As a seasoned crypto investor with a knack for spotting promising projects, I find the recent surge in Solana (SOL) quite intriguing. Having closely followed the development of this fast-growing blockchain since its inception, I’ve witnessed firsthand its potential to disrupt the market landscape.

The 8% jump on the first trading day of 2025 is a testament to renewed investor confidence and optimism, especially considering the brief consolidation phase we experienced previously. The rising open interest in SOL futures contracts, particularly the significant increase in perpetual contracts, suggests that many traders are betting on SOL’s price movements, which is an encouraging sign of strong market activity and confidence.

However, as someone who has seen a few crypto winters, I always remind myself that every bull run comes with its share of risks. Regulatory scrutiny and network stability issues are potential concerns that could impact market confidence in the short term. But with Solana’s unique Proof of History combined with Proof of Stake system, low transaction fees, and rapidly growing ecosystem, I believe it has the resilience to weather any storms that may come its way.

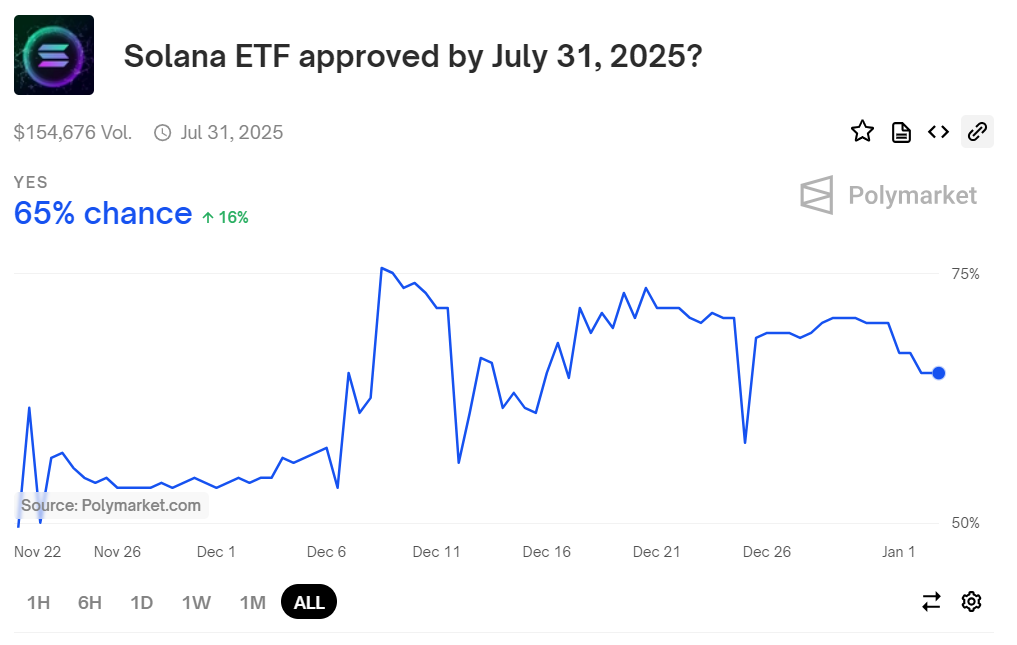

In terms of the proposed Solana ETF, if approved, it could significantly boost SOL’s visibility and accessibility, potentially driving up its value even further. But as they say in crypto, “never invest more than you can afford to lose,” so I’ll be keeping a close eye on developments and adjusting my strategy accordingly.

To lighten the mood, let me add a little joke: They say if you can’t stand the heat, get out of the kitchen… or in this case, if you can’t handle the volatility, maybe stick to baking bread!

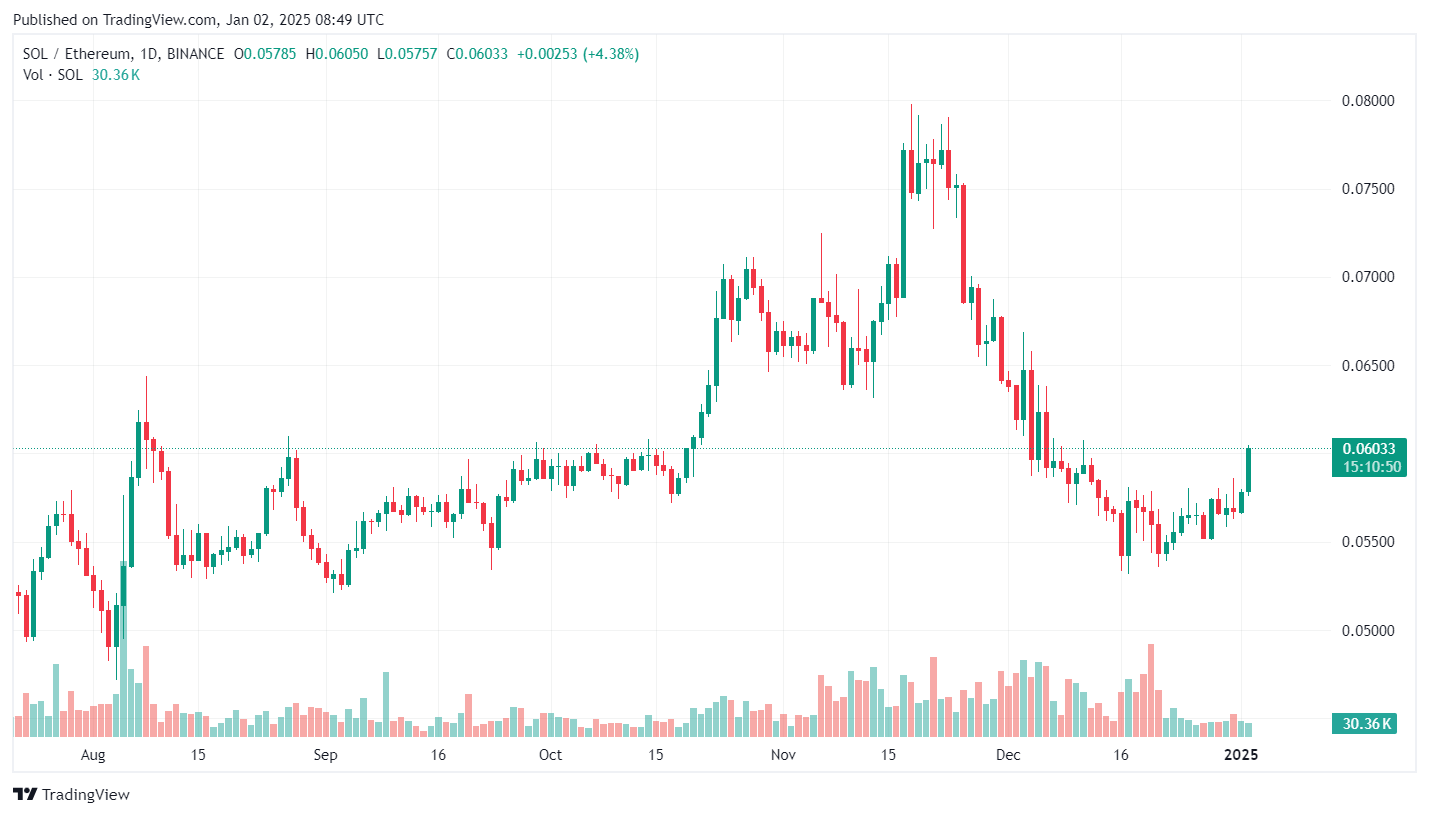

So far in 2025, Solana (SOL) is surpassing Ethereum (ETH) in terms of performance, kicking off the year with an 8% increase. This growth has kept interest high among investors who are now looking forward to a possible Solana Exchange-Traded Fund (ETF).

On January 2, 2025, Solana (SOL) is currently being traded at $205.64, representing an 8.48% rise over the past 24 hours. This uptick comes after a temporary period of stability, signaling renewed faith and enthusiasm among investors.

Today, SOL reached its peak at $205.64 and dipped to $187.82, showing a robust recovery fueled by increased interest and optimistic feelings about the potential Solana exchange-traded fund in the market.

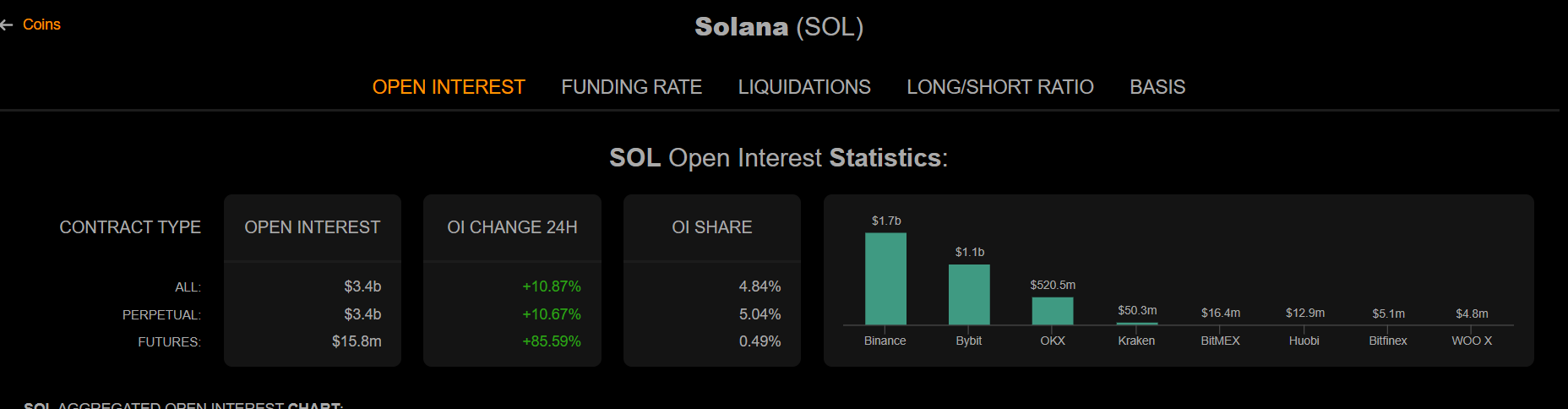

The amount of ongoing commitments in Solana (SOL) futures agreements has surged to a staggering $3.42 billion, driven primarily by increased involvement from investors.

In this market, perpetual contracts are extremely popular, with a staggering $3.4 billion in ongoing commitments, contrastingly, futures contracts have a relatively smaller figure of $15.8 million in play.

Over the last day, perpetual contracts surged by approximately 10.67%, while futures contracts saw a substantial 85.59% jump. This combined growth resulted in a total open interest increase of around 10.87%. In terms of crypto exchanges, Binance currently holds the top spot with an open interest of about $1.7 billion, followed closely by Bybit at $1.1 billion and OKX with approximately $520.5 million.

Or in a more conversational style:

In the past 24 hours, there was a significant rise in both perpetual contracts (up around 10.67%) and futures contracts (up about 85.59%). This led to an overall increase of approximately 10.87% in total open interest. When it comes to crypto exchanges, Binance is currently the leader with a massive $1.7 billion in open interest, followed by Bybit at $1.1 billion and OKX at around $520.5 million.

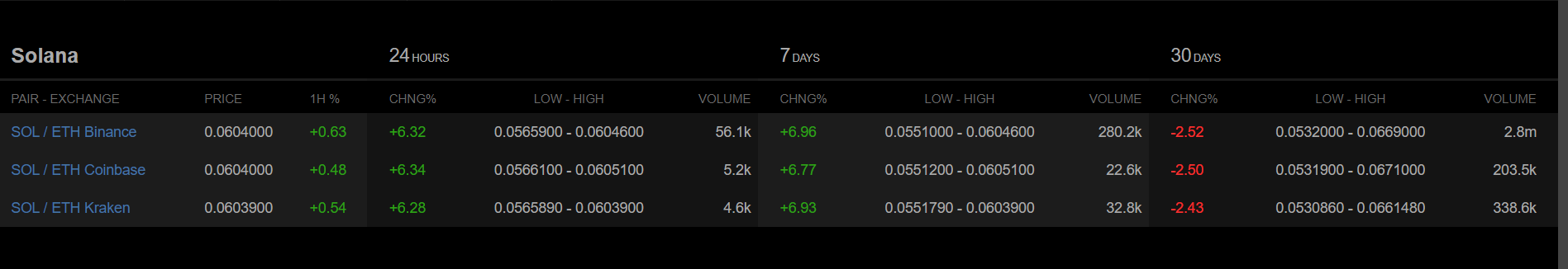

On Binance, Solana’s price surged by approximately 6.32% within the past 24 hours and saw a 6.96% rise over the last week. Both Coinbase and Kraken experienced comparable 24-hour growth of 6.34% and 6.28%, respectively. Binance also dominates in trading volume, having exchanged around 56,100 SOL/ETH pairs within the last day, whereas Coinbase and Kraken recorded 5,200 and 4,600 such trades, correspondingly.

The sharp increase in SOL’s price and open interest highlights growing optimism among investors.

85.59% increase in open interest for Solana (SOL) futures indicates a growing number of investors are wagering on SOL’s price fluctuations. Open interest usually signifies heightened market engagement and optimism, suggesting that the market anticipates more growth for SOL. The prevalence of perpetual contracts shows traders are actively leveraging SOL’s volatile pricing through short-term tactics.

This pattern highlights the balance between heightened speculative involvement and underlying investor interest, both contributing significantly to Solana’s impressive growth trajectory.

In a recent tweet, Awawat, who is both a trader and angel investor at APG Capital, shared an impressive graphic depicting the latest trends in the SOL market.

The bid is quite attractive:

* It’s under $200, which is strong.

* Its value against Bitcoin is relatively low.

* It’s bouncing back versus Ethereum.

* There are potential bullish indicators in the unlocks? (This could be rephrased as “There may be positive signs from the upcoming unlock events?”)— Awawat (@Awawat_Trades) January 2, 2025

Investors’ trust in SOL is increasing, as demonstrated by a solid backing of approximately 0.002156 in the SOL/BTC market and a consistent period of holding steady, suggesting that SOL is maintaining its ground against Bitcoin.

The surge in the SOL/ETH exchange rate suggests that Solana is regaining its appeal as a valuable investment option, due to Ethereum’s relatively sluggish progress. This growth spurt underscores Solana’s ability to compete effectively within the blockchain ecosystem.

Solana (SOL) and Ethereum (ETH) have distinct technical structures: Solana employs a unique Proof of History system along with Proof of Stake for quicker transactions, whereas Ethereum relies on Proof of Stake for scalability. Transaction costs on Solana are relatively stable at approximately $0.00025, contrasting Ethereum’s variable gas fees that often fluctuate more significantly.

Ethereum boasts a more mature, extensive community and infrastructure, whereas Solana, despite being relatively new, is swiftly expanding due to its high speed and affordability. This rapid growth has attracted developers in decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming. The unique characteristics of each blockchain significantly impact the user experience and applications they cater to.

As a seasoned investor with over two decades of experience in the financial markets, I have witnessed numerous regulatory approvals and rejections of various Exchange Traded Funds (ETFs). Over the years, I’ve learned that speculation about such events can create both opportunities and risks for investors.

Recently, there has been growing chatter around a potential Securities and Exchange Commission (SEC) approval for a Solana ETF by July 31, 2025. I have closely monitored the situation, and platforms like Polymarket have intrigued me with their rising odds for such an approval. Currently, the probabilities stand at approximately 65%, a significant increase from the 50% we saw earlier this month.

In my opinion, if the SEC does indeed approve a Solana ETF by 2025, it could be a game-changer for investors looking to gain exposure to the rapidly growing Solana blockchain ecosystem. However, I urge caution as the approval process can be unpredictable and influenced by various factors beyond our control.

I have learned from past experiences that it’s essential to stay informed, do thorough research, and make calculated decisions when investing in such opportunities. If the odds continue to increase and the SEC makes an official announcement, I will certainly consider adding a Solana ETF to my portfolio, but only after carefully weighing the risks and potential rewards.

In summary, the growing presence of whales, escalating acceptance, and swelling open interest positions in SOL have jointly fueled its growth. Nonetheless, it’s essential to be aware of potential hazards like network instability concerns and regulatory oversight, as they might undermine market trust.

Read More

- CRK Boss Rush guide – Best cookies for each stage of the event

- Fortress Saga tier list – Ranking every hero

- Glenn Greenwald Sex Tape Leak: Journalist Cites “Maliciously Political” Motives

- Cookie Run Kingdom Town Square Vault password

- Mini Heroes Magic Throne tier list

- Grimguard Tactics tier list – Ranking the main classes

- Castle Duels tier list – Best Legendary and Epic cards

- How to Prepare and Dominate the Awakened Hollyberry Cookie Update

- Overwatch Stadium Tier List: All Heroes Ranked

- Hero Tale best builds – One for melee, one for ranged characters

2025-01-02 12:25