcher with over a decade of experience in the crypto market, I’ve seen my fair share of bull runs and corrections. This week has been particularly intriguing, with Hyperliquid, Bitget token, and Movement defying the market-wide downtrend amid Bitcoin‘s dip below $100,000.

This week, the values of Hyperliquid, Bitget token, and Movement increased by a range of 25% to 50%. These three tokens have furthered their growth over the past hour.

Despite Bitcoin (BTC) falling below the $100,000 mark and a broader correction in altcoins, tokens such as Hyperliquid (HYPE), Bitget token (BGB) and Movement (MOVE) are maintaining their recent price increases. A look at technical indicators suggests that these coins could potentially continue their upward trend.

Table of Contents

Bitcoin decline does not fade these altcoin gains

On Friday, Bitcoin dipped down to $92,232 following a significant drop from its previous milestone of $100,000. This decline in Bitcoin set off a broader market correction, affecting various altcoins in different categories over the course of Thursday and Friday.

Over the last seven days, despite the tumultuous crypto market conditions, I managed to observe that Hyperliquid, Bitget token, and Movement were resilient, retaining their positive growth trajectories.

Bitcoin’s decline is likely short-lived, and on-chain metrics paint a bullish picture for BTC.

It appears that Bitcoin (BTC) might be approaching the final phases of its bullish trend. Some on-chain signals suggest it could be cooling down or even slightly overheating, but most measures indicate a substantial increase in value by 2025. The price level of $100,000 has become an important barrier for Bitcoin, and it’s predicted that the peak of this cycle will occur between $150,000 and $200,000.

HYPE, BGB and MOVE post double-digit rallies

Currently, HYPE’s value is approximately $30 as we speak. This decentralized blockchain, focusing primarily on trading, boasts a staggering total value of locked assets worth $2.191 billion, as per the latest figures from DeFiLlama.

At present, HYPE is about 45% lower than its maximum historical value, sitting at $42.252. If this Layer 1 token begins a new phase of pricing (price discovery), it might surge towards $60.491 – a level that represents a 161.8% Fibonacci retracement of the price increase from its December 10 low to the peak on December 12, as suggested by the 4-hour price chart.

The Relative Strength Index currently stands at 62 and is trending upward. A crucial indicator called Moving Average Convergence Divergence (MACD) shows red histogram bars beneath the neutral line, indicating potential weakness. However, it’s essential for traders to stay vigilant because the MACD line is about to cross above the signal line, which could suggest a transition from negative to positive momentum.

HYPE could find support in the Fair value gap between $20.250 and $20.600.

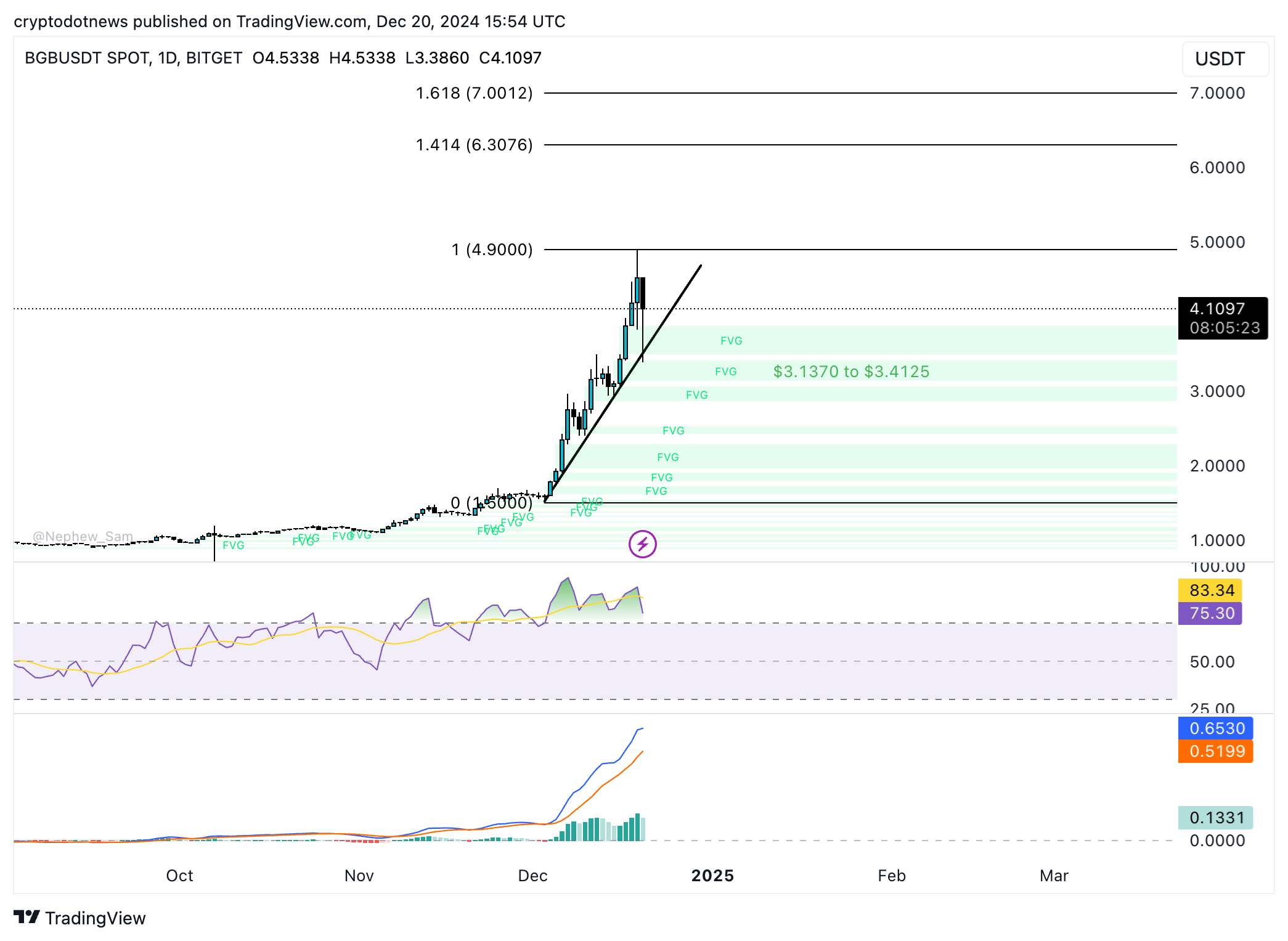

Bitget’s native token, BGB, rivals exchange tokens such as OKB from OKX and Binance‘s BNB. On Thursday, it reached a new peak at $4.90, representing a staggering growth of over 520% over the past year.

In December, BGB climbed from $1.50 to its current high, indicating a monthly gain exceeding 100%.

Despite BGB’s technical signals staying optimistic, it’s crucial for traders to exercise caution when increasing their holdings in BGB. This is because the Relative Strength Index (RSI) is currently above 70, indicating that the token might be overpriced at the moment.

If there is a correction, BGB could find support in the zone between $3.1370 and $3.4125, an FVG on the daily price chart.

The token known as Move (MOVE) is a native currency for a Layer 2 platform constructed on Ethereum, designed to enhance scalability and offer sophisticated user functions. As per data from CoinGecko, MOVE has seen a nearly 25% increase over the past week.

On Binance’s 4-hour MOVE/USDT chart, there are two significant areas to note about MOVE: a resistance level stretching from $0.8891 to $0.9038, and a support area ranging from $0.6509 to $0.6836. The technical analysis of MOVE’s price movements suggests potential for further increases in the value of this Layer 2 token.

On December 10th, MOVE reached an all-time peak of $1.4100 after being listed on Binance. However, since then, MOVE has experienced a correction and began recovering on Wednesday.

Derivatives traders make moves in the altcoins

According to Coinglass data, open interest for the HYPE token has surged by approximately 75% over the last day. This increase suggests that the token is becoming more significant within the trading community following its price growth during the past week. The current open interest in Hyperliquid stands at over $42 million.

It appears that the BGB token is no longer holding significance for traders, as indicated by a 33.38% decrease in Open Interest (OI), now at $46.85 million. The current long/short ratio of 0.8258, which is below 1, suggests that there are more short positions than long ones. This indicates that traders may be pessimistic about the token’s future prospects.

Traders specializing in derivatives have a positive outlook towards MOVE, as there are more long positions than short ones on platforms like Binance and OKX. This imbalance is evident because the number of long positions is over one for these exchanges. As a result, open interest (OI) has surged by 18% and now stands at over $101 million, according to data from Coinglass.

Strategic considerations

Should institutional investments into Bitcoin ETFs decrease, there’s a possibility that Bitcoin might experience additional price adjustments by the year 2024. Generally, a drop in Bitcoin’s value tends to have a negative impact on various altcoins and digital tokens across all classifications.

Investors should exercise caution when increasing their long holdings, as sudden drops similar to those experienced on Wednesday and Thursday this week (flash crash or market-wide selloff) could potentially reverse recent gains in tokens like HYPE, MOVE, and BGB.

On a Friday, Bitcoin surpassed $97,000, and if it continues to rise above $100,000, this could boost further increases in prices for other cryptocurrencies (altcoins).

Read More

- Castle Duels tier list – Best Legendary and Epic cards

- CRK Boss Rush guide – Best cookies for each stage of the event

- AOC 25G42E Gaming Monitor – Our Review

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Fortress Saga tier list – Ranking every hero

- Outerplane tier list and reroll guide

- Best Elder Scrolls IV: Oblivion Remastered sex mods for 2025

- Call of Antia tier list of best heroes

- Kingdom Come: Deliverance 2 Patch 1.3 Is Causing Flickering Issues

2024-12-21 00:06